You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

-oo0(GoldTrader)

Well-known member

- Messages

- 345

- Likes

- 5

Interactive Brokers spread orders

In How to place a stop order. It says there is a

In How to place a stop order. It says there is a

Thread on entering spread orders with Interactive Brokers!

Zen said:someone know the best way to enter a spread with Interactive Brokers?

GoldTrader, I would suggest you try to write one clear post using full sentences in English to try and get your message through. I do think you have a good point to make, but chopped up into pieces it's having a hard time coming across to me.

As for your repeated references to the fact that the risk is reduced - using lower margin requirements as proof - as long as the volatility on a spread is vastly different from the volatility from the underlying commodities, it is a bit like comparing apples with oranges. I would like to hear your reply related to risk/reward instead. Obviously, the possible rewards of a naked position are very different from a spread - if you look at spread volatility and underlying commodity volatility in equal time frames.

But, having earlier this year read your postings on EliteTrader about spreads, I was wondering if you could be so kind as to create a brief example of a seasonality in one commodity that repeatedly yields a profit. Earlier on this thread you referred to being paid an insurance premium from the professional hedgers, what contract months and which commodity were you thinking of in particular?

As for your repeated references to the fact that the risk is reduced - using lower margin requirements as proof - as long as the volatility on a spread is vastly different from the volatility from the underlying commodities, it is a bit like comparing apples with oranges. I would like to hear your reply related to risk/reward instead. Obviously, the possible rewards of a naked position are very different from a spread - if you look at spread volatility and underlying commodity volatility in equal time frames.

But, having earlier this year read your postings on EliteTrader about spreads, I was wondering if you could be so kind as to create a brief example of a seasonality in one commodity that repeatedly yields a profit. Earlier on this thread you referred to being paid an insurance premium from the professional hedgers, what contract months and which commodity were you thinking of in particular?

Hrokling -

I agree that GT's style does take some getting used to. However the three/four threads on this section of T2W plus the links thru to ET contain huge amounts of valuable info - much of it provided by GT. It's all there if you take time to look.

FN

I agree that GT's style does take some getting used to. However the three/four threads on this section of T2W plus the links thru to ET contain huge amounts of valuable info - much of it provided by GT. It's all there if you take time to look.

FN

-oo0(GoldTrader)

Well-known member

- Messages

- 345

- Likes

- 5

Kcbt

Hybrid Thread

Aloha,

Hrokling and Spread Traders

Answering questions is not the same as preaching, lecturing, or giving a report. I go under the assumption that everyone knows more than I do, so I try to keep it brief and let people think for themselves. If you can read charts the truth is obvious.

The first time I heard that was from a salesman. He was trying to sell me a car that I was interested in. I asked him how it compared to my Porsche, he said that "apples and oranges," thing. Hay I though we were taking about transportation?

The first time I heard that was from a salesman. He was trying to sell me a car that I was interested in. I asked him how it compared to my Porsche, he said that "apples and oranges," thing. Hay I though we were taking about transportation?

Sterling can win with anything!

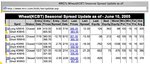

However, I really want to warn you this is like driving down a road looking out of the rear view mirror. Straights are no problem, but what do you do in the corners. The attached chart shows trades that have turned a profit in Kansas City wheat for the previous 15 years consecutively, and how they turned out this year.

Hybrid Thread

Aloha,

Hrokling and Spread Traders

I will give it a try, but over here we do not speak English. We use American which is much more casual or if your prefer sloppy. I don’t think we have much store for old world traditions. Whenever we hear someone speaking English we just assume they are from India. The language we speak here in the markets, is the language of charts.hrokling said:GoldTrader, I would suggest you try to write one clear post using full sentences in English to try and get your message through.

Mostly my charts and illustrations tell the story. My humble words are just a distraction. However, when you have a question please ask away.I do think you have a good point to make, but chopped up into pieces it's having a hard time coming across to me.

Answering questions is not the same as preaching, lecturing, or giving a report. I go under the assumption that everyone knows more than I do, so I try to keep it brief and let people think for themselves. If you can read charts the truth is obvious.

If a comparison is in order, I like to use equal dollar amounts of margin. When you risk the same amount of margin on outrights, and on spreads in the same contracts. You will almost always have a higher return on margin (ROM) on successful trades with spreads. You can check this out on any historical data that you have.As for your repeated references to the fact that the risk is reduced

Margin is a clear indication of how much risk the exchange feels the trade is worth. An equal amount of capital in margin, either naked or spread should have about the same exchanged perceived risk. ROM will be greater with the spreads.- Using lower margin requirements as proof –

I don’t know anything about that, maybe someone else can step in it, with you.as long as the volatility on a spread is vastly different from the volatility from the underlying commodities,

it is a bit like comparing apples with oranges.

Sterling can win with anything!

Spreads are less risky. Rom is greater with calendar spreads.I would like to hear your reply related to risk/reward instead. Obviously, the possible rewards of a naked position are very different from a spread - if you look at spread volatility and underlying commodity volatility in equal time frames.

Research suggests trades to us that have produced profits at least 80% of the last 15 years. Many 100%. Upcoming calendar spreads include Meal 93%, Cotton 93%, Beans 93%, Hogs 93%, Natural Gas 93%, and Euro$ 93%.But, having earlier this year read your postings on EliteTrader about spreads, I was wondering if you could be so kind as to create a brief example of a seasonality in one commodity that repeatedly yields a profit.

However, I really want to warn you this is like driving down a road looking out of the rear view mirror. Straights are no problem, but what do you do in the corners. The attached chart shows trades that have turned a profit in Kansas City wheat for the previous 15 years consecutively, and how they turned out this year.

I was thinking that the whole business of holding a portfolio of winning spreads, involves a transfer of risk as well as liquidity further out in time. It is the same for all commodities, we are being paid premiums for holding this risk and adding this liquidity.Earlier on this thread you referred to being paid an insurance premium from the professional hedgers, what contract months and which commodity were you thinking of in particular?

Attachments

hrokling said:GoldTrader, I would suggest you try to write one clear post using full sentences in English to try and get your message through. I do think you have a good point to make, but chopped up into pieces it's having a hard time coming across to me.

As for your repeated references to the fact that the risk is reduced - using lower margin requirements as proof - as long as the volatility on a spread is vastly different from the volatility from the underlying commodities, it is a bit like comparing apples with oranges. I would like to hear your reply related to risk/reward instead. Obviously, the possible rewards of a naked position are very different from a spread - if you look at spread volatility and underlying commodity volatility in equal time frames.

But, having earlier this year read your postings on EliteTrader about spreads, I was wondering if you could be so kind as to create a brief example of a seasonality in one commodity that repeatedly yields a profit. Earlier on this thread you referred to being paid an insurance premium from the professional hedgers, what contract months and which commodity were you thinking of in particular?

......Or, perhaps you should learn to read. His posts are quite clear to me, and the reasoning behind them is sound.

Could be that you are too greedy and hell bent on max ROI - which a real trader isn't so concerned about - ROI is for corporates and investors. Traders are concerned with ROM as GT points out.

GoldTrader - thank you very much for your enlightening and entertaining post. I have considered trading spreads for a long time, but since I've been very successful trading equities I haven't diversified into spreads yet. I do expect however within 6-12 months to look more closely into it, and it will partly be because of your postings I've read. I will however do my own research first, of course.

JohnDoe - I would still say that most of the posts are easier to understand for someone already familiar with spread trading, than someone with say an equities background like myself. I have traded equities and options since 1997 in many different markets, but since my futures background is non-existant (apart from a bit of reading) I think spread trading - which I'd say isn't entry-level for futures traders - has been demanding to look into. Of course, the concept is simple, but when it comes to researching historical spreads as well as seasonality which GoldTrader advocates then it's a bit much. I don't know if I'm more greedy than the next person, and so you're right I've been focused on ROI. The focus on ROM is of course completely understandable and sensible.

So GoldTrader, thank you for your answer, and JohnDoe, thank you for your concern 😉

JohnDoe - I would still say that most of the posts are easier to understand for someone already familiar with spread trading, than someone with say an equities background like myself. I have traded equities and options since 1997 in many different markets, but since my futures background is non-existant (apart from a bit of reading) I think spread trading - which I'd say isn't entry-level for futures traders - has been demanding to look into. Of course, the concept is simple, but when it comes to researching historical spreads as well as seasonality which GoldTrader advocates then it's a bit much. I don't know if I'm more greedy than the next person, and so you're right I've been focused on ROI. The focus on ROM is of course completely understandable and sensible.

So GoldTrader, thank you for your answer, and JohnDoe, thank you for your concern 😉

Hi GoldTrader

I am new here and read your post very interesting. I know you have been diss. commodity spreads,

1. I am interested in trading Index spreads on the OEx, for example, if you do know of a better instrument to on please let me know.

2. This is my setup on OEX, please comment on it:

Lets say OEX closed on 7/1 560

and I want to play a credit spread both on Call and Put side for the month of August

I am going to sell a 580 call and buy a 585 call (collect prem)

and

Sell a 540 put and buy a 535 put (collect prem)

I am selecting these spreads looking at the support and Resistance levels of the oex, are there other strategies I can use?

Also I am not shure what to do if the spreads go against me, like if my sell call goes above 580 I am losing , but the call buy is protecting me, thats all I can understand, is there a other Technique I can use?

I know you are an experienced trader and how like your comments and advice you can give me.

Thanks

Zee

I am new here and read your post very interesting. I know you have been diss. commodity spreads,

1. I am interested in trading Index spreads on the OEx, for example, if you do know of a better instrument to on please let me know.

2. This is my setup on OEX, please comment on it:

Lets say OEX closed on 7/1 560

and I want to play a credit spread both on Call and Put side for the month of August

I am going to sell a 580 call and buy a 585 call (collect prem)

and

Sell a 540 put and buy a 535 put (collect prem)

I am selecting these spreads looking at the support and Resistance levels of the oex, are there other strategies I can use?

Also I am not shure what to do if the spreads go against me, like if my sell call goes above 580 I am losing , but the call buy is protecting me, thats all I can understand, is there a other Technique I can use?

I know you are an experienced trader and how like your comments and advice you can give me.

Thanks

Zee

Hi there Zee,

This sounds more like an index options discussion. There's loads of advice/discussion over on the derivatives thread. Maybe post a thread there and, if you want GT to take a look, send him/her(?) a pm.

There also a couple of articles discussing index options strategies in the learning lab.

Let's try and keep this section of the site focused on commodity futures spreads.

Cheers,

FN

This sounds more like an index options discussion. There's loads of advice/discussion over on the derivatives thread. Maybe post a thread there and, if you want GT to take a look, send him/her(?) a pm.

There also a couple of articles discussing index options strategies in the learning lab.

Let's try and keep this section of the site focused on commodity futures spreads.

Cheers,

FN

Christrader

Junior member

- Messages

- 11

- Likes

- 0

GT, your threads on spread trading are great! I've been looking high and low on Google for the free seasonal info but can't locate any. Can you help? Or is it best to purchase from Moore Research? What's the fastest track to getting started asap?

Thanks GT!!!!

Thanks GT!!!!

-oo0(GoldTrader)

Well-known member

- Messages

- 345

- Likes

- 5

Hybrid Thread

Yes “Jerry Toepke's Weekly Spread Commentary,” is a must have!

Yes “Jerry Toepke's Weekly Spread Commentary,” is a must have!

To oo0GoldTrader

-oo0(GoldTrader) said:Hybrid Thread

Hi oo0GoldTrader,

you seem to be a profitable Spread Trader. How did you start learning about it?

From who did you learn it?? How long have you been trading Spreads?

Where should I go to get good mentoring for Trading Spreads?

Thanks for your reply,

LobStar

Pairs Trading & Spread trading

Spread trading is an interesting topic, I am currently looking at pairs trading.

In short spreads between highly correlated stocks (the pairs) can provide attractive range-bound prices to trade.

Not sure on broker services, but pairs/spreads can be set up yourself. Buy and sell equal quantities to create the spread.

Have a look at www.pairstrade.com . I am still researching the idea, but i would appreciate your views, both negative and positive.

_-----------------------------------------------------------------------------------

Do you have brokers that understand you are spreading and therefore set lower margins?

Is it practical?

Is there any market in UK for trading spreads?

Has anyone got a recommended route to get going or book as a guide.

Spread trading is an interesting topic, I am currently looking at pairs trading.

In short spreads between highly correlated stocks (the pairs) can provide attractive range-bound prices to trade.

Not sure on broker services, but pairs/spreads can be set up yourself. Buy and sell equal quantities to create the spread.

Have a look at www.pairstrade.com . I am still researching the idea, but i would appreciate your views, both negative and positive.

_-----------------------------------------------------------------------------------

Do you have brokers that understand you are spreading and therefore set lower margins?

Is it practical?

Is there any market in UK for trading spreads?

Has anyone got a recommended route to get going or book as a guide.

-oo0(GoldTrader)

Well-known member

- Messages

- 345

- Likes

- 5

-oo0(GoldTrader) said:If it was, then how come the people who stand to gain from it the most, (brokers), do not know anything about it?Insiders do use spreads, but most spread traders are no-where near the floor of the exchange. Its not that spreads put you ahead. It’s that spread traders will be around when the naked traders are gone.

True, brokers sure do stand to gain from it! 2 x the commission, much much less volatility, relative protection against locked limit moves. (Imagine being outright during mad cow, whereas a spread trader was relatively unphased) A broker will benefit more from recommending spreads by having clients that don't blow themselves out in the 'usual' 3 months or whatever, and hopefully experience SMALLER, but more consistent gains. Smaller accounts especially should learn to trade spreads first.

Locals DO trade spreads, especially in Copper and the Meats, grain locals trade 1000's of spreads at a clip... c'mon, $135 US margin for a corn spread+/-? You can do 100 of them for 13.5K, where every penny you gain gets you 5K. Sure, gaining a penny is not all that easy in a corn spread (hence the low margin --hedge margin listed above btw i'm a hedger/trader--- Who can't trade one of those? just recall that typically Bull spreads work in bull markets & vice versa.....Typically. Elevators & grain merchandisers usually have a pretty good lock on same crop-year spreads, but there are definitely opportunities to squeeeze a few pennies out of old-crop new crop spreads on many occasions.

Exactly right, to paraphrase... "SPREAD TRADERS LIVE TO TRADE ANOTHER DAY"

-oo0(GoldTrader)

Well-known member

- Messages

- 345

- Likes

- 5

Rom

Read you post

Read you post

The hidden secret is that spread gains on margin may be far in excess of the riskier outrights.drewfus31> hopefully experience SMALLER, but more consistent gains.

-oo0(GoldTrader) said:Read you post The hidden secret is that spread gains on margin may be far in excess of the riskier outrights.

Precisely, I understand and agree wholeheartedly the difference btwn ROI & ROM is grossly overlooked by most. The low low volatility of corn spreads is such that the ROM PER PENNY gained on this spread for me (with hedge margin) is 37%, am I looking at this correctly?

Mahalo!

-oo0(GoldTrader)

Well-known member

- Messages

- 345

- Likes

- 5

Return on Margin

Return on Margin

Hybrid Thread

Yah probably.

Return on Margin

Hybrid Thread

Mahalo!!drewfus31 said:The low low volatility of corn spreads is such that the ROM PER PENNY gained on this spread for me (with hedge margin) is 37%, am I looking at this correctly?

Mahalo!

Yah probably.

jxntntrader

Junior member

- Messages

- 30

- Likes

- 0

For those who want to be further educated about spread trading, let me give you the following threads that I have found invaluable (most of this comes from comments by Goldtrader):

http://www.elitetrader.com/vb/showthread.php?threadid=16982

http://www.elitetrader.com/vb/showthread.php?threadid=23994

http://www.elitetrader.com/vb/showthread.php?threadid=17053

http://www.tradingeducators.com/trading_philosophy/spreads.pdf

http://www.elitetrader.com/vb/showthread.php?threadid=17096

http://www.elitetrader.com/vb/showthread.php?threadid=23993

http://www.elitetrader.com/vb/showthread.php?threadid=24519

http://www.mrci.com/client/whysea.asp

http://sify.com/finance/equity/full...spread+trading&rnum=10&hl=en#764fdd6ff424691d

Many of the elite trader threads have further links that are helpful.

I hope this helps. If any of you have any more, please feel free to post.

Jxntntrader

http://www.elitetrader.com/vb/showthread.php?threadid=16982

http://www.elitetrader.com/vb/showthread.php?threadid=23994

http://www.elitetrader.com/vb/showthread.php?threadid=17053

http://www.tradingeducators.com/trading_philosophy/spreads.pdf

http://www.elitetrader.com/vb/showthread.php?threadid=17096

http://www.elitetrader.com/vb/showthread.php?threadid=23993

http://www.elitetrader.com/vb/showthread.php?threadid=24519

http://www.mrci.com/client/whysea.asp

http://sify.com/finance/equity/full...spread+trading&rnum=10&hl=en#764fdd6ff424691d

Many of the elite trader threads have further links that are helpful.

I hope this helps. If any of you have any more, please feel free to post.

Jxntntrader

Similar threads

- Replies

- 7

- Views

- 4K

- Replies

- 0

- Views

- 2K