You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Filters

Show only:

Loading…

The incessant intraday struggle stock market between the bulls and the bears is what drives market rallies and precipitates market declines. Regardless of the style of analysis or system employed by traders, one primary aim of their trading endeavors is to understand the degree of control held by the bulls or bears at any given time and to predict who should hold power in the near to distant future. Unfortunately, traders' natural desire to follow the crowds often gets in the way of seeing this clearly. Here we'll take a look at how psychology and behavioral finance propel bull and bear markets.

The Force of Emotion

One way to see the market is as a disorganized crowd of individuals whose sole common purpose is to ascertain the future...

A momentum strategy seeks to profit from buying high and selling higher on the long side while selling low and covering lower on the short side. Most traders fail in this enterprise because they haven’t mastered the five elements of a perfect momentum trade. Once in place, the profit and loss statement can improve dramatically, adding significant capital to the bottom line.

Trading momentum markets require sophisticated risk management rules to address volatility, over-crowding and hidden traps that steal profits. Market players routinely ignore these rules, blinded by an overwhelming fear they’ll miss the rally or sell-off while everyone else books windfall profits. The rules can be broken down into five elements: selection, risk...

There it is, that unfinished Macro Trade Plan that you committed to finishing before your next live trade, that stack of books that you promised yourself you’d read and the list of unfinished to-dos that go back weeks. You find yourself thinking, “What is wrong with me, why can’t I follow through with at least the stuff that is important?” Yes, this is all too familiar because it happens over and over, and you may feel powerless to stop it. In fact, it may be the story of your life. You’ve missed deadlines, squandered resources and embarrassed yourself all because you didn’t follow through… you procrastinate.

Procrastination – putting something off till a later time or date – appears to haunt many a trader’s life. It can ease up on...

In 1983, legendary commodity traders Richard Dennis and William Eckhardt held the turtle trading experiment to prove that anyone could be taught to trade. Using his own money and trading novices, how did the experiment fare?

The Turtle Experiment

By the early 1980s, Dennis was widely recognized in the trading world as an overwhelming success. He had turned an initial stake of less than $5,000 into more than $100 million. He and his partner, Eckhardt, had frequent discussions about their success. Dennis believed anyone could be taught to trade the futures markets, while Eckhardt countered that Dennis had a special gift that allowed him to profit from trading.

The experiment was set up by Dennis to finally settle this debate. Dennis...

Trading breakouts or pullbacks, which is better? This is a hotly contested debate, even among professional traders – but it shouldn’t be!

As a quick reminder:

- Buying a breakout is buying when the price is moving up and above an area of resistance.

- Buying a pullback is buying when the price is moving down towards support, typically sometime after a breakout higher

- Vice versa for selling.

There are advantages and disadvantages to both of these approaches. As traders we need to fully UNDERSTAND and ACCEPT the range of possible outcomes from our strategy. Only then can we feel comfortable executing it again and again over time.

Let’s look at an example.

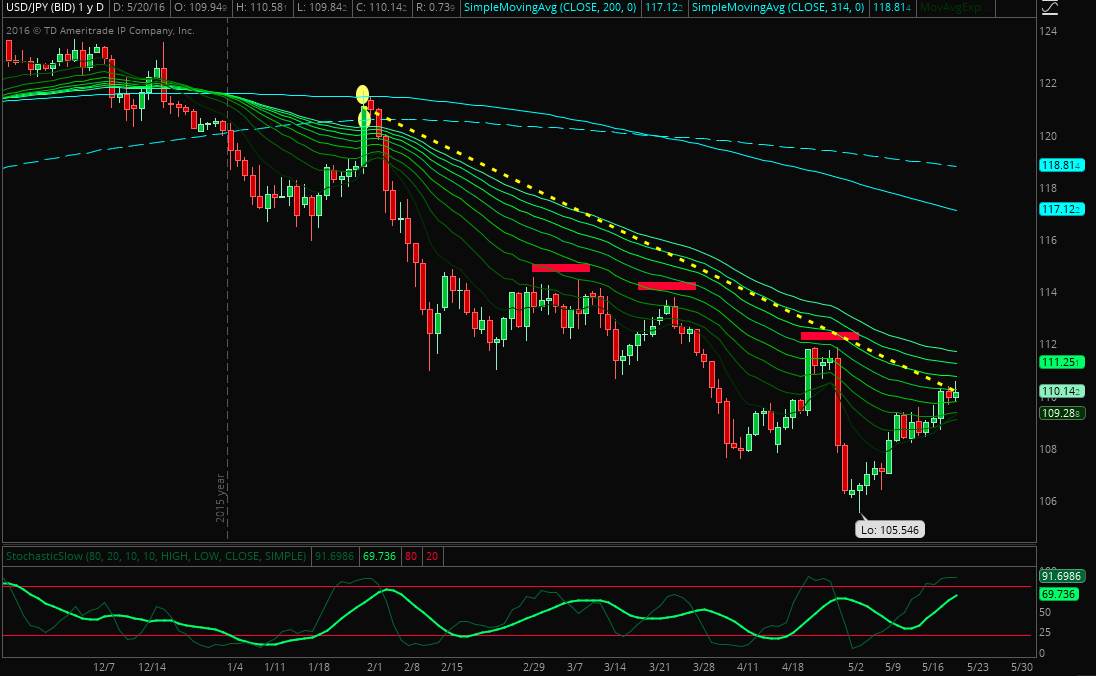

Chart 1: USDJPY 1hr candlestick chart

In Chart 1, a trader is analysing...

Finding a good entry, stop and target is fundamentally the most important aspect of trading and investing in any market, not just Forex. I have found over my years of teaching that when I introduce people to core strategies, they rarely ever want to use any of the other tools along with it because price will tell you all you need to know, if you learn to read it objectively. It will provide you with the clearest picture of the market and allow you to set stop losses, targets and entries without emotion and with controlled discipline. If you can learn to listen to what a price chart is really telling you rather than getting yourself caught up in unprofitable guesswork, you are, without doubt, on the right path to consistency in your...

There is an old saying in business: "Fail to plan and you plan to fail." It may sound glib, but those who are serious about being successful, including traders, should follow these eight words as if they were written in stone. Ask any trader who makes money on a consistent basis and they will tell you, "You have two choices: you can either methodically follow a written plan, or fail."

If you have a written trading or investment plan, congratulations! You are in the minority. While it is still no absolute guarantee of success, you have eliminated one major roadblock. If your plan uses flawed techniques or lacks preparation, your success won't come immediately, but at least you are in a position to chart and modify your course. By...

Algorithmic trading (or "algo" trading) refers to the use of computer algorithms (basically a set of rules or instructions to make a computer perform a given task) for trading large blocks of stocks or other financial assets while minimizing the market impact of such trades. Algorithmic trading involves placing trades based on defined criteria and carving up these trades into smaller lots so that the price of the stock or asset isn't impacted significantly.

The benefits of algorithmic trading are obvious: it ensures "best execution" of trades because it minimizes the human element, and it can be used to trade multiple markets and assets far more efficiently than a flesh-and-bones trader could hope to do.

What is Algorithmic...

Financial markets are enormously complex, but most trading strategies tend to fall into one of two categories: trend following or swing trading. Each strategy has advantages and disadvantages, as well as specific requirements that investors must follow consistently in order to avoid errors. However, many investors randomly apply these contrary strategies without understanding how that can undermine profitability. Identify whether you are a trend trader or a swing trader in order to hone your strategy correctly.

In theory, the trend trader takes risk in an uptrend or downtrend, staying positioned until the trend changes. In contrast, the swing trader works within the boundaries of range bound markets, buying at support and selling at...

Republicans -- to be precise, 74 percent, according to a CBS News poll -- think it’s very or somewhat likely Donald Trump’s offices were wiretapped, even though the White House has offered no evidence to back up the president’s claim that his predecessor ordered the monitoring.

I just love data points like this. They say so much about humans as a species -- how we process information, our inability to look dispassionately at a situation, the ever-present cognitive errors, even the challenges of reaching a simple, rational conclusion based on evidence.

There are lessons here for investors who want to better understand how their own minds operate, and how they can manage their own behavior. Each of these bullet points applies equally to...

Do you find yourself flitting from one way of trading to another? Or constantly tweaking the way you are trading, never quite finding that consistent winning streak?

The internet is an amazing thing – there are thousands of trading strategies described in forums, social media and YouTube videos etc. But how do you know if they work? The answer is much simpler than it seems. Test the strategy properly!

A proper test constitutes at least 30 correctly taken live or demo trades. The two elements to this are ’30 trades’ and ‘correctly taken’.

Why do you have to wait for 30 trades?

One of the biggest mistakes that newbie traders make is to give up on a trading strategy after a run of losing trades. The thinking behind doing this is...

The power of beliefs is a double-edged sword that can cut both ways. It can help you and it can hurt you. Take the placebo effect and the fact that physicians have been doling out sugar pills forever with amazing results. Or, I’m sure you’ve no doubt heard about people that were diagnosed with some horrible and incurable disease only to go into spontaneous remission or have the condition turn around overnight! It’s incredible, isn’t it? It all speaks to the awesome nature of holding a strong focus of belief on health and well-being and, presto-chango, you’re cured. Well, that’s the way it often seems.

Yes, there’s no doubt that a strong belief in yourself in any context is going to, in many cases, be the difference between...

Everywhere I turn these days, I see articles discussing how over-extended U.S. equity valuations have become. If I took a shot of mouthwash every time I came across an article that talked about U.S. equity valuations, I’d be leaving Las Vegas, Nic Cage-style, minus Elisabeth Shue. I monkey-hammered the idea of valuation as a catalyst for an equity market drawdown several weeks ago, but this week it’s woodshed time for Mr John Hussman.

Hussman has a brand new commentary beating the same dead “S&P 500 is overvalued” horse, but this time he’s coined a new phrase to describe the S&P 500: “offensively overvalued.”

While I obviously can’t say for certain what this guy uses to make investment decisions, it’s not a stretch to assume that...

There are a number of things that can impact an investor's entry (buy) into or exit (sell) out of a given stock and/or sector. Depending on the investor and his or her goals and investing time frame, the importance of timing the entry will differ. Obviously, the shorter the time frame the more important the entry; specific entries matter little to long-term (five years or more) investors.

That said, all investors should be aware of some of the more common market moving influences that can affect a stock's price. By becoming aware of these market traits, investors can make better entries and catch an extra percent or two in return.

Let's take a look at eight items that can materially impact the average day's trading.

1) Overseas...

To many traders and investors, the Bond markets are complex and intimidating. However, if you’re looking for a quality set of trading markets and/or if interest rates matter to you at all then understanding the bond markets is key for your financial well-being. In this article, I want to help simplify the powerful and important Treasury markets for you and focus on three reasons why you may want to pay a little more attention to them.

Trading Income

Bonds and, most importantly, bond and note futures are fantastic trading and investing vehicles. You can trade the bond market through multiple channels including Futures, ETFs, Bond funds and more. The major Bond markets, such as the 10 Year Note and 30 Year Bond in the USA and the Bund...

After decades of analyzing stocks and equal time spent investing for clients, I'm happy to share in plain English what's involved in this process, what works, and what doesn't. Keep in mind the reality that successful stock picking is an effort to maintain a good batting average. In baseball, a batting average of 0.30 or better is considered quite good. With stock picking, you have to do better than 0.50, which means you have more winners than losers

No one gets it right all of the time and it's not even close. Wall Street analysts all have their selected lists and the financial media regularly hawk their 10 Stocks to Buy Now or something similar. Following that road usually is a direct route to disaster so don't be tempted...

The latest bullish meme floating around Wall Street is that President Donald Trump is going to unleash a new era of big fiscal spending. As a result, lackluster U.S. economic growth is going to finally accelerate to the upside. Inflation is going to pick up. In a nutshell, this is the narrative which has triggered a huge rip higher in the U.S. stock market.

Be careful accepting that bullish narrative as gospel.

Take a look at history – it offers investors some interesting perspective. In particular, the post-election market between 1980 and 1982. On November 4, 1980, Ronald Reagan was elected president. The country appeared to be riding high.

What happened?

The stock market rallied – big. In fact, the S&P 500 jumped 7% from the...

Over the last few weeks there I have noticed much confusion in the air regarding the state of the current financial markets and with so much political and economical news in the air, it’s far from surprising to hear the questions coming.

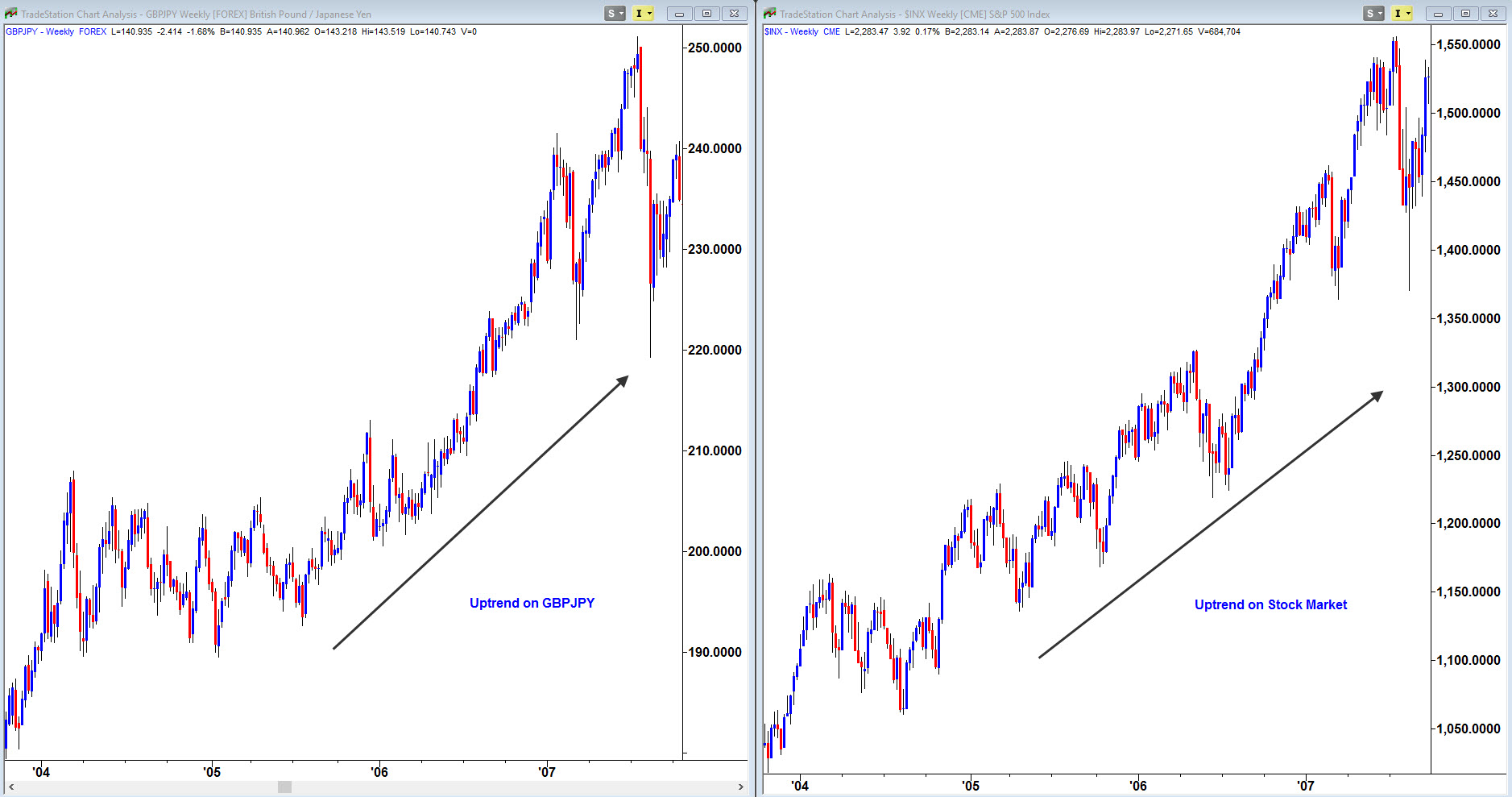

Anyone with a little experience in the world of currency trading is familiar with the impact that Central Bank Interest rates have on currency prices, and we are told to pay as much attention to this as possible so as to keep informed on all factors shaping exchange rates across the board. When reading about anything to do with FX and interest rates, you will find commentary on one aspect called the Carry Trade which is something I have been getting many questions about lately. It is a very important...

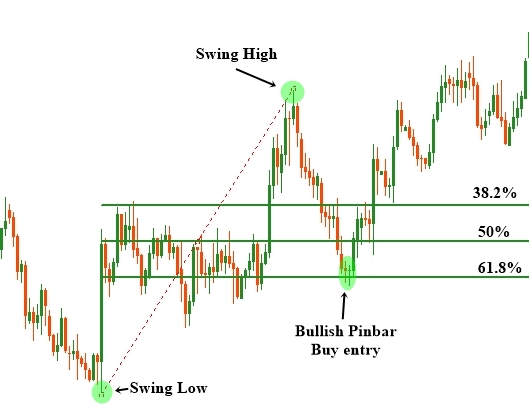

Trading financial instruments as a full-time professional trader requires a vast knowledge of the financial industry. Those who are trading the financial markets over a long period of time with consistent profit have probably gone through many difficult stages in their trading career. There are many different types of trading strategy available and professional traders have developed their preferred strategy based on their own personal traits. In this article, we will discuss an excellent trading strategy for use in the forex market. The Fibonacci trading strategy has been used in forex for a long period of time and many experts consider the Fibonacci retracement tools as their favorite. In the eyes of many professionals, the financial...

Active traders often group themselves into two camps: the day traders and the swing traders. Both seek to profit from short-term stock movements (versus long-term investments), but which trading strategy is the better one? Below, we explore the pros and cons of day trading versus swing trading.

Day trading, as the name suggests, involves making dozens of trades in a single day, based on technical analysis and sophisticated charting systems. The day trader's objective is to make a living from trading stocks, commodities or currencies, by making small profits on numerous trades and capping losses on unprofitable trades. Day traders typically do not keep any positions or own any securities overnight.

Swing trading is based on identifying...

Most investors desire diversification. It only makes sense not to put all your eggs in one basket.

One of the boons of the age of exchange-traded funds (ETFs) is that it’s now easy to diversify among many asset classes within a regular stock brokerage account. Besides funds based on combinations of stock, there are ETFs that follow the prices of bonds, real estate, precious metals, foreign currencies and more.

One category that should be of interest to all investors is the energy market. We all know that the price of oil and gas fluctuates. These may eventually be replaced by renewable energy sources, but for the foreseeable future they will be a vital part of the global economy. Like all commodities, an investment in oil provides a...

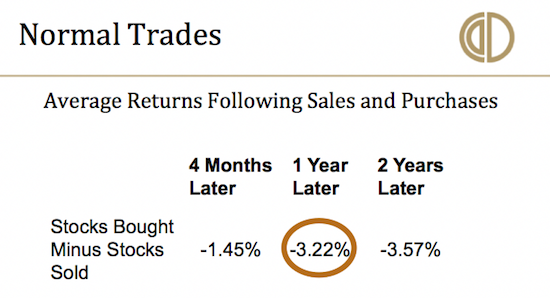

Many investors, professional and otherwise, believe that market moves can be predicted and that making frequent moves in and out of markets and investments will lead to greater returns. However, the data tells a different story, which is that market timing and frequent trading are harmful to your portfolio and will significantly reduce your overall return. Let’s begin by examining market timing.

The data below comes from research done by Terrance Odean, Ph.D., of Cal Berkeley, entitled, “Do Investors Trade Too Much?” Dr Odean discovered that amateur investors performed poorly after they made a trade (Either a buy or a sell, both speculative and non-speculative.) Thus, the stocks they sold did much better than the stocks they bought...

One of the key components of successful trading or investing, is the ability to trade around a CORE position. The “core” position as we say, is the main position of the investment or the primary amount of shares or contracts that you wish to have on during the majority of the time you are in a particular trade. Sadly, most people have no understanding of how to apply such a concept, and they plow into a trade or investment in just one single entry. Giving yourself one entry or at best two, has very limiting implications, but what is even more limiting is the idea of holding just 1 or 2 lots for the entire move.

It is true that a majority of market players approach the market in this fashion. They enter once or twice at best and they...

Any investment portfolio is bound to take some lumps in a volatile market place like that experienced by most investors in the last 14 months. During an economic market cycle, market pullbacks and corrections are commonplace and naturally occurring parts of normal market growth. Even so, they can be difficult to stomach and send investors reeling for less volatile asset classes. When the volatility pendulum swings, investors can stay too long in the way of a poorly performing investment. Riding upward growth is euphoric for most investors but the contrary is disproportionately crushing to the psyche while plundering the pocketbook. How do you stop the madness when you're holding and you should be letting go?

No matter which type of...

Momentum investing was all the rage in the 1990s when the markets were rising like a hot air balloon. This strategy is based upon the idea of purchasing whatever sector of the market has posted the greatest earnings or price gains in the market over the past year. Many funds, such as American Century Ultra (TWCUX), relied heavily on variations of the momentum strategy during this time and when the tech bubble burst, they went down with it, some harder than others.

But a new group of studies has indicated that momentum investing is actually a viable long-term investment strategy and has performed admirably over longer periods of time.

The Research

AQR Capital Management published a white paper in September of 2014 that was titled...

Among Wall Street researchers, there are two main approaches to stock picking: fundamental analysis and technical analysis. Fundamental analysis subscribes to the belief that the shares of companies will reflect changes in forward progress and financial health. In contrast, technical analysis concentrates on stock price action and how such changes reflect shifts in investor psychology. Technical analysis is totally indifferent to underlying company developments.

Therein lies its fatal flaw. As one might suspect, there are different approaches to technical analysis and there is what purports to be an academic treatise on the subject: Technical Analysis of Stock Trends, the ninth edition of which devotes nearly 800 pages to the subject...

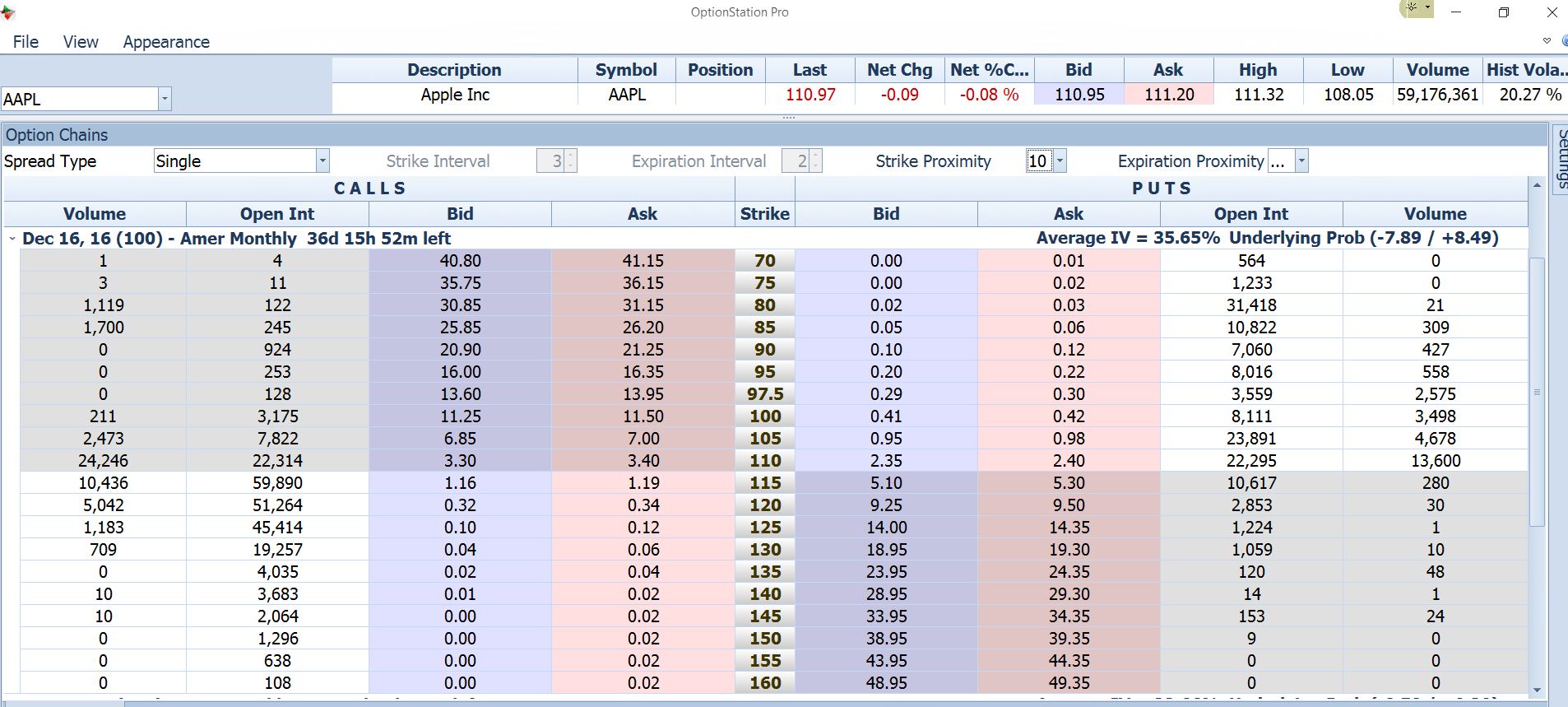

Option trading can be a great way to make money, offering strategies for traders from beginner level to the most advanced.

Before we can begin to make it work, though, there a few basic things that we need to understand.

What You Need to Understand About Options Trading

A listed stock option must be one of only two things:

Call option – A right to buy 100 shares of a stock at a fixed price, good through a definite future date

Put option – A right to sell 100 shares of a stock at a fixed price, good through a definite future date

It sounds simple with only two elements, but then so do the numbers 0 and 1. And with just those two digits, in different combinations, anything and everything in the universe can be represented (that’s...

The term “stock exchange” tends to conjure up images of a room crowded with men in suits – one hand pressing phone firmly to ear, the other waving furiously in the air. Once upon a time those iconic images were an accurate representation of the controlled chaos that was the floor of the venerable New York Stock Exchange, or NYSE as it is known.

When NASDAQ launched in 1971 as the world’s first electronic stock market, it set in motion the changes that would lead to the complex and fragmented status of markets today. A status better represented by the image of the "1s" and "0s" in a line of binary code. As alternative market centers proliferated – some exchanges, some not – so too did the choices of where to execute a trade. Today there...

“The greatest enemy of knowledge is not ignorance; it is the illusion of knowledge”. Stephen Hawking.

The participants of financial markets are possessed by a need for rational interpretations of reality which they are doomed to contemplate without a chance to change a thing. Something similar happened at the dawn of mankind when fear and weakness in the face of nature found consolation in a Supreme Devine Force suitable for «explaining» anything.

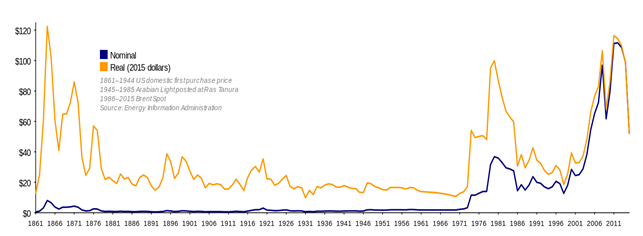

The major problem of rational interpretation of the events happening in the financial markets consists not in its uselessness but in serious material losses it entails. Today we will attempt to reveal the pitfalls laid by rational interpretations using oil futures as an example.

In the...