rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

8 july

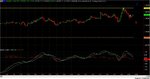

play 1:

Buy Stop Long at 1247, target 1253,

play 2:

stop "n" reverse Short 1253, target1: 1247, target2:1239, target3:1232

alternate play if price doesn't trigger play 1:

Sell Stop Short 1239, target 1232

play 1:

Buy Stop Long at 1247, target 1253,

play 2:

stop "n" reverse Short 1253, target1: 1247, target2:1239, target3:1232

alternate play if price doesn't trigger play 1:

Sell Stop Short 1239, target 1232