F

fibo_trader

Hey guys ........................ let's continue ....... Anal-ysis of USDJPY follows in accordance with my trades

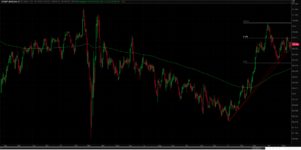

I show here 2 scenarios for USDJPY on the daily timeframe. Both are compelling. But, they are in the opposite directions, meaning one is northbound and the other southbound. F*** what a cop out by Big Joe, hehehehe. the market is going to go either up or down, the classic hogwash, full of sh*t prognosis. Duh!

Sorry guys but here's the thing. Its kinda difficult right now because the market for USDJPY has thrown me a zinger of epic proportions ................... see explanation below ..............

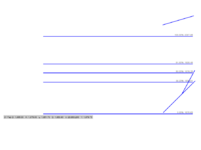

(1) Scenario 1 : Chart 1 daily for the standard A-B-C correction after a 5-wave move has occurred. The northbound move from Jan 6 to March 31 is a 5-wave move. What follows is a 3-wave simple or complex correction. The most common target for the endpoint of the correction is that C = A ................ see chart this would occur at 106.291 ................... sometimes a shortened Wave C could just say f***k it at 61.8% and end right there and the A-B-C is complete and the blast north follows immediately. But wave equality is normal and usual. If not, then the other options are 161.8%, 261.8% or maximum 423.6%.

(2) Scenario 2: The drop from March 31st /2021 is a 3-wave move, This completes a correction in the true sense of a correction, sort of like the minimum requirement. If such is the case, then USDJPY should rally into a Wave 3 up. And it could be doing exactly that. Because WAVE 3 is notorious for having 1-2, 1-2s and so on which indicate subdivision formation within the wave, which means its going to be a mofo wave of voluptuous proportions that will make a TRADER rich, rich, rich, rich. This is why I took the risk. Sure it cost me but hey one cannot live by timidity, it sucks! I take big gambles and in this case have paid for the cost of tuition.

If this scenario works out as long as the low of May 12 remains intact, then it still could be the giant upwave rally next to rejoin the Primary Trend as I stated back a few post ago.

I show here 2 scenarios for USDJPY on the daily timeframe. Both are compelling. But, they are in the opposite directions, meaning one is northbound and the other southbound. F*** what a cop out by Big Joe, hehehehe. the market is going to go either up or down, the classic hogwash, full of sh*t prognosis. Duh!

Sorry guys but here's the thing. Its kinda difficult right now because the market for USDJPY has thrown me a zinger of epic proportions ................... see explanation below ..............

(1) Scenario 1 : Chart 1 daily for the standard A-B-C correction after a 5-wave move has occurred. The northbound move from Jan 6 to March 31 is a 5-wave move. What follows is a 3-wave simple or complex correction. The most common target for the endpoint of the correction is that C = A ................ see chart this would occur at 106.291 ................... sometimes a shortened Wave C could just say f***k it at 61.8% and end right there and the A-B-C is complete and the blast north follows immediately. But wave equality is normal and usual. If not, then the other options are 161.8%, 261.8% or maximum 423.6%.

(2) Scenario 2: The drop from March 31st /2021 is a 3-wave move, This completes a correction in the true sense of a correction, sort of like the minimum requirement. If such is the case, then USDJPY should rally into a Wave 3 up. And it could be doing exactly that. Because WAVE 3 is notorious for having 1-2, 1-2s and so on which indicate subdivision formation within the wave, which means its going to be a mofo wave of voluptuous proportions that will make a TRADER rich, rich, rich, rich. This is why I took the risk. Sure it cost me but hey one cannot live by timidity, it sucks! I take big gambles and in this case have paid for the cost of tuition.

If this scenario works out as long as the low of May 12 remains intact, then it still could be the giant upwave rally next to rejoin the Primary Trend as I stated back a few post ago.