You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

I have previously alluded to the importance of trading psychology by discussing two types of trading errors: Decision Making Error and Data Error. Some readers have indicated their desire to learn more about it. In this article, I will dive deeper into the topic of option trading and trading psychology.

Trading options and trading psychology are closely interrelated. The goal of this article is to show some of those close connections between the two. Let us start by describing what option trading really is. One of the easiest ways to describe option trading is by simply comparing it to equity trading. Most people are more familiar with equity trading so I will use that as a bench mark. Equity trading involves physically owning a...

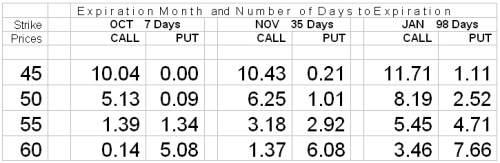

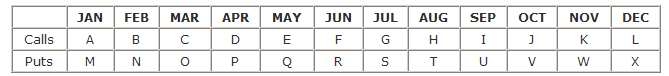

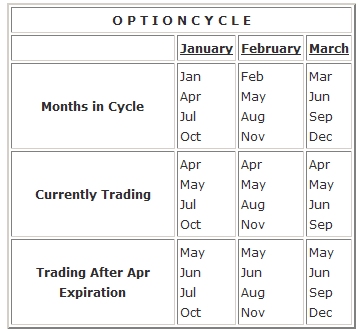

Today I'd like to talk about a strategy called the Vertical Spread. For those of you who are wondering how the terms Horizontal and Vertical came into common usage, ponder no more. In a typical options chain or montage, the options are typically displayed in the format shown here. Calendar months listed horizontally and strike prices listed vertically!

As I typically like to do, let's start out with a definition.

Definition: A Vertical Spread is an options strategy in which options are bought and an equal number of options of the same type (Puts or Calls) are sold with different strike prices, but with the same expiration date.

Vertical Spreads are directional strategies and are either bullish or bearish. This is what the generic...

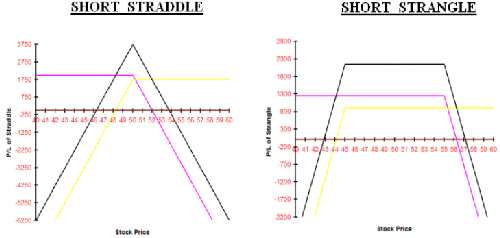

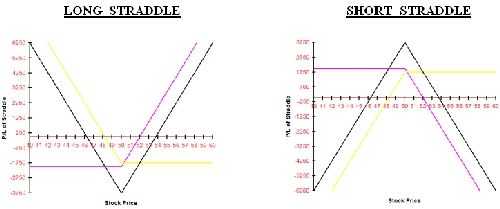

I've recently written about the popular strategies of Straddles and Strangles. For the most part, they were discussed from the long side, in other words, buying the Straddle or buying the Strangle. Obviously, there is another side to this story, and that is the short side, selling the Straddle or Strangle.

There were 2 main reasons why I emphasized the long side. The first has to do with the fact that brokerage companies don't just let everyone trade short naked options. Each company has their own set of rules and requirements regarding what they require to allow a customer to trade short options. Factors taken into account can include the customers' length of options trading experience, their income and net worth, and the size of...

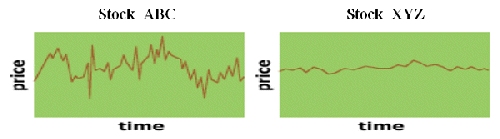

I've probably mentioned the term volatility in every article I've written about options trading. Everyone probably has an intuitive feel as to what volatility means, for example looking at the following charts of stocks ABC and XYZ, it's pretty clear which one is more volatile. If you think it's XYZ, you probably should hold off a little before you start trading options (or anything else for that matter.)

So how do we define volatility and how do we measure it? In general terms, volatility is the rate that the price of a security moves up or down. It is measured by the annual standard deviation of the daily price changes in the security. Digging down a little deeper, the standard deviation is calculated by taking the square root of...

A question recently came up about the symbols that represent options and what seems like a relatively boring and mundane topic is actually filled with twists and turns and many surprises. Okay, so it probably won't make you rich knowing more about option symbols than 99 percent of the non-professional options traders out there, but it will keep you from making mistakes when dealing with your broker, and in some circles, can make you a hit at cocktail parties.

The truth of the matter is that the system which has been in place for 25 years (since 1973) has not kept up with available technology and has become extremely unwieldy. In the industry, rumor has it that a particular large brokerage company, whose name I probably shouldn't...

I'll bet you probably never considered how international options trading can be! We know there are American options, which can be exercised at any time from when they are bought until their date of expiration (we call that "early exercise.") There are also European options, which cannot be exercised early, and can only be exercised on their expiration date. Well today we're going to learn about the "Greeks." This term should not be new to anybody who is already trading options. The reason is that they are so important, that unless you have a basic understanding of what they are, and how to use them, you are going to be trading with a serious disadvantage.

So what are these Greeks? Simply put, we can call them risk measurements, (sorry...

Since the introduction of exchange traded options in the 1973, they have become more and more popular. In fact, it seems that almost every month I get an email from the Chicago Board of Options Exchange (CBOE) announcing that a new record number of contracts have traded and showing the month to month and year to year increase in options trading.

What accounts for this increase in options volume? Well, while banks and other institutions have been using exchange traded and over-the-counter options for many years, the general public is beginning to recognize that options don't have to be as risky as their reputation may imply. In fact, they can be used in many conservative ways to hedge a portfolio, provide portfolio insurance, generate a...

Virtual Trading (VT) is a general term referring to hypothetical trades made by a trader for either practicing or for evaluation of his/her methodology. You may have also heard the term "Paper Trading" which is usually used interchangeably with VT. In fact, the days prior the rush of personal computers in all aspects of life (trading included) virtual trades were done on paper instead of being done in a real account hence the term "paper trading". Nowadays the astounding massive use of personal computers and the extensive use of internet have made virtual trading possible in an amazingly convenient way. The virtual trader does not have to adjust his notes for corporate actions, dividends and other labor intensive stuff. All these can...

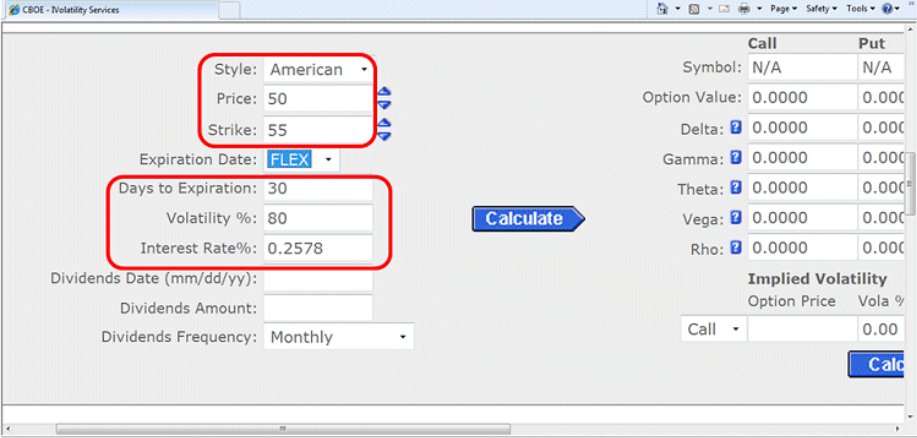

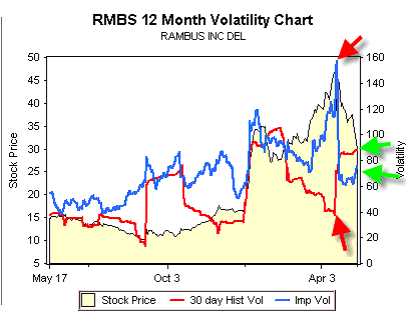

In this article, I will address one of the questions that I have recently been asked. It is on the topic of huge swings in the implied volatility on an individual stock. In order to get to the bottom of the issue under discussion, I have utilized the CBOE's Option Calculator. Here is the question that I was asked:

I own a biotech stock that is currently trading around $50 and I have recently sold some 55 strike covered calls with the expiration next month. The very next day, out of nowhere, positive news came out and the stock jumped $3. However, the value of the option fell by nearly 30%. How can that be?

The simple answer to your question is that the implied volatility decreased, which in turn has caused the premium of your 55 call...

There may be an unlimited number of approaches to the markets and their usefulness may be both obvious and questionable. As mass psychology is a basic engine which drives markets forward, so the analysis is derived from market psychology and as such it may seem more attractive than it actually is. On the other hand sound analytical methods do not get significant attention at times, as they are effective but not necessarily "promising" and give traders the truth, which sometimes may be hard to accept.

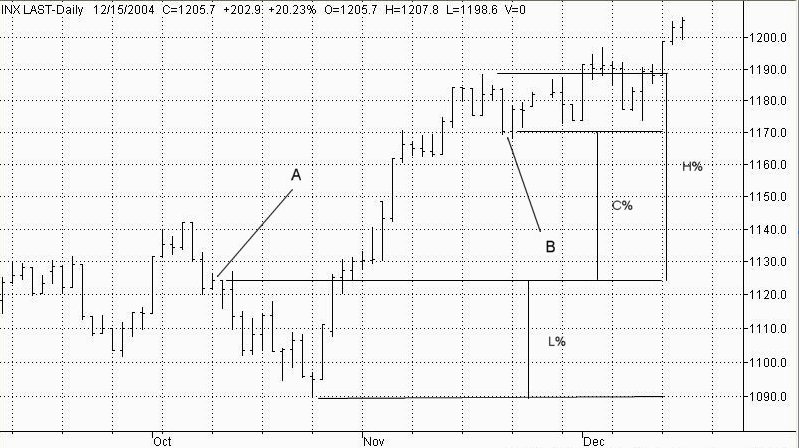

In the March 2005 edition of "Futures" magazine the ODI (Option Deviation Index) was presented, which takes measure of market fluctuations based on the entry point (Fig.1). The result is calculated as a percentage of entry value divided...

Part 1

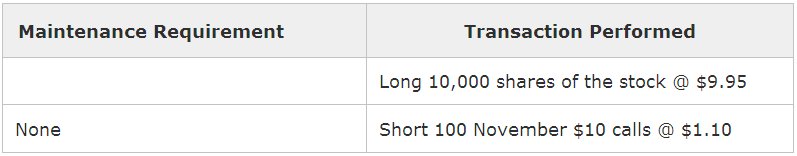

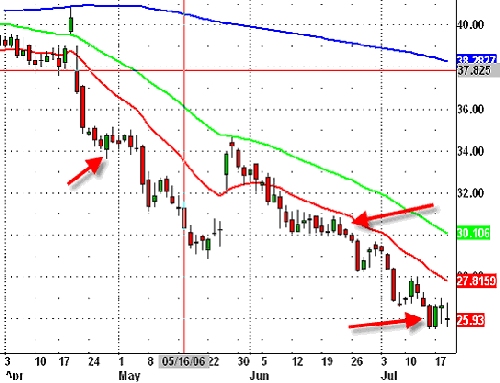

At the end of one my classes at Irvine, an option trader stopped by for some small trading chit-chat. By the look in his eyes, I could tell that he had a large position that was eating away at his sleep as well as his finances. Without disclosing the trader's identity, I would like to describe the situation in which the trader had found himself. He owned 10,000 shares of an unnamed pharmaceutical underlying which, at the time of his entry was trading at $9.95 ($9.95 times 10,000 equals $99,500 in a single trade). Knowing as much as he did about options, he had chosen to sell credit calls on the shares that he owned. As a reminder, each contract controls 100 shares, so if a trader has 10,000 shares (divided by 100) he could sell...

As a trader, one of the key things that I try to consciously do is to cultivate my instincts by talking with other traders and investors as often as possible. It still amazes me how large the divergence of opinion that exists regarding what people believe will unfold as we enter the new millennium. Many very respected names are literally predicting an economic earthquake that will measure a 10 on the Richter scale while others having looked at the exact same research claim that the consequences will be very mild. As a trader I have to evaluate the data and develop a strategy that I feel not only gives me an edge but allows for a great deal of error while still being low risk!

In his book, "Business Without Economists" author William J...

There are an unlimited number of ways to skin a cat and trading is no different. Despite your strategy, risk tolerance or trading capital, having a plan is one of the most important components of achieving success in these treacherous markets. However, perhaps the most important characteristic of a profitable trader is the ability to adapt to ever-changing market conditions. Knowing this, it seems logical to assume that a trading plan should be established but just as rules are meant to be broken, trading plans should be flexible to accommodate altering environments and new events.

The premise of a trading plan is similar in nature to a business plan. It is a relatively detailed outline of the structure of the trade and the...

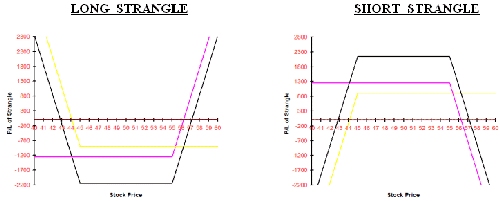

This week we'll learn about the Straddle's first cousin, the Strangle. Let's start off with a definition.

Definition: A long (short) Strangle is the purchase (sale) of an out of the money (OTM) Put and an OTM Call on the same underlying stock with the same time to expiration. There's also a similar strategy, called a Guts, where both of the options are ITM.

With XYZ stock trading at $50, an example of a long Strangle would be the purchase of the XYZ July 45 Put and the July 55 Call. If the Call is trading for $1.25, the Put for $.90 and we bought 10 Strangles, the total cost (excluding commissions) would be $2,150. Of course, if we sold the Strangles, we would receive a credit for that same amount coming into our account. Like the...

Over the last few months I've discussed a lot of the basics of trading options. It's like building a house; you start with the foundation. As far as actually trading, I've discussed Puts and Calls and a little bit about Covered Calls. Now we're going to start thinking about different types of spread strategies. Why do we want to spread? Several reasons; it reduces the overall cost and limits the risk of a position. At the same time it lowers the breakeven point for the position and allows flexibility to take advantage of different types of market conditions. Of course, like everything else in trading, there is a trade-off. The maximum potential on the upside may be capped, and there will be more commission costs and more bid/ask spreads...

Tomorrow, the 18th April 2008, is the 3rd Friday of the month, commonly referred to as expiration Friday. Coincidentally, this year it almost coincides with the first day of the Jewish holiday of Passover. I therefore find it appropriate to ask "Why is this day different than other days?" (If you don't get the joke, and care to, send me an email.)

The truth is that technically the expiration is on the Saturday following the third Friday, but you can't trade the options after the close on Friday. Also, if you want to exercise an option that is in-the-money (ITM) by less than a nickel, or not exercise an option that is ITM by a nickel or more, you must notify your broker by 5:30 pm (EST) on Friday. Some brokers require this notification...

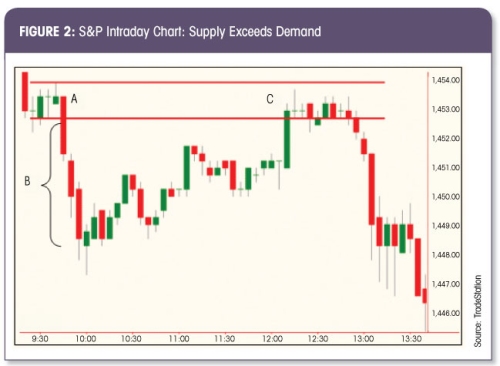

There are literally hundreds of options strategies, many more if you include the vast array of complex strategy combinations. Why so many? Simple, it s because most options speculators can't figure out price direction. Instead, they rely on complex option strategies and a variety of standard pricing models that don t work and simply add illusion to a constant simple reality of all markets: supply (resistance) and demand (support).

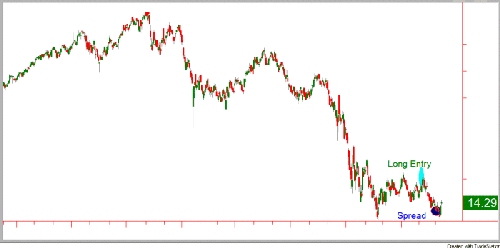

When you filter out illusion and replace it with pure supply and demand analysis in options trading, you not only simplify the useless complexity of options, you discover endless low risk-high reward opportunity based on a set of objective rules. This opportunity is one in which the reality-based options...

How does volatility affect Options trading and is it a good or bad thing?

A little violence is one's life can be very exciting, and profitable. No, I'm not suggesting you go rob your neighborhood liquor store. I'm talking about your trading life. The violence I'm referring to is the up and down fluctuations in the stock market. How severe these fluctuations are is measured by what is called "volatility."

Obviously, when there are dramatic spikes, the volatility can be very high. Conversely, when the stock is moving sideways, and not moving up and down, the volatility is reduced. Remember, earlier we discussed the components of an option price based on the Black Scholes pricing formula. Volatility is one of the ingredients. Basically...

In this article the author gives an example of how to put together all the information learnt in the past articles Covered Calls - Part 1 and Covered Calls - Part 2.

It's time to put it all together - all the stuff you've learned to this point. We're going to go through the process of selecting a position - without adult supervision. We're going to make believe we have an opinion about the direction the market is going. What is this opinion based on? It came via a fortune cookie from last night's Chinese carryout. First it gave you next Saturday night's lottery numbers. Then, it told you that EBAY was going up eight points in the next month.

Wow! What a tip! However, you look at a chart of EBAY and see that it's trading near its...

The second part of the article on Covered Call Writing looks at more detail and gives some examples.

Everybody screws up. It's human nature. I spent the last article explaining what TO do - and what NOT to do - when using the covered call strategy. Did it sink in? I hope so.

Studies have shown that you have to be exposed to something a minimum of seven times before you comprehend it. So, read on. You may think you already understand what I'm about to explain, however, it's more likely (if you're relatively new to options) that you may be a little fuzzy on the subject.

Due to the seeming simplicity of trading covered calls, dozens of books have covered the topic. They devote chapters upon chapters painting blue sky with potential...

The first of a two part look at Covered Call Writing. In this first part, we start with the basics.

When you embark upon your first adventure into options trading, there are those who will tell you that "covered call writing" is the safest strategy. Even brokerage firms allow novice option traders to trade covered calls in their IRA accounts. Little do they know. Or, if they really do know, little do they care.

Once upon a time there was an investor. All of his life he was taught that, if you buy a stock and hold onto it forever, the stock will go up, you make a lot of money and live happily ever after. It's the American dream. As we've come to learn, those dreams and Mother Goose have a lot in common. They're fairytales. The harsh...

What is gamma?

An option's price changes with fluctuations in several factors such as spot price, volatility, interest rates and time. Delta is a measure of the change in option premium with respect to a change in the underlying, or spot, price. Gamma represents the change in delta for a given change in the spot rate.

In trading terms, players become long gamma when they buy standard puts or calls, and short gamma when they sell them. When commentators speak of the entire market being long or short gamma, they usually are referring to market-makers in the interbank market.

How market makers view gamma

Let's consider how market makers view gamma. Generally, options market makers seek to be delta-neutral - that is, they want to...

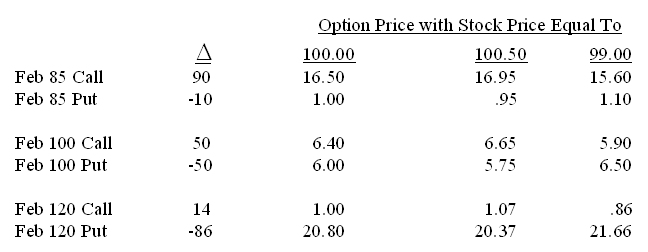

Anyone who has studied options knows that there are six basic factors that make up the price of an option. They are, the price of the underlying, strike price, days until expiration, dividends, interest rate and volatility. I thought this might be a good time to review all of these factors and how they influence an individual options price. I am choosing to do this review in more of a straight forward way rather then a purely mathematical way. There are many excellent books that use great mathematical models in explaining options, but I believe that for terms of a review we can look at some real life examples and learn from those situations. The purpose of this review is to help you to make better decisions on which options to...

Imagine how much money you could have made had you sold every option that you have ever purchased? While many traders boast of huge profits attained from a singe long option play, these stories are rare in comparison to those in which traders have lost some, or all, of the premium paid for an option.

In a sense, option buyers are throwing good money after bad in hunt of that one big market move that could return extraordinary profits. Given the fact that markets spend most of their time trading in a range, it is easy to see why few traders experience the abnormal returns that drew them to the markets in the first place.

A less exciting, but more fundamentally sound approach would be to attempt to profit from markets that are trading...

Casinos bring in gaming revenue confident that over time they will collect more than they will pay out in winnings. They know that even though there are jackpots to be paid, the odds are in favor of the house. Similarly, insurance companies collect premium with the expectation of future payouts. By knowing the probability of a claim, they can calculate their expected return for assuming the risk of the policyholder. The insurer is confident that, over time, they will profit despite their obligation to pay claims.

Option traders can benefit from the same logic by selling credit spreads. This strategy gives them the ability to capitalize on probabilities, as opposed to entering a position hoping to profit on a "long shot", as well as...