options-george

Guest Author

- Messages

- 484

- Likes

- 94

Hello,Fugazsy!

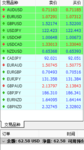

Thank you for your suggestion. I have to say this is truely a good suggestion for a newbie, especially for the one who is not capable of making profit from the market. But I also have some reasons to trade more currency pairs. Fisrt, I am not a scalpler which means I don't have to keep my eyes on the price every minute. I try to be a trend trader on the 30 min chart. I only check the price now and then, i.e. about 20-60 minutes a time. Second, the way I trade allow me to keep track of more currency pairs, and I hope to find more and better chances by doing this . As for the higher spread, since I trade in small scale and I try to hold the position as long as the trend last, so I dont pay much attention to it. Anyway ,I will apply a new account for lower spread.

I hope you can understand what I say inspite of some grammer mistakes😛\

Regards

It's nice to continue seeing your updates on this thread! Keep it up.

I think F's suggestion to limit yourself to six currency pairs is a really good one. Even if you are not scalping, for the amount of trades you are currently doing, I would think that reducing the number of instruments you are monitoring, would be a good step. I have one friend who monitors and trades a large number of fx pairs and indices, but the lowest timeframe he looks at is 4H, and mostly daily and weekly (and he is 10-15 years into his trading career). I am trading full-time at the moment, and I basically watch two markets - that's it. Anyways, just food for thought.

As a point of interest, a friend of mine who spent 20 years working for a bank as a trader was only trading TWO instruments for the first 2-3 years of his full-time career, and he was certainly not scalping.

One other suggestion (if you don't mind) is to not underestimate how much difference the higher spread during the Asian session, will make on your profit+loss. For example I noticed the stop on your EURGBP trade was only 13 pips - what was the spread on that trade? What percentage of the stop was consumed up by your stop?

Also, how much attention you pay to the spread should not be influenced by the size of your position, regardless whether you are trading 1 mini-lot or 10 standard lots. Instead it needs to be judged relative to your stop size. Additionally,if you are holding it more than 1 day, then remember to add rollover costs to your spread cost.

Obviously, you don't have to implement the suggestions that F or I are making - but it might be good thinking material for you 🙂

Keep posting your trades here, because you might get more feedback from people who are happy to help, and possibly shorten your learning curve 🙂

Good luck!!