You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trade what you see, not what you think....

- Thread starter robster970

- Start date

- Watchers 11

counter_violent

Legendary member

- Messages

- 12,672

- Likes

- 3,787

Attachments

L

Liquid validity

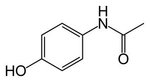

Derivative of benzene.

Sherlock hat on says petrochem eng?

Sherlock hat on says petrochem eng?

random12345

Established member

- Messages

- 793

- Likes

- 280

Hi random,

I'll try and answer your (very well made) point. Over the years, many members have thrown up their hands in horror at the drivel that gets posted and wondered why Admin' or the Mods tolerate it. Here's why . . .

As you know, T2W is a forum that's free for anyone to join. Who are we (i.e. staff, moderators etc.) to say one member's point of view is more or less valid than another? Anyone can say anything - regardless of how daft it may be in the eyes of the majority. Freedom of speech rules the day - so long as it respects the site's guidelines. T2W relies upon members such as your good self to highlight the flaws in the arguments put forward by members who are less well informed, knowledgeable and experienced than you.

Anyone reading this thread - or any other on T2W come to that - is then free to make up their own minds and listen to you, or me, or 15 min tlb or any other member. If a member chooses to take on board one member's view of the markets in preference to another - no matter how 'off-piste' it may be - that's their decision and they're free to make it. The only caveat of course is that they accept responsibility for their decisions and subsequent actions - however good or bad they may prove to be.

Tim.

It's a fine line I guess - the first half of this thread was a good example of how people with differing opinions can come to some kind of meaningful conclusion or agreement and I don't think such parties should be at all censored for thinking one another to be in the wrong, but then there don't seem to be any repercussions for posting quantitative lies either.

Perhaps a sticky is in order explaining that if a post contains a banal youtube link or Abrahamic verse applied to trading then it and its author are best ignored. 👍

counter_violent

Legendary member

- Messages

- 12,672

- Likes

- 3,787

Derivative of benzene.

Sherlock hat on says petrochem eng?

They are very hard to come by. Normally, the parrots have eaten them all.

Ask Wackypete !

timsk

Legendary member

- Messages

- 8,837

- Likes

- 3,538

Hi random,It's a fine line I guess - the first half of this thread was a good example of how people with differing opinions can come to some kind of meaningful conclusion or agreement and I don't think such parties should be at all censored for thinking one another to be in the wrong, but then there don't seem to be any repercussions for posting quantitative lies either.

Perhaps a sticky is in order explaining that if a post contains a banal youtube link or Abrahamic verse applied to trading then it and its author are best ignored. 👍

I hear what you're saying and, trust me, I have huge sympathies with your point of view. However, the problem comes with defining 'quantitative lies'. Given that trading is based on the very premise that two or more people disagree with one another (i.e. one trader is long and the other short), it then becomes a veritable minefield trying to distill quantitative lies from quantitative truths. I can do it easily; to me it's obvious. Ditto for you, no doubt. However, would all other members of T2W agree with us - assuming we're in full agreement? Almost certainly not, as one man's meat is another man's poison etc. So, we inhabit an imperfect world where the burden of responsibility rests upon the shoulders of those who really know to highlight the misguided thinking of those who merely think they know!

😉

Tim.

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

one man's meat is another man's poison etc.

The ratio of meat to poison on these boards is awful at best, and gets worse every day. I'm not saying it's t2w's fault. There are a lot of reasons. It started several years ago with the advent of retail forex. Minimum account sizes at $50 or even lower makes instant "professionals" out of regular idiots.

Peter

15 min tlb

Senior member

- Messages

- 2,057

- Likes

- 99

How do you reconsile that statement with item number seven of the t2w community constitution ?

7 This is not a freedom of speech site.

😕

7 * 2 = 14 , 14 clowns providing entertainment to stressed out traders.

15 min tlb

Senior member

- Messages

- 2,057

- Likes

- 99

It's a fine line I guess - the first half of this thread was a good example of how people with differing opinions can come to some kind of meaningful conclusion or agreement and I don't think such parties should be at all censored for thinking one another to be in the wrong, but then there don't seem to be any repercussions for posting quantitative lies either.

Perhaps a sticky is in order explaining that if a post contains a banal youtube link or Abrahamic verse applied to trading then it and its author are best ignored. 👍

I read the first beginning part of the thread , and walked away without posting.Wadaloadbcks .

We came back for lulz.

My grammar is awful , but I can read bollox when it is there.

15 min tlb

Senior member

- Messages

- 2,057

- Likes

- 99

They are very hard to come by. Normally, the parrots have eaten them all.

Ask Wackypete !

No ! Impossible .

They couldn't have chewed his nuts offf .

15 min tlb

Senior member

- Messages

- 2,057

- Likes

- 99

15 min tlb

Senior member

- Messages

- 2,057

- Likes

- 99

Let us get back to the high intelligence level of this thread.

Which software/program/codes can trade 30 to 100 times a day , like a human brain can in a ranging market?

Which software/program/codes can trade 30 to 100 times a day , like a human brain can in a ranging market?

ZEN archer

Experienced member

- Messages

- 1,528

- Likes

- 241

Differences in methodology then would certainly produce different outcomes.

The reason nobody declares profits and verification then is that they are unsure of themselves and that they have the best method as compared to another, and they are not about to expose themselves just in case 😆

Meh, I have no such qualms in this area. I am the greatest, and I have to believe this, and you better believe it too. etc etc.

I'm glad it works for you CV

I've had a closer look and if I'm not mistaken you let one trade go to around -£622 loss before closing it for +£62.50 profit. Another was in around -£226 loss before closing it for +£16.90 profit.

Do you have a limit (max loss)? Do you think that every trade must come back to profit one day (before you run out of money)?

Thanks

Attachments

Last edited:

BeginnerJoe

Senior member

- Messages

- 3,329

- Likes

- 351

I'm glad it works for you CV

I've had a closer look and if I'm not mistaken you let one trade go to around -£622 loss before closing it for +£62.50 profit. Another was in around -£226 loss before closing it for +£16.90 profit.

Do you have a limit (max loss)? Do you think that every trade must come back to profit one day (before you run out of money)?

Thanks

Hold until wins work most of the time, especially if you don't get the entry extremely wrong. The few times it doesn't work will wipe you out. I think it's better to use chart structure to determine it's gone wrong than to rely on an arbitrary loss value. The trouble with CV's trades is that the winners are not allowed to run. So when something does go wrong, the wins will not cover the loss. I reckon CV has not given the strat sufficient cooking time.

Last edited:

ZEN archer

Experienced member

- Messages

- 1,528

- Likes

- 241

I reckon CV has not given the strat sufficient cooking time.

Well – I'm not sure BJ. Maybe he came with a good system (hedging etc. limiting the loss somehow) – hopefully CV sheds some light for us and makes us better traders

trendie

Legendary member

- Messages

- 6,875

- Likes

- 1,433

I'm glad it works for you CV

I've had a closer look and if I'm not mistaken you let one trade go to around -£622 loss before closing it for +£62.50 profit. Another was in around -£226 loss before closing it for +£16.90 profit.

Do you have a limit (max loss)? Do you think that every trade must come back to profit one day (before you run out of money)?

Thanks

Glad to see someone else just running through the numbers.

CV has expounded on his idea of not taking losses often.

He had a thread about trading gold a while back, where he actually showed how he traded.

I raised all the questions about markets going on a prolonged trend, and he answered these questions, and more.

In that previous thread, his starting point was that markets range more often than trend, and built upon that. He had all the stats, etc.

I suspect he has advanced on his trading ideas in the interim.

random12345

Established member

- Messages

- 793

- Likes

- 280

Let us get back to the high intelligence level of this thread.

Which software/program/codes can trade 30 to 100 times a day , like a human brain can in a ranging market?

Your idiocy and ignorance aside, I can guarantee you this - none of them trade small enough lots for you, so please go back to your £1 IG bets you poor deranged hapless clueless human.

I've said before. Stop. Look in the mirror. You are not well. You CAN stop pretending and do something productive with your days.

counter_violent

Legendary member

- Messages

- 12,672

- Likes

- 3,787

I'm glad it works for you CV

I've had a closer look and if I'm not mistaken you let one trade go to around -£622 loss before closing it for +£62.50 profit. Another was in around -£226 loss before closing it for +£16.90 profit.

Do you have a limit (max loss)? Do you think that every trade must come back to profit one day (before you run out of money)?

Thanks

Let's just say then that I accept your figures and workings without question and we can take them at face value.

At the same time as positions are going offside, do you think I may have been doing other things other than just waiting around in the hope that they might come good?

ZEN archer

Experienced member

- Messages

- 1,528

- Likes

- 241

Let's just say then that I accept your figures and workings without question and we can take them at face value.

At the same time as positions are going offside, do you think I may have been doing other things other than just waiting around in the hope that they might come good?

Hopefully I haven't made any mistakes. Too much calculation all the time – too tiring👎

Anyway thanks for the help – obviously you are doing some hedging.

Hope it works for you:clover:

counter_violent

Legendary member

- Messages

- 12,672

- Likes

- 3,787

As long as you show the spoils before you pull the trigger, I should be satisfied. I think all my creative parts are already done. I am in the implementation, refinement, and reflex training phase. Nothing to do but to wait for the market to open.

Well, most people here think they have made it when they get 20 pips. So the cost of business takes a signification bite. This is why the cost is such a major factor in their consciousness. Going by your trades, you are merely a couple of steps more evolved than they are. So your costs are still high enough to be significant. There is really only one way to lower the costs. But it ain't easy to take that way, even though that's the true way towards the spoils.

😆

Attachments

Similar threads

- Replies

- 1

- Views

- 2K

- Replies

- 6

- Views

- 5K