You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

dc2000

Veteren member

- Messages

- 4,766

- Likes

- 129

sold @5433, bought @5423, +10

my trades at spreadco are now referred - what a joke. Tiny account with a tiny profit.

Will be out of this provider soon.

is spreadco the name of the company? must admit Ive only heard of i-g city andcmc

I am intrigued by some of the methods presented in this thread for trading the FTSE Futures. I traded the UK100 daily with real money for about a year but decided it was too difficult to be consistent. So I took a different approach, which meant learning to program.

I developed a simple system, which I use in a demo account, but am very keen to get ‘real’ again.

The system buys when the price goes up , sells when it goes down and waits when it goes sideways . There are a number of parameters in the program which for example distinguish between sideways, up and down, but no complex mathematical indicators.

My guiding principle is ‘avoid complexity’, which includes candle analysis, chart patterns, Elliot Waves and Fibonacci – all of which I find fascinating and often apply extremely well to historic data.

Going live any time since March would have been good and last week’s results were also good. But what about December 2010 to January 2011? That makes me very cautious about going live now with December approaching.

Of course, the rules don’t change, the behaviour of the price changes. It still goes up, down and sideways as before, but in a different way, which is difficult to quantify. Human descriptions such as “choppy, volatile, trending” etc may be true, but my dumb program needs more precision. Any ideas?

Yes I can tweak the parameters to better fit the historic data, but who cares about the past? I know that losses are part of winning and there are no guarantees, but I’m being very cautious nevertheless.

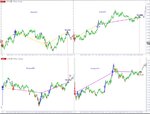

I’ve attached some charts to show the success of the last few days and a really bad couple of days. Also today’s chart. Where will it go? How will the logic respond?

Nice job Jimi. Simple ideas are always the best. Can't be bad having an equity curve like that. Which spreadbetting firm do you use and do they have an automatic trading feature? You could apply that to the FTSE futures and set up the automatic program on the Open ECry sim. Curious to see what your program does on a range bound day with lots of 1 tic breaks in either direction.

ordinaryguy76

Established member

- Messages

- 618

- Likes

- 16

Yes, I played with etxcapital, worldspreads and spreadco to date. My choice of providers is based on new client cashback offers to limit risk.

Spreadco seems to be the only one showing volume with charts, but navigation around their charts is crap in my opinion. I prefer it-finance charts used by etx/worldspreads. During the session forexpros chart is ok as well. I don't use a lot of indicators.

Spreadco seems to be the only one showing volume with charts, but navigation around their charts is crap in my opinion. I prefer it-finance charts used by etx/worldspreads. During the session forexpros chart is ok as well. I don't use a lot of indicators.

dc2000

Veteren member

- Messages

- 4,766

- Likes

- 129

Yes, I played with etxcapital, worldspreads and spreadco to date. My choice of providers is based on new client cashback offers to limit risk.

Spreadco seems to be the only one showing volume with charts, but navigation around their charts is crap in my opinion. I prefer it-finance charts used by etx/worldspreads. During the session forexpros chart is ok as well. I don't use a lot of indicators.

seems this sector of market making is long overdue for some regulation

ordinaryguy76

Established member

- Messages

- 618

- Likes

- 16

5405 exit from long and short again

Thanks, sell @5404 buy @5381 +23

don't know what it was, but I liked it 🙂

ordinaryguy76

Established member

- Messages

- 618

- Likes

- 16

planning to stop for today, good profit has been made.

Next area down I'll be watching 5335.

Next area down I'll be watching 5335.

dc2000

Veteren member

- Messages

- 4,766

- Likes

- 129

Thanks, sell @5404 buy @5381 +23

don't know what it was, but I liked it 🙂

your welcome

I think that spike down was more greek eurobable rubbish. I did hope we would get more than just a few days of normality before the euro trash started again.

5349 is the big swing high from August 15th so it is now becoming support. I hope!!

DAX is down 5.2%. That's a bit overdone in my book. We've got US PMI data due at 2pm, and the US has consistently tried to force it up in the pm.

5349 is the big swing high from August 15th so it is now becoming support. I hope!!

DAX is down 5.2%. That's a bit overdone in my book. We've got US PMI data due at 2pm, and the US has consistently tried to force it up in the pm.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -Nice job Jimi. Simple ideas are always the best. Can't be bad having an equity curve like that. Which spreadbetting firm do you use and do they have an automatic trading feature? You could apply that to the FTSE futures and set up the automatic program on the Open ECry sim. Curious to see what your program does on a range bound day with lots of 1 tic breaks in either direction.

Thanks Martin - I use FXCM’s Strategy Trader (ST) which is an absolutely superb chart platform and an automatic trader (see AUTO button in top left of charts). I’ve made tremendous progress with their ST C# language implementation, but in my (ignorant) opinion (I have nothing to compare it with ), it ain’t pretty.

Sitting in my bubble of isolation I probably miss some obvious things like: I thought the FTSE UK100 and the FTSE futures were the same thing. Am I wrong?

Also, what is the ‘Open ECry sim’, please?

I included the 20-21 October chart simply because I think it bad form to only present your successes. I’ve added another chart for the 23 & 24 August for comparison.

Both could be described as ‘range bound' I guess: The charts have a number of similarities but give very different results – if I can’t tell the difference, the program can’t – It’s no smarter than me, unfortunately.

Attachments

DaddyJohn

Experienced member

- Messages

- 1,375

- Likes

- 9

sold @5433, bought @5423, +10

my trades at spreadco are now referred - what a joke. Tiny account with a tiny profit.

Will be out of this provider soon.

What do you mean "referred" ?

DaddyJohn

Experienced member

- Messages

- 1,375

- Likes

- 9

I think that spike down was more greek eurobable rubbish. I did hope we would get more than just a few days of normality before the euro trash started again.

5349 is the big swing high from August 15th so it is now becoming support. I hope!!

DAX is down 5.2%. That's a bit overdone in my book. We've got US PMI data due at 2pm, and the US has consistently tried to force it up in the pm.

Can you imagine Merkels reaction when she heard the Greek PM say he is now holding a referendum as to accept the bailout or not!!! Given the fact he won't be able to do it until January leaves me wondering how the Market is going to handle this medium term..

Can't help but feel we are only one piece of bad news away from another strong leg down...at what point do the big money funds just throw in the towel?

ordinaryguy76

Established member

- Messages

- 618

- Likes

- 16

What do you mean "referred" ?

Well, normally if you want to open a trade, it is opened within 1-2 seconds.

Since today, if I am opening a trade, the screen says something like:

- referred to dealer (5-10 seconds wait)

- waiting for dealer authorisation (2-5 seconds)

- success

This means that trades are not started automatically, but need manual approval.

I think referral should only happen on highly profitable accounts. This account is around 20% up with total well under £1000 at the moment. Hardly a big risk to spreadco.

Last edited:

Similar threads

- Replies

- 1

- Views

- 2K