Schwab seems to be going the wrong way. The Roth account is up 1.95% while the Traditional IRA is down 2.16%. Altogether slightly negative $76 (0.12%). The Traditional has almost all the negative positions: NVDA, TGT, LVS. Only HUT is in the Roth. It is discouraging to see progress getting eaten away like that. I even considered dumping Schwab into Robinhood and putting it on the MACD strategy (more on that later).

I am looking at it as a consequence of having funds spread over multiple accounts though. What I pencil-whipped before the market opened was that all accounts are up somewhere around $1870 (2.25%) for the year. That’s in line with my trading goals.

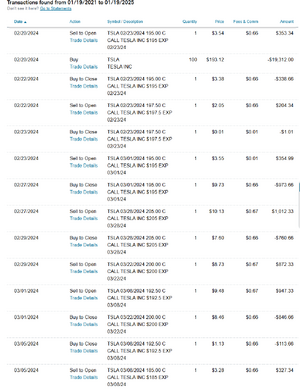

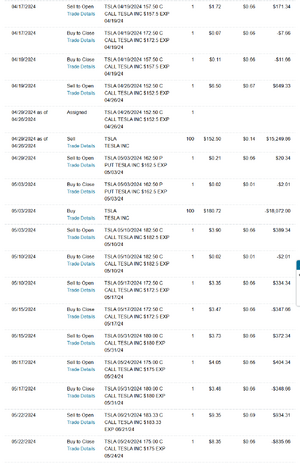

Today I am just working through everything, rolled everything out as well as added some puts to existing trades. TGT was assigned overnight so now I’m selling calls. LVS I also kept on the put side. I would have had to switch it over today if I wanted to get the dividend, but it was going to cost me more than the $25 in dividends to do that so I decided not to go after them. Since TGT was assigned I will be getting those dividends. I checked on PG today, it’s up about $2 from when picked it over TGT while TGT is down $10. So that’s a lesson for me that I should go after the better setup and not dividends.

MACD is up and running by itself not…mostly. It opened 3 trades in VFC and closed 1, but that put me at 100 shares and VFC is falling. So signals are now paused and I am selling options on them both. RKLB is close to breakeven with an adjusted price of $28.41 and the $29 Call will give me $51 in profit. VFC is at $24.65 and its $25 Call will give me $35 in profit. It's ironic that when I start paying for automation I have to stop the automation.

Going over the logs the 2 open trades Traderspost took are okay. One is the same strike between the signal and order and one the signal was at $24.76 and the order came in at $24.84. That shaves about 2 dollars off the profit if there is not slippage on the sell side. Thats in line with the closed trade that made $10.59 ($12.50 would be zero slippage). So there is going to be some slippage from the delay between signal and entry. Manually I just set the sell limits based on entry price so any difference from signal entry was avoided.

Like I said earlier I considered pulling money out of Schwab and putting it into the MACD strategy. Maybe that’s something for the future (Schwab isn’t available in Traderpost, or anywhere that I’m aware). Right now I’m still considering the whole thing in testing. Even with the newer code it still has losing trades, and I’m not sure why that is. It's usually near larger than average wins as well so maybe its a result of FIFO selling. I’d still like to run through more rounds to see how TraderPost works for me.

So far to get up and running I am on the $49 monthly plan, I also have the Essential Plan on TradingView for $15 a month. After talking to TradersPost they count each sub account as 1 broker so just moving my accounts from Schwab to Robinhood I’d have to bump up to the $99 plan for 2 accounts, or $199 for all three accounts.

As it sits I’d also need to bump up to a higher tier in TradingView. My current workaround to get it to stop at 100 shares is to set a new strategy for each symbol and then manually adjust the pyramiding setting until it has 4 open spots. If I can get a count figured out I might be able to get rid of that. Or if I could adjust the start date on the strategy. But, as far as I can tell that would still need a custom strategy for each symbol.

Another possibility that I considered is doubling the amount of money per symbol. That would allow it to get 200 shares and I could sell options after the first 100 and still let the automation run. That will halve my total returns and have money sitting on the sidelines when things are running well. It also only helps the costs of TraderView which isn’t expensive.

I’m not interested in consolidating accounts down either; 401ks, IRAs, ROTH IRAs, and Taxable accounts all serve different purposes. That’s why I wouldn’t dumped all of Schwab into the MACD account, but use both retirement accounts Robinhood has.

Even then, using three accounts in Robinhood and upgrading Tradingview so I can have more strategies running Its only $250 a month. It’s not a bad price if the returns continue in line with January’s numbers.

Okay, I’m done for today. I’ll be back sometime this weekend for performance stats.