04/28/08 05:00 Sidebar and Session Open

Good Morning All,

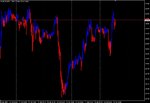

Fading Fibonacci levels through impulsive price action.

I've been working with this particular strategy for several weeks. Going into the exploration I just faded every level and watched what happened. What I found initially was that some levels are more reliable than others for a fade trade into impulsive action while other levels typically mark a consolidation phase of the move and provide an opportunity to enter into the trend. The structure of price leading into a level has a large part in determining which levels will be effective as a fade and which ones provide an entry into the trend. My strategy has thus been modified to accommodate the typical behavior of impulsive price action as it relates to these Fibonacci levels. Here is my current focus set for this method.

1) This strategy has a good track record of finding tops and bottoms. Here's a single lot entry from 04/22 that called a bottom of a 120 pip move. This occurs with enough regularity to warrant further exploration into which levels provide tradable probabilities for using multiple lot strategies to exploit a decent portion of the move.

Looking further into the impulse of 04/22 again the effectivenes of the Fibonacci levels can be seen by three consecutive short entries. The third one is the top of the impulse. And the correction bottomed at 73 pips.

2)Some entries will be at or near the top and some will be a pullback before a fresh high. The problem here is finding appropriate Stop/ Profit target parameters and determining if the edges have a tradable probability of producing target results in the event that they are just a pullback. These pullbacks can and do provide a good countertrend trade but a complete evaluation of which profit target is most effective for these trades is still needed.

So the focus set is defined as:

1) Where in the impulse / Fibonacci structure do the best opportunities for a multiple lot countertrend strategy exist.

2) How can each edge be exploited to it's fullest potential even if it is just a short term tradeable pullback.

3) Which levels provide a tradeable probability to enter in the direction of the impulse.

Session Open:

I got another daily system sell signal on EURUSD (makes a set of three) and a corresponding one in The US Dollar Index.

This system has a much higher probability if a weekly signal occurs reasonably close to the daily signals (none has occurred yet). By themselves, the nature of the daily signals are not as reliable, as can be seen on the two dailies below.

Other than that, I'm going into the week with a Dollar bullish bias but the focus will be on the current focus set defined above and the more important correct mind-set of risk acceptance and the elimination of fear based decisions while continuing to explore the method.

Yellow's Blue Charm dollar buy signals. More effective if confirmed by a weekly signal

All the Best,

Yellowlion