You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Relationship between Liquidity and Volatility as a factor in Assessing Risk

- Thread starter TheBramble

- Start date

- Watchers 4

TheBramble

Legendary member

- Messages

- 8,394

- Likes

- 1,171

I am continuing to work on this issue looking at a process involving the relative variances on Ticks, Volume and Spread. I have nominally assigned to each, one of three values: same, increasing, decreasing. So in total, 27 possible combinations. I thought that was too many to be thinking about, but it actually provides an extremely useful perspective for considering the potential business model from the angle of each type of market participant.

For instance, the MM widening or narrowing the spread purely as an exercise in manipulation: Why would they do that? When would they do that? What would I expect Volume to do in these circumstances? What would I expect to happen to Tick Pressure in these circumstances? An example (thanks to member 'X' for this one), one reason the MM may manage the spreads would be if the book gets weighted to one side. Hit on the bid consistently. In that situation the MM will widen his spread typically to give himself some wriggle room to lay off the length. The offer will stay more or less the same and the bid will drop a tick or two. He hopes that this will dry up the flow into the length side of his book. There are other reasons, sometimes an error creeps in or he's mis-priced or more usually mis-sized and again he needs to buy time. What would you imagine would happen to Volume in these circumstances? To Tick Pressure? Would you be able to determine is was movement on the Spread causing the Tick Pressure and Volume profile to change rather than the other way round? Of course you would. That's precisely HOW you get to know what's happening 'out there'.

Even ignoring for the moment the issue of spread, the relationship between Volume and Tick Pressure is intensely interesting by itself. I've been monitoring and storing data on over 100 stocks (from across the volatility spectrum based on 30-day volatility) since starting this thread and I'm already getting a sense the 8 possible combinations of activity (using the same nominal categories of: same, increasing, decreasing) are capable of giving statistically significant advance indication of potential price action.

In a post I made a long time ago, I attempted to start a discussion on the inter-relationship of a large number of factors based on Time, Price and Volume. Factors such as flex, action, twitch, finish, range, trend, with various 'flavours' for each one. The number of combinations soon became far too unwieldy for me to consider any serious analysis in the time I had available to me during the normal trading week. While I am still developing that work (at a very slow pace - and one of the reasons I've taken a week off from trading this week is to get some momentum behind that work), there seems to be these other factors which could well do with stirring into the pot.

I don't want to muddy the waters now, or use any more metaphors as I'm running out of steam (arf!), but I guess all I'm trying to do is synthesise what I (and presumably other traders) do when I'm trading along with knowledge of how the other market participants work, in their various timeframes, with a view to codifying it. Then, I ask myself, why would I want to do that? Is it an intellectual arrogance (oops) or do I simply want to understand what I do more clearly so that I can develop my trading to even greater efficiency and effectiveness? And why am I talking to myself?

For instance, the MM widening or narrowing the spread purely as an exercise in manipulation: Why would they do that? When would they do that? What would I expect Volume to do in these circumstances? What would I expect to happen to Tick Pressure in these circumstances? An example (thanks to member 'X' for this one), one reason the MM may manage the spreads would be if the book gets weighted to one side. Hit on the bid consistently. In that situation the MM will widen his spread typically to give himself some wriggle room to lay off the length. The offer will stay more or less the same and the bid will drop a tick or two. He hopes that this will dry up the flow into the length side of his book. There are other reasons, sometimes an error creeps in or he's mis-priced or more usually mis-sized and again he needs to buy time. What would you imagine would happen to Volume in these circumstances? To Tick Pressure? Would you be able to determine is was movement on the Spread causing the Tick Pressure and Volume profile to change rather than the other way round? Of course you would. That's precisely HOW you get to know what's happening 'out there'.

Even ignoring for the moment the issue of spread, the relationship between Volume and Tick Pressure is intensely interesting by itself. I've been monitoring and storing data on over 100 stocks (from across the volatility spectrum based on 30-day volatility) since starting this thread and I'm already getting a sense the 8 possible combinations of activity (using the same nominal categories of: same, increasing, decreasing) are capable of giving statistically significant advance indication of potential price action.

In a post I made a long time ago, I attempted to start a discussion on the inter-relationship of a large number of factors based on Time, Price and Volume. Factors such as flex, action, twitch, finish, range, trend, with various 'flavours' for each one. The number of combinations soon became far too unwieldy for me to consider any serious analysis in the time I had available to me during the normal trading week. While I am still developing that work (at a very slow pace - and one of the reasons I've taken a week off from trading this week is to get some momentum behind that work), there seems to be these other factors which could well do with stirring into the pot.

I don't want to muddy the waters now, or use any more metaphors as I'm running out of steam (arf!), but I guess all I'm trying to do is synthesise what I (and presumably other traders) do when I'm trading along with knowledge of how the other market participants work, in their various timeframes, with a view to codifying it. Then, I ask myself, why would I want to do that? Is it an intellectual arrogance (oops) or do I simply want to understand what I do more clearly so that I can develop my trading to even greater efficiency and effectiveness? And why am I talking to myself?

Risk....implicitly a calculable outcome from a series of same according to a 'known' distribution for price.

Uncertainty...on a continuum from risk....becoming increasingly higher when the risk becomes increasingly uncertain in terms of the way price will distribute.

Why does risk move to uncertainty...because volatility moves from dispersion to conversion indicating that price will not be bracketed and the way it will distribute is not yet calculable on a probability basis.

Uncertainty...on a continuum from risk....becoming increasingly higher when the risk becomes increasingly uncertain in terms of the way price will distribute.

Why does risk move to uncertainty...because volatility moves from dispersion to conversion indicating that price will not be bracketed and the way it will distribute is not yet calculable on a probability basis.

sandpiper

Well-known member

- Messages

- 458

- Likes

- 54

jimbo57 said:There are many successful traders who trade purely on gut but there are increasingly more who use heavy duty analysis and mathematics to help them understand the market action and more particularly the relationship between markets (thinking of hedge funds in particular here) -as these players become more prevelant the market dynamics must change.

I'm sure you are right regarding the impact of buy-side participation, particularly the long-only hedge funds. More specifically, algorithmic execution is having a particularly dramatic effect on market dynamics and will continue to do so. It occurred to me that the effects aren't always as obvious as people might think either. For a start, it's pretty obvious that the CME's trade aggregation changes to their data feed earlier this year were due not just to increased volume but also to increased algorithmic execution.

Anyway, the bottom line is that algorithmic execution capability is substantially reducing traders' costs by allowing them to trade in smaller lot sizes. Doing this clearly reduces the impact of their trades. All of this can easily be substantiated by examining the reduction in average trade size on most of the electronic markets. As an aside, I still find it mildly amusing that a large number of futures traders persist in using multi-tick charts (not single tick) given these changing dynamics.

Tony,

As you've said, It is a given that liquidity attracts liquidity. Liquidity reduces transaction costs so regardless of motivation (and I'm not discounting the importance of that) reduced transaction costs encourage more trade, etc, etc..

The discussion on 'spread' thus far seems to have concentrated on the difference between a single market maker's best-bid and best-offer. Even with this restriction I share your view that spread can be a perfectly reasonable representation of liquidity.

Obviously, the one essential factor that is missing from a single market maker's quotes most of the time (given the tendency to refresh quotes) is the size that the bid or offer is good for. If spread is expanded to include all the bids or offers on the order book needed to execute orders of varying sizes then the resultant average cost per share/contract bought/sold gives an 'implied spread' that can be a much better representation of liquidity as a whole.

Actually, thinking about this in a little more detail, it becomes obvious why the 'size attracts size' argument must, for the most part, hold water since the market will almost always attract more participants on the side where the transaction costs are cheaper.

Anyway, I recently saw quite a nice piece in relation to futures by Galen Burghardt that suggests:

As a general rule, the effective bid/ask spread for a trade of any given size will be proportional to a ratio that includes a measure of price volatility in the numerator and of trading velocity (e.g., average daily trading volume) in the denominator. The form of this ratio would be:

- Bid/ask spread for trade size N = k x price volatility / square root of volume

where k captures things like the risk aversion of market makers and some mathematical constants.

The ratio makes intuitive sense at a basic level. The more volatile the price of the commodity, the more a market maker (the liquidity provider) will require to take your position from you. On the other hand, the faster the flow of trading through the market, the more quickly the market maker can unload the position and the lower his risk. (The presence of the square root in the ratio will seem natural to options traders who are comfortable with the relationship between price volatility and the square root of time.

I particularly like the inclusion of 'some mathematical constants'.

He also goes on to provide figures related to the futures industry highlighting the increased/reduced liquidity in various markets between 1999 and 2005 (all calculated using the formulae above).

The results are striking on a number of fronts. All of the financial contracts, which are traded electronically, have become substantially more liquid. By 2005, the implied bid/ask spreads for Eurobunds, 10-year Treasury notes, JGBs, the Nikkei, and the Euro were all about 40% of what they were in 1999. And the implied spreads for the E-mini S&P and the Eurostoxx contracts were less than 10% of what they were in 1999. These are astonishing improvements.

In contrast, crude oil and soybeans, both of which are pit-traded contracts, have become less liquid over the same period. The implied bid/ask spread for soybeans in 2005 was about 25% higher than it was in 1999, while the implied spread for crude oil contracts was more than double what it used to be.

As for volatility. It's all been said hasn't it? The calculation of volatility using high-low rather than close-close has to make more sense.

TheBramble

Legendary member

- Messages

- 8,394

- Likes

- 1,171

Interim Update

Unfortunately there does appear to be a correlation between the factors I have been considering.

I say unfortunately because I initially considered it was more likely to be a function of experience and exposure (familiarity) rather than anything that could be systemised through empirical number crunching.

The results so far indicate there is a mechanical correspondence between Volume, size of trades, number of trades per unit time (tick), Bid/Ask spread and Volatility (as measured High-to-Low rather than Close-to-Close).

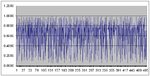

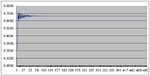

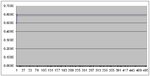

The graphs below are not price charts or equity curves. They are the output from functional analyses of the relationships of all of the above. Surprisingly (to me anyway) they fall into just five major categories.

Chaotic, cyclic, stable, extinct and damped.

These are my terms and relate not to the price action but the most likely future behaviours of the combinations of factors listed above.

The really worrying thing is that the periodicity and behaviour seems remarkably similar, within each of the categories, across a wide range of instruments.

When I change any of the parameters (Bid/Ask spread) for instance it's possible to deduce what type of waveform it will transform into from whatever the current state may be.

In the same way changing any two or more factors also leads to a very specific, and more interestingly, calculable state.

So for instance, increasing only the number of trades without changing trade size if we are in a cyclic state, will move it to a stable state. This is NOT I stress, stable price action, but stability in relation to liquidity and volatility and spread and tick pressure - which in turn leads to specific price action (or non-action!).

I'm posting this and the graphs for comment. Do these waveforms strike a chord with anyone? Seen them before anywhere? Any of this make sense?

I'm probably hoping that those of you who have been down this track before will head me off at the pass and stop me wasting my time. This is gripping stuff (sad but true), but if not of potential utility to my trading, I'd probably prefer to be doing something else. The beach is calling me...

Unfortunately there does appear to be a correlation between the factors I have been considering.

I say unfortunately because I initially considered it was more likely to be a function of experience and exposure (familiarity) rather than anything that could be systemised through empirical number crunching.

The results so far indicate there is a mechanical correspondence between Volume, size of trades, number of trades per unit time (tick), Bid/Ask spread and Volatility (as measured High-to-Low rather than Close-to-Close).

The graphs below are not price charts or equity curves. They are the output from functional analyses of the relationships of all of the above. Surprisingly (to me anyway) they fall into just five major categories.

Chaotic, cyclic, stable, extinct and damped.

These are my terms and relate not to the price action but the most likely future behaviours of the combinations of factors listed above.

The really worrying thing is that the periodicity and behaviour seems remarkably similar, within each of the categories, across a wide range of instruments.

When I change any of the parameters (Bid/Ask spread) for instance it's possible to deduce what type of waveform it will transform into from whatever the current state may be.

In the same way changing any two or more factors also leads to a very specific, and more interestingly, calculable state.

So for instance, increasing only the number of trades without changing trade size if we are in a cyclic state, will move it to a stable state. This is NOT I stress, stable price action, but stability in relation to liquidity and volatility and spread and tick pressure - which in turn leads to specific price action (or non-action!).

I'm posting this and the graphs for comment. Do these waveforms strike a chord with anyone? Seen them before anywhere? Any of this make sense?

I'm probably hoping that those of you who have been down this track before will head me off at the pass and stop me wasting my time. This is gripping stuff (sad but true), but if not of potential utility to my trading, I'd probably prefer to be doing something else. The beach is calling me...

Attachments

TheBramble

Legendary member

- Messages

- 8,394

- Likes

- 1,171

Over and Out

Sometimes things appear so complicated that it is impossible to predict what they will do next, but in reality, they are simply obeying a small number of really simple, functionally co-dependent rules.

Like the layering of cycles upon cycles (or cycles within cycles) can make what appears to be a totally random squiggle, but when deconstructed, the component waveforms are quite easily recognisable.

What most seem to do, myself included until oh so recently, is go about the process by attempting to take 'what is' and work out 'what it's made of'. These leads to an effectively infinite number of subsets of possibility.

That the human mind can unflinchingly assume the arrogance to work on any one subset without any empirical basis for assessing, let alone ensuring, it's validity or success, is probably what drives the human race to make the enormous advances it has - and does. So I'm not knocking it. But...it's like throwing darts in the hope that someone will invent a dart-board at some point.

When you take what you know at it's most basic (and that's the vital aspect of it all) level and apply 'what ifs' - you are then taking the tiger by the tail in layering each of those primordial elements of the markets' 'soup' into different plays. You are in effect, taking those things that are 'easily recognisable' and playing with them until they appear to become 'totally random' - and actually look a lot like the reality you started out trying to fathom.

Which brings me back to the initial aim at the start of this thread and with much self-deprecating laughter realise that once you do make the connection, risk was never the issue at all. Any more than was the Liquidity-Volatiltiy relationship. These are all byproducts of the manner of the market.

Sometimes things appear so complicated that it is impossible to predict what they will do next, but in reality, they are simply obeying a small number of really simple, functionally co-dependent rules.

Like the layering of cycles upon cycles (or cycles within cycles) can make what appears to be a totally random squiggle, but when deconstructed, the component waveforms are quite easily recognisable.

What most seem to do, myself included until oh so recently, is go about the process by attempting to take 'what is' and work out 'what it's made of'. These leads to an effectively infinite number of subsets of possibility.

That the human mind can unflinchingly assume the arrogance to work on any one subset without any empirical basis for assessing, let alone ensuring, it's validity or success, is probably what drives the human race to make the enormous advances it has - and does. So I'm not knocking it. But...it's like throwing darts in the hope that someone will invent a dart-board at some point.

When you take what you know at it's most basic (and that's the vital aspect of it all) level and apply 'what ifs' - you are then taking the tiger by the tail in layering each of those primordial elements of the markets' 'soup' into different plays. You are in effect, taking those things that are 'easily recognisable' and playing with them until they appear to become 'totally random' - and actually look a lot like the reality you started out trying to fathom.

Which brings me back to the initial aim at the start of this thread and with much self-deprecating laughter realise that once you do make the connection, risk was never the issue at all. Any more than was the Liquidity-Volatiltiy relationship. These are all byproducts of the manner of the market.

Similar threads

- Replies

- 2

- Views

- 8K

- Replies

- 0

- Views

- 2K