Joules MM1

Established member

- Messages

- 648

- Likes

- 142

http://www.trade2win.com/boards/commodities/135664-gold-2011-12-a-33.html#post2046344

carrying on from the above

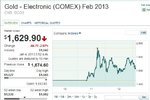

the bulls, the money managers, are puking some today.....likely target for a bounce, i think, is the 1635 then 1618 fro a head fake level on a ratio.....but a larger swing down will find a lot of commercials buyers...silver has blown it's 1:1 ratio today, although, if a sustained lift in the SML/RUT in the US is likely to see a strong swing in demand for silver to out-play gold......

carrying on from the above

the bulls, the money managers, are puking some today.....likely target for a bounce, i think, is the 1635 then 1618 fro a head fake level on a ratio.....but a larger swing down will find a lot of commercials buyers...silver has blown it's 1:1 ratio today, although, if a sustained lift in the SML/RUT in the US is likely to see a strong swing in demand for silver to out-play gold......