Here Are 3 Short-Term Trade Set-Ups

We have three pairs today that offer solid set-ups over the next 24-48 hours, those being USD/JPY, USD/CHF and NZD/USD - a couple of footnotes:

- entries for 24-Hour Target Trades are typically made at the time of posting (i.e. 5:05 AM PDT for today)

- given that there has been a big move overnight, prices still may pullback a bit more before resuming their path towards our projected target prices. Hence, traders may wish to scale into these trades at current levels and at the levels noted below

USD/JPY - 112.30

USD/CHF - 1.2155

NZD/USD - .6375

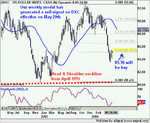

Looking at the Dollar Index (DXC) from a longer-term perspective, the long holiday weekend ushered in more selling in the dollar (DXC). In fact, the sell-off that began on Monday has now resulted in an outright sell signal based on our weekly model. While our weekly model has been quite effective with signals over the last year, it is key to remember that these signals project out price direction that may last several weeks/months.

On a short-term basis, DXC is finding support on the 60-min chart at 84.27 and appears poised to rally towards 84.45-50 before resuming the downtrend.

Launch FX Desktop Ticker

Dave