Well, it's a point of view.

Perhaps we should just agree to differ on the above.

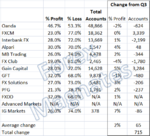

OK, now we are talking in terms of facts. Do we have the published facts for these other brokers (and shouldn't we be comparing them to other SB firms, rather than FX brokers?).

Do we have the published figures for the percentage of profitable traders from IG, for example, with whom you like to compare CS?

EDIT: OK, looking back, I assume you are comparing them with the list of US FX brokers that you posted.

Sorry had not seen that before.

However, you are still not comparing like with like.

You need to compare CS with other SB firms operating in the UK market (like IG Index).

However, I don't think those figures are available.

Unfortunately, we don't have the boss of IG Index on here to tell us.