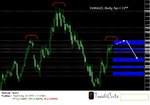

Intraday Usd/Chf

Overall USD outlook remains weak relative to majors but currently Price Action and Support/Resistance indicate short term corrective move for most pairs. For intraday traders we recommend short term shorts or wait for buy opportunity at Strong Support.

Here is our technical analysis for Usd/Chf

Best

TradeCuts

Overall USD outlook remains weak relative to majors but currently Price Action and Support/Resistance indicate short term corrective move for most pairs. For intraday traders we recommend short term shorts or wait for buy opportunity at Strong Support.

Here is our technical analysis for Usd/Chf

Best

TradeCuts