DashRiprock

Experienced member

- Messages

- 1,650

- Likes

- 482

Open an account with an FCM or get an uncoalesced data feed and trading simulator like Ninjatrader. Working on the grounds that you each already have the basics in chart patterns and candlesticks, get and read the following books (split up into category);

Trading Books:

Mind Over Markets

Markets in Profile

The Secrets of Economic Indicators (advanced candidates only)

Trading Psychology:

Trading in the Zone

Daily trading Coach

High Performance Trading

Technology:

Excel for Dummies (not necessary of knowledge of excel alredy).

Then do this until you are consistently profitable:

PRE MARKET

Pick a contract for which you can be at your desk for either the opening few hours (preferred) or closing few hours.

1) On a tick/volume/range (NOT time bars) chart, mark out the previous days high and low, and any high volume areas (if trading at the close, mark out present day's high + lows too). It also helps to either look at "average" bars or just Hi-Lo bars, dont read anything into the open and close on intra-day bars they just get in the way.

1a) Mark out other points of reference (advanced candidates only)

2) Look at an economic calendar, avoid trading around news announcements.

THEN WHEN THE MARKET OPENS

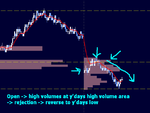

Look to see where the open is in relation to the levels you have marked out. In the first stages you will be looking for the open type to tally itself with one of these areas (Open, rejection, reverse off yesterdays High volume area for instance. It's all in the books).

THEN

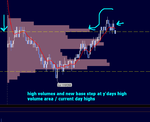

When it gets to one of these levels, Watch the DOM , Time and Sales. Ideally you want to be able to keep a running total of how many contracts are trading at a particular price that refreshes every bid/offer change, but a rolling total/histogram is OK too.

The first thing to watch for is where there are alot of contracts going through a narrow range of prices (so the histogram bars get longer and longer). When this happens consider it a "base step". Once that happens one of 3 things will occur

1) it will keep chopping around and building a "normal" profile

2) It will turn around and go back to where it came from

3) it will go sideways for a bit and then carry on going the way it came.

NOW

in scenario 1) you just wait / call it a day. Advanced traders can do things here but not for newbs

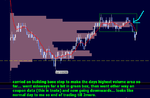

in scenarios 2) and 3) you are going to trade the way it is going. It will be clear which way its going because it's going that way. A fast EMA can help here.

THEN

watch your Time and Sales / DOM and try to pick a good entry and stop. At first you won't have a clue but if you keep at it eventually you will get the hang of it. ints:

* in the beginning, do the opposite of what conventional wisdom suggests (so if you are looking to buy because it's going up, look for selling as a good time to enter).

* look for lots of trades going through on the bid/offer but without moving it

* Filter your time and sales by trade size

* ask yourself where orders are likely to be, and what type they'll be

Run trades until you get to another point of reference or you see another "base step" developing.

Only trade for a few hours a day but make it the BEST quality trading you can. You don't need to spend 10 hours in front of screens to make money, in fact that makes it harder. Obviously keep good records in Excel and a Journal.

POST MARKET

Read at least one chapter of the psychology books after you've finished your day job or whatever. Don't matter if youve read them already, it will sink in more and more and give you motivation for next day. Sports psychology books are also helpful.

THEN

If your trading hasn't improved markedly after doing this for 1 yr, give up.

Obviously this is not comprehensive, it's not meant to be. But it's a start.

Trading Books:

Mind Over Markets

Markets in Profile

The Secrets of Economic Indicators (advanced candidates only)

Trading Psychology:

Trading in the Zone

Daily trading Coach

High Performance Trading

Technology:

Excel for Dummies (not necessary of knowledge of excel alredy).

Then do this until you are consistently profitable:

PRE MARKET

Pick a contract for which you can be at your desk for either the opening few hours (preferred) or closing few hours.

1) On a tick/volume/range (NOT time bars) chart, mark out the previous days high and low, and any high volume areas (if trading at the close, mark out present day's high + lows too). It also helps to either look at "average" bars or just Hi-Lo bars, dont read anything into the open and close on intra-day bars they just get in the way.

1a) Mark out other points of reference (advanced candidates only)

2) Look at an economic calendar, avoid trading around news announcements.

THEN WHEN THE MARKET OPENS

Look to see where the open is in relation to the levels you have marked out. In the first stages you will be looking for the open type to tally itself with one of these areas (Open, rejection, reverse off yesterdays High volume area for instance. It's all in the books).

THEN

When it gets to one of these levels, Watch the DOM , Time and Sales. Ideally you want to be able to keep a running total of how many contracts are trading at a particular price that refreshes every bid/offer change, but a rolling total/histogram is OK too.

The first thing to watch for is where there are alot of contracts going through a narrow range of prices (so the histogram bars get longer and longer). When this happens consider it a "base step". Once that happens one of 3 things will occur

1) it will keep chopping around and building a "normal" profile

2) It will turn around and go back to where it came from

3) it will go sideways for a bit and then carry on going the way it came.

NOW

in scenario 1) you just wait / call it a day. Advanced traders can do things here but not for newbs

in scenarios 2) and 3) you are going to trade the way it is going. It will be clear which way its going because it's going that way. A fast EMA can help here.

THEN

watch your Time and Sales / DOM and try to pick a good entry and stop. At first you won't have a clue but if you keep at it eventually you will get the hang of it. ints:

* in the beginning, do the opposite of what conventional wisdom suggests (so if you are looking to buy because it's going up, look for selling as a good time to enter).

* look for lots of trades going through on the bid/offer but without moving it

* Filter your time and sales by trade size

* ask yourself where orders are likely to be, and what type they'll be

Run trades until you get to another point of reference or you see another "base step" developing.

Only trade for a few hours a day but make it the BEST quality trading you can. You don't need to spend 10 hours in front of screens to make money, in fact that makes it harder. Obviously keep good records in Excel and a Journal.

POST MARKET

Read at least one chapter of the psychology books after you've finished your day job or whatever. Don't matter if youve read them already, it will sink in more and more and give you motivation for next day. Sports psychology books are also helpful.

THEN

If your trading hasn't improved markedly after doing this for 1 yr, give up.

Obviously this is not comprehensive, it's not meant to be. But it's a start.

Last edited: