You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FetteredChinos

Veteren member

- Messages

- 3,897

- Likes

- 40

or just that the sell-offs occurred over the summer each year..

also helped by the result bull market starting in october 2002 etc..

i wouldnt trade it personally, but it does show that cashing in unit trusts etc in may might be an idea until early october...

also helped by the result bull market starting in october 2002 etc..

i wouldnt trade it personally, but it does show that cashing in unit trusts etc in may might be an idea until early october...

FetteredChinos

Veteren member

- Messages

- 3,897

- Likes

- 40

ok, lunar cycles anyone?

http://www.erhvervsastrologi.dk/erhvervsastrologi/Nytdesign/Doesplanetarycycles.htm

nice bit of bedtime reading...

http://www.erhvervsastrologi.dk/erhvervsastrologi/Nytdesign/Doesplanetarycycles.htm

nice bit of bedtime reading...

We may all snigger but I do have a friend that does not trade at the start of a lunar cycle; Friday 13th or the first day of a new quarter. He also states that his first trade for the month, quarter and year must yield a profit no matter how small (he will close an index or currency trade for a profit of 1 point).

What does one say to a trader with such beliefs?

What does one say to a trader with such beliefs?

FetteredChinos

Veteren member

- Messages

- 3,897

- Likes

- 40

dont step on pavement cracks?

peterpr

Established member

- Messages

- 609

- Likes

- 7

user said:Go Long when the Institutions are net long the S&Ps (for buys) and Go Short when institutions are net short (for sells).

As usual when the subject of COT's open interest comes up on this thread it is likely to create more heat than light.

Here are a few facts which ought to persuade you that short-term DOW or S&P futures trading off the COT's reports is far from the simple matter claimed.

1. There are 2 separate DOW and 2 separate S&P futures contracts, the pit-traded ones are 5 times the size of the respective emini ones per contract respectively. So, first of all you need to consolidate them by value for them to mean anything. Why? because often they have almost diametrically opposite OI positions (by value if not by number of contracts).

2. Each index has 2 x options contracts too. Do you consolidate the options with the futures? because again they can show opposing positions (both to each other and/or their respective futures OI positions). If not why not? and if not which is the more reliable as an 'indicator?

3. Since the consolidated S&P and DOW contracts are often contradictory too (if not exactly diametrically opposed), how do you use that information?

That's just the simple stuff.

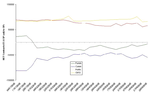

And just out of interest, here is a chart of the consolidated SPX OI from the beginning of the year. Note that the Commercials have been net short the whole time. So work that one out.

Attachments

Racer

Senior member

- Messages

- 2,666

- Likes

- 30

This isn't the bit I read over the weekend but gives an idea

According to the most current Reuters Estimates data, 27 per cent of the 242 US companies that had pre-released second-quarter earnings warned they would miss estimates, compared with 22.9 per cent who had revised upward as of June 24.

According to the most current Reuters Estimates data, 27 per cent of the 242 US companies that had pre-released second-quarter earnings warned they would miss estimates, compared with 22.9 per cent who had revised upward as of June 24.

Racer

Senior member

- Messages

- 2,666

- Likes

- 30

LION63 said:The markets have only been closed for 5 hours and we are already coming up with all sorts of theories, what will happen if it closes for a week? Strategies based on rainfall (or has someone done that already)?

5 hours?

Uh, US closed 21:00 last Friday!

🙁

Racer

Senior member

- Messages

- 2,666

- Likes

- 30

LION63 said:Racer,

Boredom has a tendency to play tricks on the mind. But I am right in that 7.30pm - 2.30pm = 5 hours (pure genius, I think I will have a Guinness now).

Yes that is mathematically correct but.....

markets were closed before that..........as well... I think.....

😕

Stamp duty - my creation; poll tax - great for controversy; family tax credits - now you have, and now you pay it back; congestion charge - shame it has not gone national yet (I have tried to convince them); new ways of calculating inflation - even the financial markets do not understand it any more. Got seconded to Enron but turned up for work just after they collapsed - real shame that.

Never mind, about to start work in the PM's office - wish me luck.

Never mind, about to start work in the PM's office - wish me luck.

Racer

Senior member

- Messages

- 2,666

- Likes

- 30

LION63 said:Stamp duty - my creation; poll tax - great for controversy; family tax credits - now you have, and now you pay it back; congestion charge - shame it has not gone national yet (I have tried to convince them); new ways of calculating inflation - even the financial markets do not understand it any more. Got seconded to Enron but turned up for work just after they collapsed - real shame that.

Never mind, about to start work in the PM's office - wish me luck.

you didn't invent that other superb revenue gathering tax on motorists... speed cameras? Ah well, spose you will have to grovel a bit if poll tax, stamp duty, congestion charges, inflation manipulation and tax credits were your only claims from the needy

BTW dow futures are down a bit according to IG... spose I better put in a bit of Dow or I will get deleted 😉

Since you have failed to recognise pure genius, I am going to make you all suffer by bringing in the following measures

- Dustbin levies

- Air fuel duties

- Pay as you drive levies

- Tax on second homes

These I have concluded will help narrow the government deficit and help fund the National Health Service. Once I have presented these measures to the relevant ministers and got them approved, I will receive my ennoblement and pension and sit in the House Of Lord's as one of the PM's appointees (for Statistical Services rendered to the nation).

- Dustbin levies

- Air fuel duties

- Pay as you drive levies

- Tax on second homes

These I have concluded will help narrow the government deficit and help fund the National Health Service. Once I have presented these measures to the relevant ministers and got them approved, I will receive my ennoblement and pension and sit in the House Of Lord's as one of the PM's appointees (for Statistical Services rendered to the nation).

July 5 (Bloomberg) -- U.S. stocks may decline as the second-quarter ``earnings season'' brings a greater share of disappointing results than the first quarter did, judging by companies' announcements so far.

Companies that provided outlooks fell short of analysts' estimates at a 65 percent rate, according to data compiled by Bloomberg. That's higher than the 54 percent pace in the first quarter and the 53 percent that came up short a year ago.

------------------------------------------------------

Does anyone have a list of earnings release dates for DJIA companies ?

Companies that provided outlooks fell short of analysts' estimates at a 65 percent rate, according to data compiled by Bloomberg. That's higher than the 54 percent pace in the first quarter and the 53 percent that came up short a year ago.

------------------------------------------------------

Does anyone have a list of earnings release dates for DJIA companies ?

Racer

Senior member

- Messages

- 2,666

- Likes

- 30

Racer said:

Thanks Racer, most grateful. Just spent a hour looking at various sites thrown up by google, with no joy. Much obliged.

Racer

Senior member

- Messages

- 2,666

- Likes

- 30

Minder said:Thanks Racer, most grateful. Just spent a hour looking at various sites thrown up by google, with no joy. Much obliged.

You're welcome 🙂

Similar threads

- Replies

- 1

- Views

- 3K

- Replies

- 1

- Views

- 5K