You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Filters

Show only:

Loading…

Introduction

The strategy detailed in this article was written almost two years ago and has been available on the forums throughout that time. Since then, there have been many members of Trade2Win who have commented on how it has improved their trading. Even today, two years on, the rules devised are still valid. There have been new "discoveries"- the magic 32 and 64 to name but one, and yet there are still mysteries that have to be resolved.

Even so, this document will probably stand the test of time, which is to help newbies get a feel for trading the Dow, and at the same time, stay in the game by way of capital preservation. It has given me great pleasure in receiving thanks from many members. Truly gratifying. This is just the...

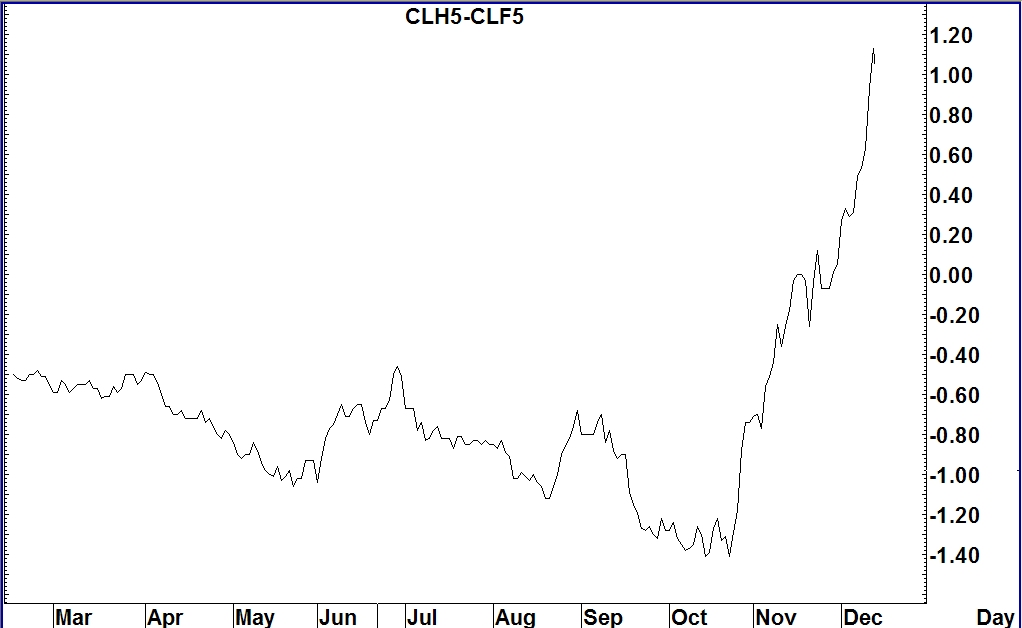

One of the best kept secrets in trading is that of reduced margin spreads. You cannot name a trading method that provides more safety or a greater return on margin than does a reduced margin spread, while also being one of the least time-consuming ways to trade. Have you ever asked yourself why it is that many of the largest, most powerful traders trade spreads? I'm going to show you why!

What is a reduced margin spread?

Because of perceived lower volatility, exchanges grant reduced margins on certain types of spreads. Spreads consist of being long in one or more contracts of one market and short in one or more contracts of the same market but in different months - an intramarket spread; or being long in one or more contracts of one...

One of the most mysterious and elusive methods of charting price action for most traders is

Japanese Candlesticks. This is one of the oldest methods of charting dating back 400 years in Japan!

This article is on a specific candle pattern called the Doji. Recognizing it is pretty straightforward. There are several Doji formations, the Dragonfly, the Gravestone and the Rickshaw. The significance behind a doji is the market price establishes a range and closes almost exactly where it opens. Give or take a tick or two in most cases. Doji's help form two and three candle formations that can develop into more powerful and trust-worthy signals once identified.

Doji's indicate indecision, the market ends where it began. Confidence is lost...

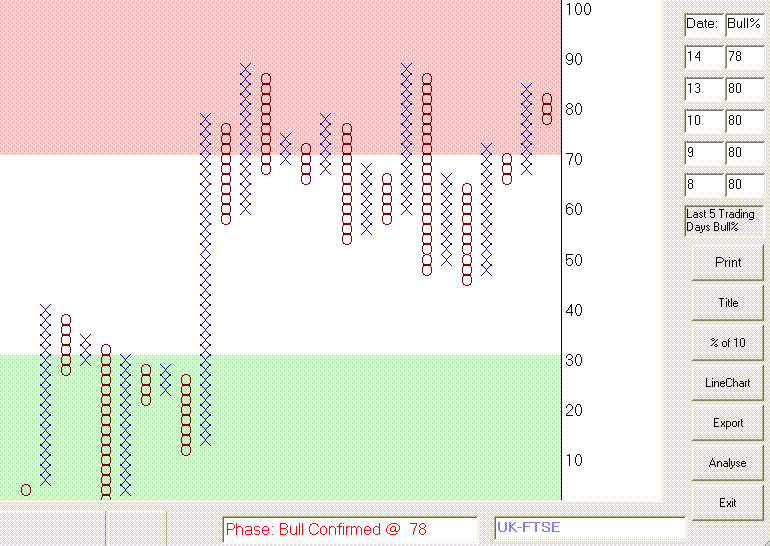

Point and Figure (P&F) charting has been around for well over a century, occupying a bit of a niche. It tends to be an area that some get quite heavily into, while a fair percentage of the non-users look at it now and again and regard it as something they'd quite like to get the hang of but never seem to get round to it. As what it does for traders today is far more important than whether Dow used it in 1903 (in my view at least) that's it for the history lesson.

P&F charts go left to right, with columns of X's and O's showing periods when the price was climbing or dropping. That's not all that dissimilar to most other chart styles - where P&F deviates somewhat is in the fact that a column can last anything from a day to weeks, months...

FX WHOLESALE MARKET PARTICIPANTS - WHO ARE THEY, WHAT DO THEY DO AND HOW DO THEY DO IT?

Introduction

The foreign exchange market is the world's largest capital market, with daily transaction volumes between the various wholesale participants averaging $1.9 trillion This guide will give the reader a basic idea of who these participants are, and how they go about their business.

Who are the key participants?

? Banks. Primarily in the business of the distribution of money (whilst retaining some of it for themselves), banks act in several capacities dependant on situation.

? Investment Managers: Investing client money in the world's equity and fixed income markets, investment managers are required to effect foreign exchange...

1. Introduction

A trading strategy is simply a pre-determined set of rules that a trader has developed to guide their trading. The advantages to the trader of developing a trading strategy are:

However, developing a trading strategy that is effective can become a complex process. There are computer programs available (such as TradeStation and WealthLab) which aim to automate the process. Unfortunately the ease with which systems can be developed and optimised using these programs can mislead the unwary trader. Fundamentally a strategy must be built around some kind of statistical edge. It is this edge that will play out over time and create positive cashflow for the system and the trader.

In this article, which will be published in...

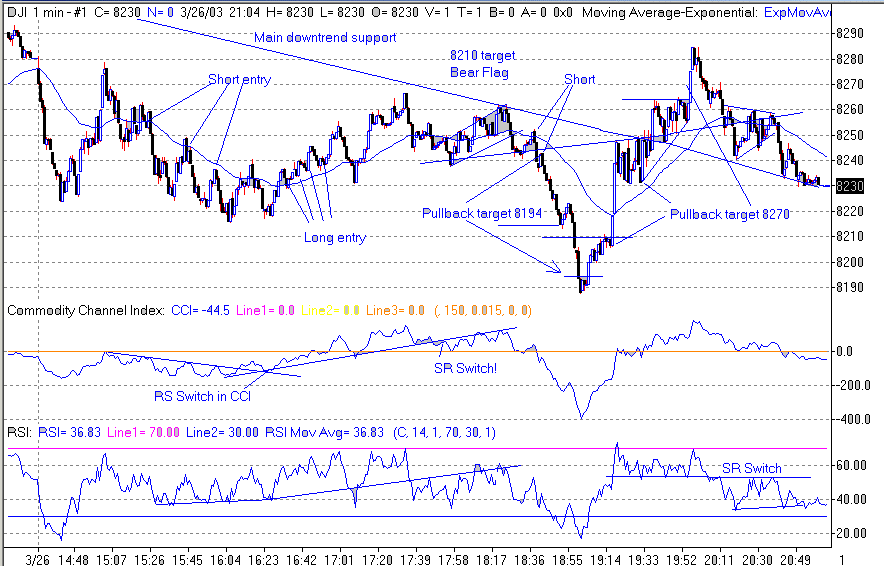

Capturing Trend Days

Trend days occur when there is an expansion in the daily trading range and the open and close are near opposite extremes. The first half-hour of trading often comprises less than 10% of the day's total range; there is usually very little intraday price retracement. Typically, price action picks up momentum going into the last hour -- and the trend accelerates.

Classic Trend Day - A large opening gap created a vacuum on the buy side. The market opened at one extreme and closed on the other. Note how it made higher highs and higher lows all day. Also, volatility increased in the latter part of the day--another characteristic of trend days.

A trend day can occur in either the same or the opposite direction to the...

The Basics of Trading

I've had a long running thread on the T2W boards giving an introduction to the central themes of trading. This series of articles has been adapted from that thread and will take you through all the areas you need to get a start in trading, from chart reading to defining a strategy.

In Part 1 I will look at:

Basic chart reading

Money management

Exiting a losing trade

Setting a price target

Part 2 will then consider:

The importance of discipline

Paper trading

The trading plan

And finally, in Part 3, I will bring it all together by taking you through a simple trading strategy.

Basic Chart Reading

Ok let's start with the basics of chart reading and deal with Support, Resistance and Trendlines. This...

The Right Tools for the Job: a guide to the hardware needed to trade from home

As someone who's already considering trading, you'll already have a PC and be connected to the internet - you wouldn't be reading this otherwise - but you might be asking yourself just what sort of hardware and software does a trader need to give them an edge in today's high-tech marketplace.

In the last few years, the relentless march of technology has made trading from home a viable proposition for many people. With a fast connection, modern PC and a Direct Access Broker, we as self-employed traders are able to access the same tools and systems that not so long ago were strictly for the professional.

There are many different ways to trade the markets...