DAX30DayTrader

Well-known member

- Messages

- 474

- Likes

- 51

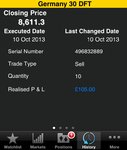

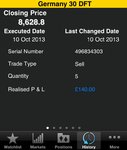

Very hard to justify selling the DAX here at 8600/10 resistance band, the price action is dictating that this is a trending day with a gap fill at 8630 looking a possibility, there is also resistance up at 8645. (8630 is an old unfilled gap).

Take the lead MrDAXTrader - Anticipate the breakout and have big enough hairy ones to take action on my opinion.

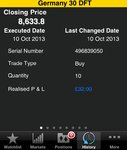

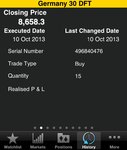

Bought @ 8600.8

Take the lead MrDAXTrader - Anticipate the breakout and have big enough hairy ones to take action on my opinion.

Bought @ 8600.8