You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wellshot

Much appreciated, thanks.

Anyone in here trade the DAX?

Some say morning activity on the DAX can often reflect what's coming later on in the US. I've been watching it drift steadily down, so if views on job data here later on are right, or if FC is right with his armageddon analysis, short dax trade in the 4280's with stops around 4310 (cash figures) looks inviting.

Any views ?

Much appreciated, thanks.

Anyone in here trade the DAX?

Some say morning activity on the DAX can often reflect what's coming later on in the US. I've been watching it drift steadily down, so if views on job data here later on are right, or if FC is right with his armageddon analysis, short dax trade in the 4280's with stops around 4310 (cash figures) looks inviting.

Any views ?

Racer

Senior member

- Messages

- 2,666

- Likes

- 30

mofo said:Wellshot

Much appreciated, thanks.

Anyone in here trade the DAX?

Some say morning activity on the DAX can often reflect what's coming later on in the US. I've been watching it drift steadily down, so if views on job data here later on are right, or if FC is right with his armageddon analysis, short dax trade in the 4280's with stops around 4310 (cash figures) looks inviting.

Any views ?

Yes I trade and watch the DAX all the time, it is a very useful indicator

geraldpeters said:Semantics. According to the dictionary:

View: somebody’s opinion on or interpretation of something such as politics or religion

Opinion: the view somebody takes about a certain issue, especially when it is based solely on personal judgment

Ah, but the ersatz Greek troll tries to use semantics to perpetrate the illusion of inscrutable knowledge. You'll spoil his tiresome game if you start defining his terminology 😆

mofo said:Wellshot

Anyone in here trade the DAX?

Some say morning activity on the DAX can often reflect what's coming later on in the US. I've been watching it drift steadily down, so if views on job data here later on are right, or if FC is right with his armageddon analysis, short dax trade in the 4280's with stops around 4310 (cash figures) looks inviting.

Any views ?

Occasionally - it appears to operate in sync with general Dow trends to some extent but it's degree of divergence, especially when both are falling, tends to be much greater.

kriesau said:Occasionally - it appears to operate in sync with general Dow trends to some extent but it's degree of divergence, especially when both are falling, tends to be much greater.

Racer / Kriseau

Thanks. I'll stick to the rules, & just watch today.

Racer said:mofo, the Dax can move very fast and a lot especially on news from US...

And if the Dow falls today or Monday then a short position in the 4280's could do very well.

Racer

Senior member

- Messages

- 2,666

- Likes

- 30

kriesau said:And if the Dow falls today or Monday then a short position in the 4280's could do very well.

Or very badly 😉

Slapshot

Well-known member

- Messages

- 391

- Likes

- 32

mofo said:Yep, i'm aware of that, thats why i was contemplating a short dax position in advance of what appears to be a general consensus re bad news from the US later on.

Caution is advised, it only takes a few words to be left out of a statement for the whole thing to go bananas! Not that anything would ever be left out of a statement to mysteriously re-appear 2 hours later 😱

Slapshot

Well-known member

- Messages

- 391

- Likes

- 32

Racer said:Slapshot, where ever did you get a silly idea like that 🙂

Well, a mate of mine knows this bloke who's going out with this girl who's Dad used to live in the states and he knows a guy who knows a gal that's got a friend called Alan 😆

FetteredChinos

Veteren member

- Messages

- 3,897

- Likes

- 40

mofo said:Yep, i'm aware of that, thats why i was contemplating a short dax position in advance of what appears to be a general consensus re bad news from the US later on.

therein implying that we should all be long..

ooo err 50 mins to go.. futures creeping up all over the place at the mo...

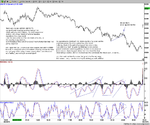

FetteredChinos said:well the big day is here at last..

i dont want to alarm you, but we could well see a 150 point+ down move today.

my rationale..

1) last friday's close was 10,194. we are currently still 150 points above that, and havent really tested anything below it all week.

2) the cycles are pointing to an early dip today at the very least. this would coincide with shyte payroll data

3) if we get an early dip, it is likely that 10,300 support will get taken out, leading to further technical sell-offs, perhaps before a mini recovery into the weekend

4) my dow comp entry is at 10,180 🙂

on the other hand, yesterdays action, with the successful re-test of 10,300 and then moved back up to a more neutral 10,350 level might suggest that the Big Boyz were using 10,300 as an opportunity to buy in cheaply before today.

so in summary, it could go either way. logic suggests a fall, but suspicion points to upside.

ive my orders in (stop at 10,450. TP at 10,190) and im gonna sit on my hands as it unfolds.

good luck everyone,

may the Bourse be with you. 🙂

FC

Is that a Stop Sell at 10450 ?

What's TP ?

Similar threads

- Replies

- 1

- Views

- 3K

- Replies

- 1

- Views

- 5K