samich1262

Well-known member

- Messages

- 293

- Likes

- 3

If I understand it correctly, your approach to newborn trends (first leg, first pullback) is not taking them, because you either want confirmation of the trend or test of the barrier from which trend commenced? I really like my last BB and consider it one of the best setups, so this part of your comment caught me off guard. Could you elaborate on this topic a little more please? 🙂 Thank you.

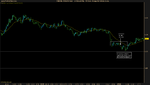

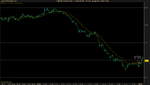

Yeah, it did look like the start of a strong downtrend, but it did not look like it came from a proper range break. It didn't break from the bottom of the range. As a general rule, I never take a trending setup after an IRB unless there is a successful retest of the breakout level first. It basically needs confirmation that a new trend is starting. Price didn't create a good barrier at the 1.254 zone to prevent price from climbing back into the range so I expected a retest. Since I didn't see it, I thought the move might get countered. Sometimes if there is a retest that comes 1-pip short of the breakout level, I skip those too unless they look really strong.

The only other problem that I have with the BB is that none of the candlesticks closed against the lower barrier. On my chart, there are 5 equal touches of the bottom barrier but they are all candle wicks, no bodies. I don't really know if that's a valid reason for concern, but it does possibly show bullish interest at that level.

Hope this helps. It's something I'm still trying to wrap my head around too.