You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Atilla

Legendary member

- Messages

- 21,036

- Likes

- 4,208

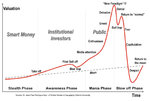

Bubble phases .

Just like that other so called currency!

Atilla

Legendary member

- Messages

- 21,036

- Likes

- 4,208

Litecoin went from $4 to $27 in just a few days 😴

I reckon it may become like the black economy. Everybody knows it's there and very productive. However, highly risky.

Will always be there.

However, I remain out of touch with this Bit coin stuff. What happens with counterfit coins? Who verifies them? How will the system be policed?

Whole can of worms. Tasty morsels for some maybe. 😎

I reckon it may become like the black economy. Everybody knows it's there and very productive. However, highly risky.

Will always be there.

However, I remain out of touch with this Bit coin stuff. What happens with counterfit coins? Who verifies them? How will the system be policed?

Whole can of worms. Tasty morsels for some maybe. 😎

It would take billions of dollars of computing power just to replicate a few coins. The transactions are automatically verified on the blockchain for everyone to see. The system is a decentralized peer to peer network so it is not policed, but that is the beauty of it. No central governing authority is necessary for the system to work.

Last edited:

Atilla

Legendary member

- Messages

- 21,036

- Likes

- 4,208

It would take billions of dollars of computing power just to replicate a few coins. The transactions are automatically verified on the blockchain for everyone to see. The system is a decentralized peer to peer network so it is not policed, but that is the beauty of it. No central governing authority is necessary for the system to work.

Hmmm I'm sure they are working on cracking it as we blog...

However, the concept and principal is fantastic and can see how it resonates with people including me.

👍

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

It would take billions of dollars of computing power just to replicate a few coins. The transactions are automatically verified on the blockchain for everyone to see. The system is a decentralized peer to peer network so it is not policed, but that is the beauty of it. No central governing authority is necessary for the system to work.

where is the blockchain stored or how is it accessed?

Peter

tar

Legendary member

- Messages

- 10,443

- Likes

- 1,314

Atilla

Legendary member

- Messages

- 21,036

- Likes

- 4,208

where is the blockchain stored or how is it accessed?

Peter

You thinking what I'm thinking? :cheesy:

tar

Legendary member

- Messages

- 10,443

- Likes

- 1,314

You thinking what I'm thinking? :cheesy:

Hackers are already working 24/7 to steal coins from individuals and exchanges , it happens all the time , just an example :

http://www.coindesk.com/bitcoin-payment-processor-bips-attacked-1m-stolen/

http://www.ibtimes.co.uk/articles/521981/20131113/bitcoin-czech-exchange-wallet-hacked.htm

Jason Rogers

Senior member

- Messages

- 2,772

- Likes

- 93

I believe the appropriate word is D'oh: Black Friday for owner after $8m in Bitcoin lost to landfill

Jason Rogers

Senior member

- Messages

- 2,772

- Likes

- 93

OrderFlowDashPro

Member

- Messages

- 76

- Likes

- 9

Digital currency of some sort is likely going to have a future. The problem I've always had with bitcoin is that there is no way to know that bitcoin will be the winner and even if you pick the digital coin that wins -- there is no reason that such coin must be destined go up a huge amount in price. Perhaps the currency that wins is designed to be relatively price stable.

Credit cards have demonstrated one thing if nothing else - convenience wins the day and frankly bitcoin hasn't proven itself to be that.

Credit cards have demonstrated one thing if nothing else - convenience wins the day and frankly bitcoin hasn't proven itself to be that.

darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

Buy and hold it is then! 😀

Jason Rogers

Senior member

- Messages

- 2,772

- Likes

- 93

Digital currency of some sort is likely going to have a future. The problem I've always had with bitcoin is that there is no way to know that bitcoin will be the winner and even if you pick the digital coin that wins -- there is no reason that such coin must be destined go up a huge amount in price. Perhaps the currency that wins is designed to be relatively price stable.

Unlike the format wars between VHS and Betamax, and between Blu-ray and HD DVD, I think the market might eventually be able to support multiple digital currencies. It might be in the interest of Bitcoin proponents to set up an exchange between it and other digital currencies.

People might be more confident investing in Bitcoin or one of its digital rivals if there was a viable market to convert between them. Then you wouldn't have to worry about getting stuck with the digital currency equivalent of a Betamax or HD DVD player.

Last edited:

OrderFlowDashPro

Member

- Messages

- 76

- Likes

- 9

I see another problem with bitcoin which is the price of it. I know it is divisible but nobody wants to deal with long numbers for small transactions. I mean right now, to send a $1 via bitcoin, I've got to deal with this very long number which isn't friendly at all. Now if they want to call that number satoshi or whatever then that's fine but if I've only heard of bitcoin then I don't know satoshi.

The real question is have the network effects enabled bitcoin to "break out" in some significant way? That's the real test because right now functionally bitcoin is way of transacting over the internet, rather similar to pay pal and like pay pal it is useful but has limited value. I could use google wallet or some other service. However, if bitcoin is accepted by enough places then it takes on a new nature, at that point it is no longer just a way to "send money" or do ecommerce. But, at that point it becomes the dominant currency.

There are no more conversions. So, that would be powerful. I could send bitcoin overseas but that person doesn't have to convert it. They just spend the bitcoin at another bitcoin accepted establishment.

So, to understand whether or not bitcoin is viable we need to look at other networks like Facebook and MySpace. The value of bitcoin other then being a hindrance to its adoption has little to do if it has reached the network potential.

So we need to compute the value of bitcoin based on how many businesses accept it. If one desire one can compute a ratio of the value of bitcoin to the network value to see if they are moving in tandem or if it is a speculative bubble. If the value of bitcoin has grown much faster then network value then bitcoin can be said to be over priced. You want to buy when the ratio is historically low.

The real question is have the network effects enabled bitcoin to "break out" in some significant way? That's the real test because right now functionally bitcoin is way of transacting over the internet, rather similar to pay pal and like pay pal it is useful but has limited value. I could use google wallet or some other service. However, if bitcoin is accepted by enough places then it takes on a new nature, at that point it is no longer just a way to "send money" or do ecommerce. But, at that point it becomes the dominant currency.

There are no more conversions. So, that would be powerful. I could send bitcoin overseas but that person doesn't have to convert it. They just spend the bitcoin at another bitcoin accepted establishment.

So, to understand whether or not bitcoin is viable we need to look at other networks like Facebook and MySpace. The value of bitcoin other then being a hindrance to its adoption has little to do if it has reached the network potential.

So we need to compute the value of bitcoin based on how many businesses accept it. If one desire one can compute a ratio of the value of bitcoin to the network value to see if they are moving in tandem or if it is a speculative bubble. If the value of bitcoin has grown much faster then network value then bitcoin can be said to be over priced. You want to buy when the ratio is historically low.

Last edited:

DitterPD

Active member

- Messages

- 177

- Likes

- 6

I see another problem with bitcoin which is the price of it. I know it is divisible but nobody wants to deal with long numbers for small transactions. I mean right now, to send a $1 via bitcoin, I've got to deal with this very long number which isn't friendly at all. Now if they want to call that number satoshi or whatever then that's fine but if I've only heard of bitcoin then I don't know satoshi.

The real question is have the network effects enabled bitcoin to "break out" in some significant way? That's the real test because right now functionally bitcoin is way of transacting over the internet, rather similar to pay pal and like pay pal it is useful but has limited value. I could use google wallet or some other service. However, if bitcoin is accepted by enough places then it takes on a new nature, at that point it is no longer just a way to "send money" or do ecommerce. But, at that point it becomes the dominant currency.

There are no more conversions. So, that would be powerful. I could send bitcoin overseas but that person doesn't have to convert it. They just spend the bitcoin at another bitcoin accepted establishment.

So, to understand whether or not bitcoin is viable we need to look at other networks like Facebook and MySpace. The value of bitcoin other then being a hindrance to its adoption has little to do if it has reached the network potential.

So we need to compute the value of bitcoin based on how many businesses accept it. If one desire one can compute a ratio of the value of bitcoin to the network value to see if they are moving in tandem or if it is a speculative bubble. If the value of bitcoin has grown much faster then network value then bitcoin can be said to be over priced. You want to buy when the ratio is historically low.

Soooo... Demand + convenience = value?