You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

-5.1 pips – 2 July 2013

A bit of a relief today in that we actually had some movement during the London session. 50 pips worth! Too bad there were not any grade A opportunities to go along with the move.

1 – trade 1 – Once the move really started to get underway at 4:10 EDT I waited until I saw this nice block before looking to join the bearish trend. I doubted my entry as soon as I was in. While I like taking BBs in strong trends I just felt now that the strength of the move was not extreme enough to see a strong break out of a consolidation block. When price hugged the bottom of the lower block boundary after entry I knew that the pressure just wasn’t there yet so when it broke back inside the block I bailed on the trade.

When price makes a false break at 2 and then breaks below the block low (3) it presents a much better setup. I consider it a mistake not to have taken this entry, but at the time I feared that I’d get bitten twice on the same block. I hadn’t moved on from the result of the first trade to be fully open to taking this setup. I need to focus on clearing my mind after the end of any trade so that I can fully open to what’s happening now.

The sideways consolidation at 4 was another point where I debated the virtue of playing it short. The consolidation block was nicely resting on the EMA. If the preceding pullback had been greater, maybe back up towards 1.3040 I think I might have given it greater validity.

A bit of a relief today in that we actually had some movement during the London session. 50 pips worth! Too bad there were not any grade A opportunities to go along with the move.

1 – trade 1 – Once the move really started to get underway at 4:10 EDT I waited until I saw this nice block before looking to join the bearish trend. I doubted my entry as soon as I was in. While I like taking BBs in strong trends I just felt now that the strength of the move was not extreme enough to see a strong break out of a consolidation block. When price hugged the bottom of the lower block boundary after entry I knew that the pressure just wasn’t there yet so when it broke back inside the block I bailed on the trade.

When price makes a false break at 2 and then breaks below the block low (3) it presents a much better setup. I consider it a mistake not to have taken this entry, but at the time I feared that I’d get bitten twice on the same block. I hadn’t moved on from the result of the first trade to be fully open to taking this setup. I need to focus on clearing my mind after the end of any trade so that I can fully open to what’s happening now.

The sideways consolidation at 4 was another point where I debated the virtue of playing it short. The consolidation block was nicely resting on the EMA. If the preceding pullback had been greater, maybe back up towards 1.3040 I think I might have given it greater validity.

Attachments

matty_dunn

Active member

- Messages

- 188

- Likes

- 17

Felt despondent after trading today. Not being able to see incremental improvements in a tangible way is hard to take sometimes, especially when I make poor judgement calls like today. I know that I’ve only been trading this method for two months, and that is really just a drop in the ocean. At least the take away message of the day, of being more cognisant of unfavourable conditions and actually letting them override setups, is a positive that I can work on going forward.

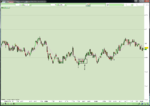

1 – trade 1 (-5.9 pips) - Too impulsive to start the day. The small 3 candle block just prior to this block essentially invalidates the potency of this block. The fact that the 50 level also stands in the way to the TP is a double whammy of why this was a bad entry. I do like a good BB continuation trade but lately I’ve been seeing them where they don’t warrant attention.

When the pullback ended at 2 I couldn’t decide if it warranted a FB entry or if I should be waiting for a SB. I dithered and missed what in hindsight is now a good entry point. I consider it a valid entry point now as the pullback made it up to the resistance level offered by the Tokyo session low at 1.2962.

3 – trade 2 (-3.8 pips) – A second bite of the cherry on the block that I’d taken trade 1 from. I again dithered at the time of entry and while I did enter it meant I got filled at a worse price then if I’d been confident of the setup and had been stalking it prior. The entry ended up being too rushed in my head. For that alone I should have just passed instead of being impulsive and just going for it. The 50 level was again a big con that should have probably stayed my hand all on its own.

4 – trade 3 (-5.7 pips) – After breaking through the 50 level on the second attempt, price continued to fall to a low of 1.2923 before rebounding. The pullback was nice and orderly and there was a FB looking setup at 4. At the time I took the signal, I think mainly to make up for not having taken the FB signal at 2. In hindsight this is not really a good FB, as the initial downward move was not out of a range (unlike the move that preceded 2). I should not have taken this entry.

5 – trade 4 (-4.5 pips) – This was the only valid setup of the four trades that I actually took today that I consider to be a reasonable and decent entry. After the false FB a 4 pip block forms. My entry is a joint BB/SB. The trend continuation falters and I bail. I’m not sure if it’s something I’m seeing or if it a real market dynamic but if there is a significant move in the first hour of the London open then the second hour seems to pullback or be more range bound.

1 – trade 1 (-5.9 pips) - Too impulsive to start the day. The small 3 candle block just prior to this block essentially invalidates the potency of this block. The fact that the 50 level also stands in the way to the TP is a double whammy of why this was a bad entry. I do like a good BB continuation trade but lately I’ve been seeing them where they don’t warrant attention.

When the pullback ended at 2 I couldn’t decide if it warranted a FB entry or if I should be waiting for a SB. I dithered and missed what in hindsight is now a good entry point. I consider it a valid entry point now as the pullback made it up to the resistance level offered by the Tokyo session low at 1.2962.

3 – trade 2 (-3.8 pips) – A second bite of the cherry on the block that I’d taken trade 1 from. I again dithered at the time of entry and while I did enter it meant I got filled at a worse price then if I’d been confident of the setup and had been stalking it prior. The entry ended up being too rushed in my head. For that alone I should have just passed instead of being impulsive and just going for it. The 50 level was again a big con that should have probably stayed my hand all on its own.

4 – trade 3 (-5.7 pips) – After breaking through the 50 level on the second attempt, price continued to fall to a low of 1.2923 before rebounding. The pullback was nice and orderly and there was a FB looking setup at 4. At the time I took the signal, I think mainly to make up for not having taken the FB signal at 2. In hindsight this is not really a good FB, as the initial downward move was not out of a range (unlike the move that preceded 2). I should not have taken this entry.

5 – trade 4 (-4.5 pips) – This was the only valid setup of the four trades that I actually took today that I consider to be a reasonable and decent entry. After the false FB a 4 pip block forms. My entry is a joint BB/SB. The trend continuation falters and I bail. I’m not sure if it’s something I’m seeing or if it a real market dynamic but if there is a significant move in the first hour of the London open then the second hour seems to pullback or be more range bound.

Attachments

JRS

Member

- Messages

- 59

- Likes

- 23

Felt despondent after trading today. Not being able to see incremental improvements in a tangible way is hard to take sometimes, especially when I make poor judgement calls like today. I know that I’ve only been trading this method for two months, and that is really just a drop in the ocean. At least the take away message of the day, of being more cognisant of unfavourable conditions and actually letting them override setups, is a positive that I can work on going forward.

Don't feel bad. The guys at SMB Capital claim it takes a trader 6-8 months to be consistently profitable, and that's doing it for your day job with tons of people around for support.

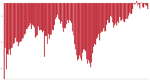

All that matters is you keep showing up and working. Here's a graph of my own performance over the last 6 months. Each bar represents a moving average of the last 20 days.

Attachments

matty_dunn

Active member

- Messages

- 188

- Likes

- 17

Don't feel bad. The guys at SMB Capital claim it takes a trader 6-8 months to be consistently profitable, and that's doing it for your day job with tons of people around for support.

All that matters is you keep showing up and working. Here's a graph of my own performance over the last 6 months. Each bar represents a moving average of the last 20 days.

Totally agree JRS. Hang in there HornedGod, if it was easy everyone would be consistently profitable. You must be pleased with your improvement over time JRS!

One trade for Wednesday, and in hindsight, not a great one. Interested to hear what others think.

Attachments

1.1 pips – 4 July 2013

With the ECB rate announcement later today and with the US markets closed due to July 4th, I knew that it was probably going to be a very subdued session. I knew that if any good trading opportunity came along it was more than likely going to be an IRB, which is exactly what I got.

2 - trade 1 (1.1 pips) – After the false break (1), price entered a 3 pip block. When it broke out to the top heading back into the middle of the larger range I took an IRB entry.

There was another IRB setup shortly afterwards (3) but this one was not as nice so I skipped it. It seemed to lie in the middle of a smaller range that was forming. It had no apparent double pressure, such as the false break that preceded the trade I took and it was higher up in the range.

With the ECB rate announcement later today and with the US markets closed due to July 4th, I knew that it was probably going to be a very subdued session. I knew that if any good trading opportunity came along it was more than likely going to be an IRB, which is exactly what I got.

2 - trade 1 (1.1 pips) – After the false break (1), price entered a 3 pip block. When it broke out to the top heading back into the middle of the larger range I took an IRB entry.

There was another IRB setup shortly afterwards (3) but this one was not as nice so I skipped it. It seemed to lie in the middle of a smaller range that was forming. It had no apparent double pressure, such as the false break that preceded the trade I took and it was higher up in the range.

Attachments

garageboyFUJI

Member

- Messages

- 66

- Likes

- 0

Hi

I have a question.

What chart do you display other charts ? only 70 tick chart ?

I think only 70 tick chart is difficult for me to find attention lines.

In hindsight, I can understand, but it's makes me confused only 70 tick in real time.

I come to have many just useless entries.

What do you think about it ?

I have a question.

What chart do you display other charts ? only 70 tick chart ?

I think only 70 tick chart is difficult for me to find attention lines.

In hindsight, I can understand, but it's makes me confused only 70 tick in real time.

I come to have many just useless entries.

What do you think about it ?

matty_dunn

Active member

- Messages

- 188

- Likes

- 17

Hi

I have a question.

What chart do you display other charts ? only 70 tick chart ?

I think only 70 tick chart is difficult for me to find attention lines.

In hindsight, I can understand, but it's makes me confused only 70 tick in real time.

I come to have many just useless entries.

What do you think about it ?

I understand your dilemma as I have been swinging back and forth. I find it difficult not to take a look further back. Sometimes this helps keep me out of losing trades but it also keeps me out of winning ones too.

I know Bob is clearly in favour of only about 2 hours of 70 tick data FOR THIS APPROACH. He also trades set-ups using 5 minute data independently of the 70 tick set-ups, and even though he says he often looks at the 5 minute data when the highs and lows of the day come into play, he believes this information has kept him out of more winning trades than losing ones.

I guess you've just got to try different things and work out what works best for you.

No trades for me on Thursday, had night off.

garageboyFUJI

Member

- Messages

- 66

- Likes

- 0

garageboyFUJI

Member

- Messages

- 66

- Likes

- 0

Hi

This is " London Open" my trading on Friday.

I feel so so. It's not so easy, but I can wait for set up better than before now.

I'm tired...

I don't understand what wrong with me...

I want some advise, especially 4th chart.

This is " London Open" my trading on Friday.

I feel so so. It's not so easy, but I can wait for set up better than before now.

I'm tired...

I don't understand what wrong with me...

I want some advise, especially 4th chart.

Attachments

Last edited:

0 pips – 5 July 2013

An NFP morning meant that I was expecting things to be pretty quiet. It ended up being slightly more active than I expected. The break of the block at 1 was the only potential setup I saw today bit it was less than ideal, being stuck in the middle of previous price action. After it broke you could see a bearish channel forming but that was not apparent to me beforehand.

No trades.

An NFP morning meant that I was expecting things to be pretty quiet. It ended up being slightly more active than I expected. The break of the block at 1 was the only potential setup I saw today bit it was less than ideal, being stuck in the middle of previous price action. After it broke you could see a bearish channel forming but that was not apparent to me beforehand.

No trades.

Attachments

matty_dunn

Active member

- Messages

- 188

- Likes

- 17

0 pips – 5 July 2013

An NFP morning meant that I was expecting things to be pretty quiet. It ended up being slightly more active than I expected. The break of the block at 1 was the only potential setup I saw today bit it was less than ideal, being stuck in the middle of previous price action. After it broke you could see a bearish channel forming but that was not apparent to me beforehand.

No trades.

Declined the same trade. Looks ok in hindsight - often the way...

No trades

Charts below

Attachments

matty_dunn

Active member

- Messages

- 188

- Likes

- 17

Hi

This is " London Open" my trading on Friday.

I feel so so. It's not so easy, but I can wait for set up better than before now.

I'm tired...

I don't understand what wrong with me...

I want some advise, especially 4th chart.

Hey FUJI, I understand why you would take the first entry, especially as Bob has been highlighting the good opportunities that often come during the London open, particularly in the way of range breaks.

It's a fine line, but for there to be a range in the first place there needs to be at least 2 highs or lows from which to form a barrier. In the case of your first trade there was no second low from which to draw a barrier before the actual ARB formation itself took place. It would have been preferable to see prices bounce up again before being squeezed down against a barrier line that would now comprise 2 clearly separate lows.

The reason I'm going into so much detail on this one is because I've been thinking about this type of set-up a lot and when to accept or decline the offer - that is: where the set-up occurs on the second touch of the barrier.

It seems that during the London open is the best time to take up these opportunities, so in that regard your trade was well timed.

I think with your second trade a decent block had formed but its location, in terms of offering a 10 pip pop was not ideal - 3 pip above the ultimate low made by a small cluster of bars to the immediate left. The market certainly looked weak though.

In my mind your third trade just didn't have enough time at the barrier line to be a high odds trade. I think it was too premature to accept.

Your last 2 entries are totally understandable - a clear signal line with multiple touches and a nice long squeeze, pushing prices up against it. And your second entry even had a little false low before it took off. Under normal circumstances I think it would be an opportunity to take up, but with the biggest news release of the month coming up shortly and London lunch approaching the desired response to such an event might not be as favourable as one would like. Also, if you go back a little further in time you'll see a substantial block of price action hovering just above the break out zone which won't help much.

It's frustrating I know, especially when most of your trades are showing a profit of 6 or 7 pip then end up as a loss. I think you just have to limit yourself to the very best set-ups with the very best conditions in order for a 10 pip run to occur. Hard, I know...

Anyway, hope this helps

PS - just had another look at last set-up and added a chart that might also help. Have noticed this phenomena a bit.

Attachments

Last edited:

garageboyFUJI

Member

- Messages

- 66

- Likes

- 0

Thank you very much for your kindness, matty_dunn.

it's very helpful for me, and I could understand. Thank you very much.

now I feel good, and I'm sure I can report my trading better than before next🙂.

it's very helpful for me, and I could understand. Thank you very much.

now I feel good, and I'm sure I can report my trading better than before next🙂.

BLS

Established member

- Messages

- 642

- Likes

- 229

Week 27 charts from Bob:

https://www.dropbox.com/sh/1amxmi9af0fk6ej/VA5_ZrjQF1

https://www.dropbox.com/sh/1amxmi9af0fk6ej/VA5_ZrjQF1

Similar threads

- Replies

- 15

- Views

- 8K