We should all know the 2% rule. Devised by Dr Alex Elder. Says capital risked per trade should be not more than 2% of your total account.

I have followed this rule and quoted it here and elsewhere. My own current trades are running at about 3% risk on average - I'm not a novice but still conservative and still trying to respect the rule. But we shouldn't give unquestioning faith to any rule in trading.

First off, this rule first appeared in print no less than 23 years ago in "Trading for a Living", by Dr Elder. His name started to become known in the late 80's. His trading obviously pre-dates the launch of his website in 1988. That passage of time on its own should qualify for this to be re-visited.

Dr Elder is a psychiatrist who trades. Nothing wrong with that, but he is bound to bring a psychological viewpoint to his writings. It's therefore very possible that the major benefits of following his teachings are protection from negative psychological impact, rather than wealth generation.

Dr Elder's knowledge and experience in trading are derived from the US private trader's viewpoint. This is not necessarily going to be universally reflected by traders' conditions in other countries.

His experience pre-dates the huge increase in private trading in the late 1990's. I don't say good trading rules should have come out of the frenzied daytrading of the tech bubble, those were atypical market conditions, but some things in the game have changed since then.

His experience was (I think) derived from going long on US stocks in the late stages of a decades-long bull stock market and US economic expansion. As far as the markets were concerned then, I'm sure the feeling was this was never going to end. But being a long-only one-country share-buyer probably doesn't count as trading as we now understand it. How relevant is buying shares in a bull market to trading both ways on the huge variety of other instruments we can now access?

Sorry if I've taken a swing at your personal guru, but I suspect those of us who know the rule also break it every trade. Don't you?

I read his book/s and saw his site many times , with all the very expensive trading courses .I am glad some people believe he was a trader , but the only thing I saw was another author , course seller and educator and the only evidence I see is making money from courses , books ,videos and consultations.Good luck to him for making money!

Even his method of indicators and moving averages does not have any edge .Those who can, do; those who can't, teach.

Prov. People who are able to do something well can do that thing for a living, while people who are not able to do anything that well make a living by teaching.

I was very dissaponited with your Guru and his books .I learnt nothing from him about trading psychology , I wonder how much of it he knew , and how little his followers can learn from him.The only thing to learn was you need discipline , god was I happy , I told all the pub crowd drinking their money " you need discipline! " , they bought more drinks and did the opposite.Does it work ?You need discipline for trading.

If he was any good as a psychiatrist , he would have told you more about psychology.He would have told you , the 2% is theoretical figure , if he was a real psychologist , he would have told that in reality , your brain is not in reality with the markets , that your primitive brain is not rational about money , it gets into a weird state when it smells money.Therefore , the 2% does not work ,just follow the 2% discipline and keep buying my trading courses from my site.

Search on google for "Weird Things Money Does To Your Brain"

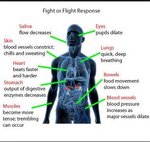

I know traders who have put on larger trades ,than their system 2% set position sizes , simply because their brain command centre is shutdown or is shortcircuiting in a stress response.

An Amygdala Hijack is an immediate and overwhelming emotional response out of proportion to the stimulus because it has triggered a more significant emotional threat. The amygdala is the part of our brain that handles emotions. During an Amygdala Hijack, the amygdala "hijacks" or shuts down the neo-cortex (the command centre of the brain).Mistakes are made especiality when your brain is not in reality