Develop a Neural Network based indicator has some advantages:

- Indicator may consist of a predicted values, as a leading indicator.

- This leading indicator will be useful prior placing any trade

- Neural network training can be performed using available softwares (freeware and commercial are available).

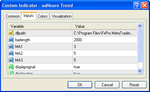

- the trained NN can be implemented as indicator in Metatrader either written neural configuration (weight) or calling the dll.

As a sample of NN implementation, I found the following link as the starting point: http://forums.babypips.com/57970-post1.html

Here I attached all file discussed on above link, basic idea to create the neural net is explained on the file (description.doc).

Using the same idea, I use Neuroshell to train the neural network and implement it in MT4 to create the indicator.

The following steps to build the NN:

1. Prepare the training data,i.e. consist of inputs and outputs for NN. Using MT 4 script to collect the data. Input can be indicators available in MT4 such as EMA, RSI, CCI, WPR etc. The output can be predicted EMA, Close, etc which useful for our trading depend on the NN strategy (back propagation, kohonen, PNN, GRNN, or GMDH).

2. Train the network using neuroshell:

- Create new problem

- Advanced NN: loading the data, define input/ouput, extract data (training and testing), design NN to choose NN strategy, create the dll using run time facilities.

3. Copy the created dll into MT4 folder.

4. Create MT4 indicator which consist of: dll file link definition, NN initiation OpenNet (in MT4 init function), calculate the indicator using FireNet and CloseNet (in MT4 deinit function). FireNet is used to firing the neural network using inputs as defined while preparing the data to get the NN output (predicted data).

5. Improving indicator, in my attachment I use moving average and comparison between the output net to generate trading signal and classifier indicator.

6. Converting MT4 indicator to expert advisor (I need some one to help me to create the EA based on created indicators).

The original MT4 files should been modified due to the format data required on

Neuroshell is different.

Attachment explanations:

- Description.doc (brief description from the originator)

- Data collection script.zip (sample code to collect data)

- Indicator, met file, template including instruction (in zip)

- aa Neurotred.jpg (indicator produced based on Neuroshell dll)

- Neuro Trend Classifier 4H.jpg (improved indicator)

Any advice is highly appreciated.

Cheers,

Arryex

- Indicator may consist of a predicted values, as a leading indicator.

- This leading indicator will be useful prior placing any trade

- Neural network training can be performed using available softwares (freeware and commercial are available).

- the trained NN can be implemented as indicator in Metatrader either written neural configuration (weight) or calling the dll.

As a sample of NN implementation, I found the following link as the starting point: http://forums.babypips.com/57970-post1.html

Here I attached all file discussed on above link, basic idea to create the neural net is explained on the file (description.doc).

Using the same idea, I use Neuroshell to train the neural network and implement it in MT4 to create the indicator.

The following steps to build the NN:

1. Prepare the training data,i.e. consist of inputs and outputs for NN. Using MT 4 script to collect the data. Input can be indicators available in MT4 such as EMA, RSI, CCI, WPR etc. The output can be predicted EMA, Close, etc which useful for our trading depend on the NN strategy (back propagation, kohonen, PNN, GRNN, or GMDH).

2. Train the network using neuroshell:

- Create new problem

- Advanced NN: loading the data, define input/ouput, extract data (training and testing), design NN to choose NN strategy, create the dll using run time facilities.

3. Copy the created dll into MT4 folder.

4. Create MT4 indicator which consist of: dll file link definition, NN initiation OpenNet (in MT4 init function), calculate the indicator using FireNet and CloseNet (in MT4 deinit function). FireNet is used to firing the neural network using inputs as defined while preparing the data to get the NN output (predicted data).

5. Improving indicator, in my attachment I use moving average and comparison between the output net to generate trading signal and classifier indicator.

6. Converting MT4 indicator to expert advisor (I need some one to help me to create the EA based on created indicators).

The original MT4 files should been modified due to the format data required on

Neuroshell is different.

Attachment explanations:

- Description.doc (brief description from the originator)

- Data collection script.zip (sample code to collect data)

- Indicator, met file, template including instruction (in zip)

- aa Neurotred.jpg (indicator produced based on Neuroshell dll)

- Neuro Trend Classifier 4H.jpg (improved indicator)

Any advice is highly appreciated.

Cheers,

Arryex

Attachments

Last edited: