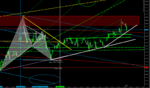

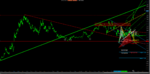

I've been studying some analysis instruments in my free time, and it astounds me how much subjective reasoning must be present. You need to understand trend to know what method to use. But how do you define trend? Well, it's kind of fuzzy - just pick one you see fit. Using Elliott waves is useful tool, but how do you define the starting point? Meh, pretty random. Stochastic oscillator is a great tool to define if stock is oversold or overbought. But if it goes over 80, how do you decide whether you should sell the stock or keep it because it will stay ovebought for some time? You guess it... Literally.

Is it just me, or is really the case? Or is it the combo of these instruments that let you predict the market? Because so far it doesn't look all that useful to me as everyone seems to claim. 😱

Is it just me, or is really the case? Or is it the combo of these instruments that let you predict the market? Because so far it doesn't look all that useful to me as everyone seems to claim. 😱