Hello Everyone

I started another thread whose title is "Beyond Price Action"

as a trading journal.

I noticed that there were very few inquiries

I have been trading professionally for about 15 years

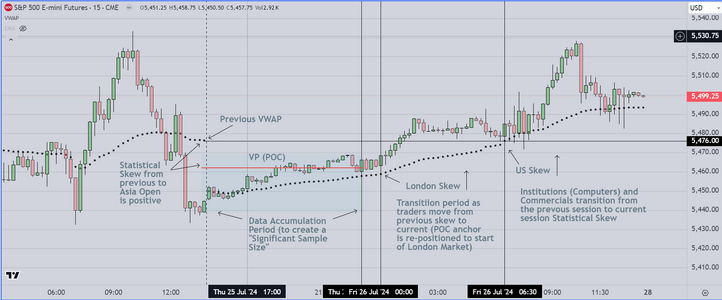

My background is diverse, with emphasis on Math (Statistics)

I have used the same tools for many years.

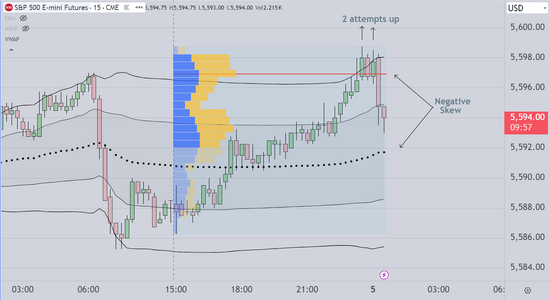

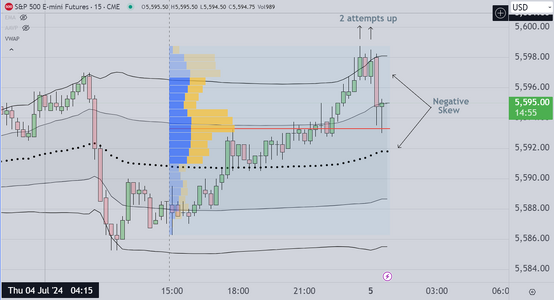

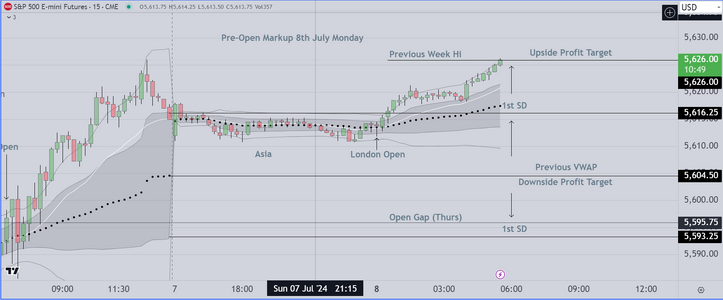

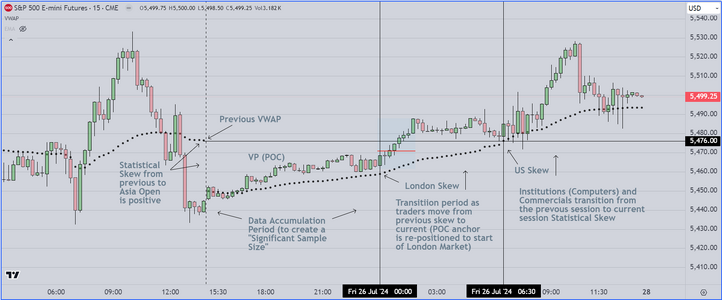

Volume Profile

VWAP

Analysis of Price Action

I hope struggling traders will take a look

and perhaps find something that they can

use to improve their results.

I did this to honor the memory of the gentleman

who trained me. I think he would be proud of my

work and my progress.

Good luck in the markets

I started another thread whose title is "Beyond Price Action"

as a trading journal.

I noticed that there were very few inquiries

I have been trading professionally for about 15 years

My background is diverse, with emphasis on Math (Statistics)

I have used the same tools for many years.

Volume Profile

VWAP

Analysis of Price Action

I hope struggling traders will take a look

and perhaps find something that they can

use to improve their results.

I did this to honor the memory of the gentleman

who trained me. I think he would be proud of my

work and my progress.

Good luck in the markets