trader_dante

Veteren member

- Messages

- 4,535

- Likes

- 1,704

Today I placed two trades one on the GBP/JPY and the other on USD/JPY and they did not workout the way I wanted it to. Oh well on to the next........

Those pairs are fairly correlated and the setup was almost identical on both so the chances were high that if one failed, the other one would also.

I can see why you took them - The pin that appeared at 2pm helped form an hourly double bottom. My problem with both of those setups though is that the market is back at that level in the first place.

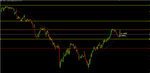

Have a look at the daily chart of Usd/Jpy (chart 1). We have two major levels that mark a zone between 93.90-94.40 and this is a pretty critical level. Now look at the level above that at 95.50. We tested this in late June, crashing through it on the 23rd only to undo that and go back at above it the next day on the 24th. Two days later on the 26th, we smash back through it again and then after the weekend, on the 29th (the next trading day) we undo that day and move higher. But the rally just runs out of steam after three days and then we come back into that level hard again. Note how yesterday we also break the ascending minor TL.

Now check out the second chart which is Usd/Jpy on the hourly. A pin formed at a minor hourly support (not shown here) at 8am this morning. This rally took us right where we would expect. Another test and failure to close above the hourly s/r pivot (yellow) and the prolonged retest of that ascending TL. In my opinion we are going to make a decent attempt to take out 93.90 very shortly. Wind and rain erode the coastline over time.