This article looks at the same put strike for a long put and also a short put. First, focus will be placed on the long put's Delta. Then the same put strike price that was used for the long will be analyzed from the perspective of the short put.

Delta has multiple levels of meaning. One of the most commonly quoted definitions is that Delta is a measure of the change in an option's premium with respect to a change in the price of the underlying. The Delta of a long call and also of a short put are positively correlated to the movement of the underlying. While in the case of a long put, as well as the short call, the Delta is negatively correlated to the movements of the underlying asset.

Delta could also be an approximate Measure of Probability; what chance does the option have of expiring ITM (in-the-money)?

Let us assume that the SPY current price is 123, which it was at the time of writing, and the October weekly 120 put strike price had a Delta of 0.11, while the Bid was 0.49 and the Ask was 0.50.

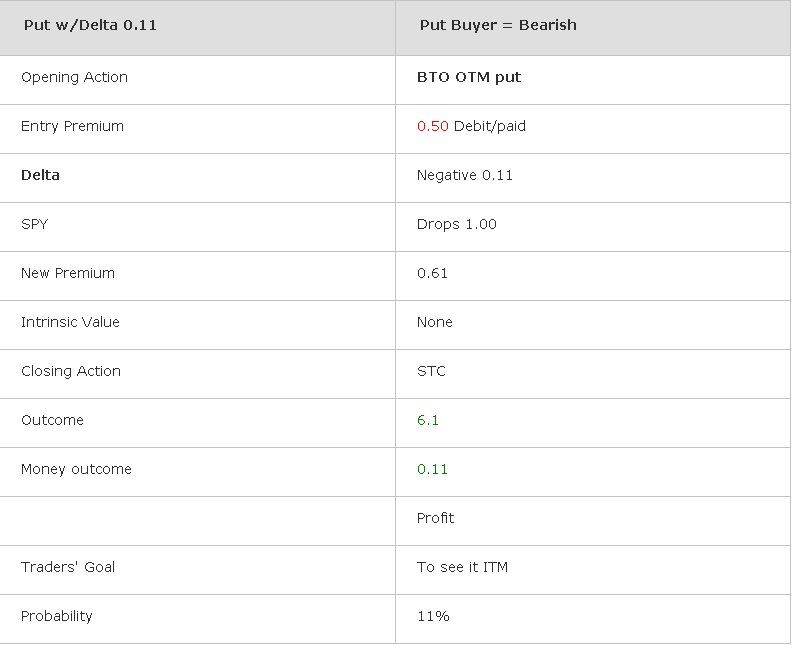

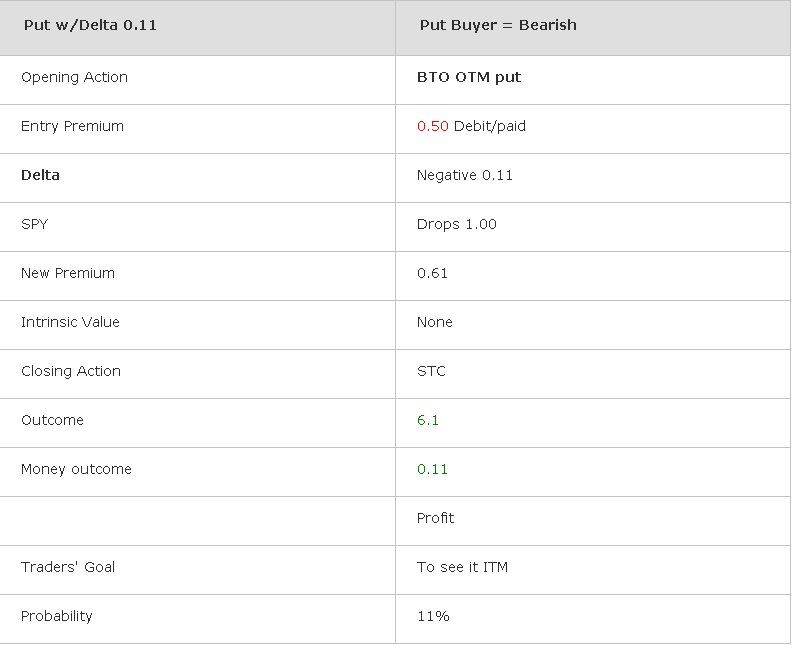

For our example, let's say we had bought that Oct weekly 120 put, which was 3 points out-of-the-money. The cost would be only fifty cents. The purchase of that particular 120 put with a Delta of 0.11 for a premium of 0.50 would cause the trader's account to be debited in the amount of $50 (100 x 0.50) because the trader has paid money out of his account for this buying transaction. We will use the premium per share for our evaluation. In Figure 1 below, the left column explains the right column. The buyer has BTO (bought to open) an OTM (out-of-the-money) 120 put for the premium of 0.50 with a negative Delta of 0.11. If the SPY drops one whole point, or 100 cents, the 120 put should increase in value the amount of Delta, which means that the new premium should be 0.61. If at that point, the trader chooses to close, the trade action that needs to be done is STC or sell to close.

Figure 1

The new premium value of 0.50 + 0.11 becomes 0.61. The trader's goal, after buying the long 120 put, was to see the SPY drop and for the 120 put option to expire ITM, yet that did not happen regardless of the fact that the premium had increased in value. The increase of the premium in this case is not caused by intrinsic value but by extrinsic value. As the SPY dropped in value by one whole point, the buyer gained NOT 100% of the move, which would have been penny for penny, but only about 11% of the same one dollar move. The selection of buying the 120 put was not the wisest choice because the probability of the 120 expiring ITM was only 11%. Next, let us turn our attention to the short put.

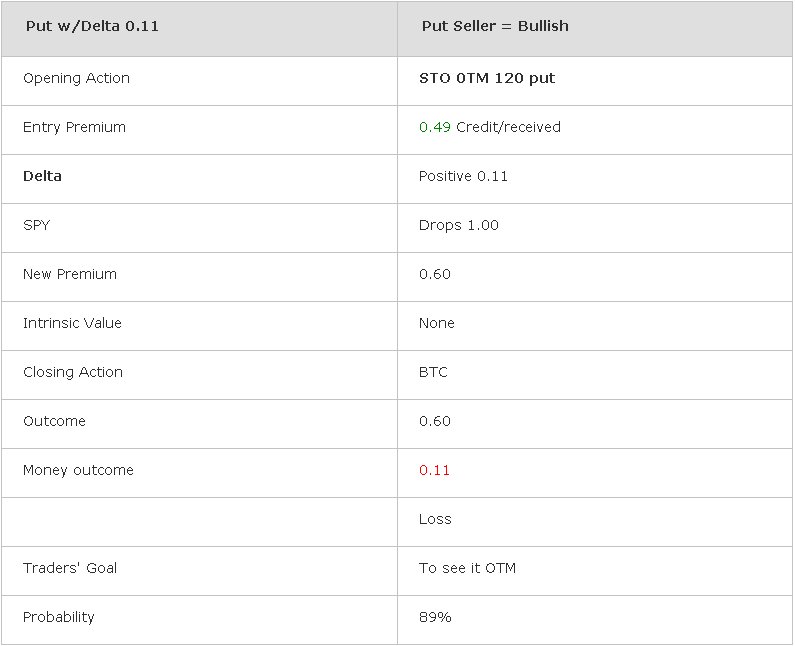

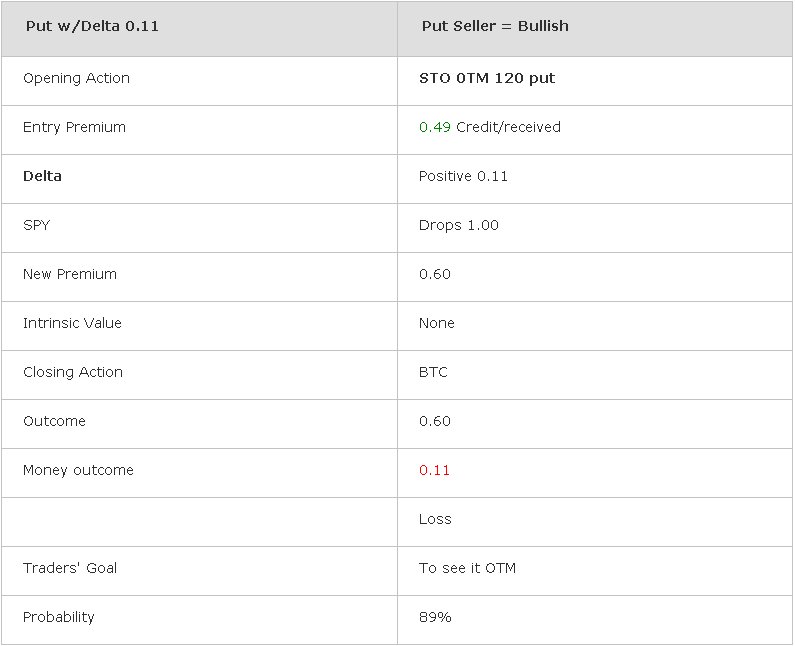

At the same time, the seller of that very same 120 (out-of-the-money) put has a much better chance of achieving his or her goal. The seller sold the 120 put with the anticipation of seeing the sold call expiring OTM (out-of-the-money). This result could take place if the SPY did nothing, meaning stayed flat, or even if the SPY were to move down a little bit. Figure 2 shows that the put was sold for 0.49 (at the Bid) and the amount is colored in green since it was a credit.

Figure 2

Going through the entries above, the SPY dropped one point and the sold put for 0.49 increased in value by 0.11, or the amount of Delta. However, unless the put seller closes the position at this point, none of that increase has any meaning because at expiry, only the intrinsic value is going to matter. The sold 120 put gives the seller an obligation to buy the stock at 120, yet even if the product which was initially trading at 123, drops one whole point to 122, the 120 put still does not have any intrinsic value. As time passes, none of that extrinsic value is going to matter because the SPY trading at 122 still makes the 120 sold put OTM.

Although the seller of the put did not want to see the put premium increase in value, at first, that is exactly what took place. Had the trader panicked and closed the trade, there would have been a loss of 0.11. Yet, what really matters is where the SPY is at expiry when all the time decay goes out.

Hence, here is the question: Who is better off; the one who bought the OTM 120 put, or the one who sold it? In terms of probability, the answer might have been obvious from the beginning had the trader really understood that Delta is also an approximate Measure of Probability showing how much of a chance the option has of expiring ITM (in-the-money). The long 120 put had only an 11% chance of achieving its goal, while the short 120 put probability was 89%.

In conclusion, the put Delta of the 120 OTM strike price has been addressed. Whether the trader is a buyer or a seller has absolutely no impact on the Delta's value since it remains the same. One can be on either side of the trade while the Delta number is the Delta no matter what. It will just be negative or positive depending on what side of the trade you are on. Know your Greeks well and as we, Plan the Trade and Trade the Plan. Have green trading.

Delta has multiple levels of meaning. One of the most commonly quoted definitions is that Delta is a measure of the change in an option's premium with respect to a change in the price of the underlying. The Delta of a long call and also of a short put are positively correlated to the movement of the underlying. While in the case of a long put, as well as the short call, the Delta is negatively correlated to the movements of the underlying asset.

Delta could also be an approximate Measure of Probability; what chance does the option have of expiring ITM (in-the-money)?

Let us assume that the SPY current price is 123, which it was at the time of writing, and the October weekly 120 put strike price had a Delta of 0.11, while the Bid was 0.49 and the Ask was 0.50.

A Long Put

For our example, let's say we had bought that Oct weekly 120 put, which was 3 points out-of-the-money. The cost would be only fifty cents. The purchase of that particular 120 put with a Delta of 0.11 for a premium of 0.50 would cause the trader's account to be debited in the amount of $50 (100 x 0.50) because the trader has paid money out of his account for this buying transaction. We will use the premium per share for our evaluation. In Figure 1 below, the left column explains the right column. The buyer has BTO (bought to open) an OTM (out-of-the-money) 120 put for the premium of 0.50 with a negative Delta of 0.11. If the SPY drops one whole point, or 100 cents, the 120 put should increase in value the amount of Delta, which means that the new premium should be 0.61. If at that point, the trader chooses to close, the trade action that needs to be done is STC or sell to close.

Figure 1

The new premium value of 0.50 + 0.11 becomes 0.61. The trader's goal, after buying the long 120 put, was to see the SPY drop and for the 120 put option to expire ITM, yet that did not happen regardless of the fact that the premium had increased in value. The increase of the premium in this case is not caused by intrinsic value but by extrinsic value. As the SPY dropped in value by one whole point, the buyer gained NOT 100% of the move, which would have been penny for penny, but only about 11% of the same one dollar move. The selection of buying the 120 put was not the wisest choice because the probability of the 120 expiring ITM was only 11%. Next, let us turn our attention to the short put.

A Short Put

At the same time, the seller of that very same 120 (out-of-the-money) put has a much better chance of achieving his or her goal. The seller sold the 120 put with the anticipation of seeing the sold call expiring OTM (out-of-the-money). This result could take place if the SPY did nothing, meaning stayed flat, or even if the SPY were to move down a little bit. Figure 2 shows that the put was sold for 0.49 (at the Bid) and the amount is colored in green since it was a credit.

Figure 2

Going through the entries above, the SPY dropped one point and the sold put for 0.49 increased in value by 0.11, or the amount of Delta. However, unless the put seller closes the position at this point, none of that increase has any meaning because at expiry, only the intrinsic value is going to matter. The sold 120 put gives the seller an obligation to buy the stock at 120, yet even if the product which was initially trading at 123, drops one whole point to 122, the 120 put still does not have any intrinsic value. As time passes, none of that extrinsic value is going to matter because the SPY trading at 122 still makes the 120 sold put OTM.

Although the seller of the put did not want to see the put premium increase in value, at first, that is exactly what took place. Had the trader panicked and closed the trade, there would have been a loss of 0.11. Yet, what really matters is where the SPY is at expiry when all the time decay goes out.

Hence, here is the question: Who is better off; the one who bought the OTM 120 put, or the one who sold it? In terms of probability, the answer might have been obvious from the beginning had the trader really understood that Delta is also an approximate Measure of Probability showing how much of a chance the option has of expiring ITM (in-the-money). The long 120 put had only an 11% chance of achieving its goal, while the short 120 put probability was 89%.

In conclusion, the put Delta of the 120 OTM strike price has been addressed. Whether the trader is a buyer or a seller has absolutely no impact on the Delta's value since it remains the same. One can be on either side of the trade while the Delta number is the Delta no matter what. It will just be negative or positive depending on what side of the trade you are on. Know your Greeks well and as we, Plan the Trade and Trade the Plan. Have green trading.

Last edited by a moderator: