You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SOCRATES

Veteren member

- Messages

- 4,966

- Likes

- 136

No, I am not playing. I am giving you a chance.badtrader said:Some people play very, very well just so they won't get embarrassed.Is this what you are playing 😉

The chance I am giving you is for you to own up.

This is why I am not solving the riddle for you.

Because it is obvious.

And if I did, it would make you look very stupid.

And, as I do not want to make you look stupid, I do not want you to get embarrassed either.

But you are pushing it.

And if you push further, I will solve it and make you look very stupid and very embarrassed as well.

So I advise you not to push and to behave properly instead.

You may embarrass me if you can.How much easier it is to be critical than to be correct. 😉SOCRATES said:No, I am not playing. I am giving you a chance.

The chance I am giving you is for you to own up.

This is why I am not solving the riddle for you.

Because it is obvious.

And if I did, it would make you look very stupid.

And, as I do not want to make you look stupid, I do not want you to get embarrassed either.

But you are pushing it.

And if you push further, I will solve it and make you look very stupid and very embarrassed as well.

So I advise you not to push and to behave properly instead.

sandpiper

Well-known member

- Messages

- 458

- Likes

- 54

bad,

Panning for systems that nobody will use....... looking for help backtesting magic s&p numbers from the pit.. risk/trade management "questions" that you already know the answer to... You could at least develop a subtler approach. Alternatively you could just do your own homework!!!!! At the very least, the magic word might help, as my mum would say.

Incidentally, there are ample references around regarding the merits of each of your proposals, i.e trade management. I think you'll find that Kevin546 posted some examples of trade management using multiple contracts. However, I suspect that the search might be too much trouble!!!!

Anyway, good luck with your fishing expedition.

Panning for systems that nobody will use....... looking for help backtesting magic s&p numbers from the pit.. risk/trade management "questions" that you already know the answer to... You could at least develop a subtler approach. Alternatively you could just do your own homework!!!!! At the very least, the magic word might help, as my mum would say.

Incidentally, there are ample references around regarding the merits of each of your proposals, i.e trade management. I think you'll find that Kevin546 posted some examples of trade management using multiple contracts. However, I suspect that the search might be too much trouble!!!!

Anyway, good luck with your fishing expedition.

SOCRATES

Veteren member

- Messages

- 4,966

- Likes

- 136

Ok, I will embarrass you if you like.badtrader said:You may embarrass me if you can.How much easier it is to be critical than to be correct. 😉

What you propose is perfectly STUPID.

This is because the true object of effective trading is to maximise advantage.

Using a 10 point stop to try to capture !0 points is not advantageous, it is stupid, absolutely STUPID.

It is akin to flicking a coin in the air and hoping you will win.

But using a very tight stop on a very high ratio is a very different matter.

That is the correct thing to do.

But invariably newbies know better, that is why they are newbies.

And newbies, are apt to treat trading as a casino, which it is not.

It is not a casino but obviously according to your frame of reference all of this is random, but your frame of reference is completely wrong.

If it were right, the banks, the pension funds, the insurance companies, the legal profession, the accounting profession, and governments would not get involved in trading and investment, they would leave money to rot in bank vaults and for the purchasing power of money to be eaten away by inflation.

You see how STUPID your statements really are now you have read this.

I would not call 1, to 1 ratio,stupid, If you are looking for 10 pips and 10 pips stop, you would move stop to even once the market moves 5 pips. with 80% wins. You call this stupid Maybe because you play position trading where it does not work.

There is more chance of being correct on a trade in the first 2 to 5 mins.than waiting for 30 mins for 30 pips

There is more chance of being correct on a trade in the first 2 to 5 mins.than waiting for 30 mins for 30 pips

SOCRATES

Veteren member

- Messages

- 4,966

- Likes

- 136

No, you are wrong again.badtrader said:I would not call 1, to 1 ratio,stupid, If you are looking for 10 pips and 10 pips stop, you would move stop to even once the market moves 5 pips. with 80% wins. You call this stupid Maybe because you play position trading where it does not work.

There is more chance of being correct on a trade in the first 2 to 5 mins.than waiting for 30 mins for 30 pips

In positional trading because the expected gain is greater and over a longer timeframe the stoploss paameters are relevant to big moves over time.

What you are saying with regard to short time frame trading is STUPID.

In short timeframe trading you have to get it consistently right more than 90 % of the time to make it truly worthwhile. You can only achieve this if you are in possession of the right skills (dealing skills) and the correct trading trading skills (knowledge and understanding), otherwise you are engaged in a sort of mechanical gambling that may or may not work.

Therefore a 1 to 1 ratio is ridiculous.

The curious thing about all this is that newbies insist on using wide stops on the basis they think the position has to be given space for the price to breathe, but in effect what they are doing is increasing the potential for crippling losses. They consider to be stopped out on a tight stop as an unnecessary aggravation, because they argue the stop is easily hit. This is because they expect to get it wrong often, and because their entry point is not sufficiently accurate and because their timing is not exactly right.

The really experienced efficient trader gets it right many many more times that he gets it wrong, and, when he does get it wrong, it comes as a surprise, instead of an event expected with foreboding and fear.

For this reason, a tight stop is essential to cut losses, if any, and to liquidate a postition which may have been right at the outset, but is now suddenly wrong.

Now think about this carefully again, and how STUPID it is to use wide stops and to think in terms of a 1 to 1 ratio as you do. It is not necessary, it is just asking for trouble where none exists.

I have done testing on a 1 to 1, and it works although I got many different approaches one being I scale in to a position. others I will get out quick before my stop is hit. I also play longer term on forex.I offer you to watch at me trade live, on the 1 to 1 approach we can set a chat room up. let me know

good night

good night

senyorqueso

Member

- Messages

- 96

- Likes

- 2

Definitely a familiar ring to these posts! Just how many identities can one person have around here?

Bigbusiness

Experienced member

- Messages

- 1,408

- Likes

- 23

So what market are we talking about here? A 10 point stop can be tiny on some markets and huge on others. That is one of the holes I can see. As for stops, why not use time? If what you want hasn't happened after a defined period of time, get out of the trade. There are times when the markets are noisy and will consistently take out tight stops. Perhaps some people can get the perfect entry most of the time but I have yet to see any hard proof of this. It is easy to say use tight stops but lets see some examples. I suppose that wont happen as it will give away too many secrets and I will be accused of trying to get a trading method for free but I don't mind being made to look stupid. So please show some examples of tight stops in use.

trendie

Legendary member

- Messages

- 6,875

- Likes

- 1,433

post below is post 6 from "Mr T trades Live"

twalker BEGIN:: does limit mean where you take profit or move stop? That is question.

I would also question the rationale that you need a larger profit target than stop on every trade, despite what the people who write books say. I have a successful es sysem that takes 6 pts profit and runs a 17 point stop but the ratio is in my favour.

END.

I questioned the logic, as would any newbie, of risking more than the potentail reward. Above was the reply.

twalker appears to regularly risk 17 to win 6. But because the hit ratio is so high, it is worth it.

( Soc reagrds 1:1 as stupid )

The whole premise of 10:10 pips won/risked being bad rests on the assumption that the trade success ratio is also possibly 1:1.

If you can use patterns / indicstors / volume analysis to have a better chance of identifying the direction, then the 10:10 is relatively meaningless.

If you can identify the direction, say 70% of the time, and carry out your "coin-flip", then you will win 7 lots of 10 pips agiant losing 3 lots of 10 pips.

surely is not only risk:reward, but also the win:loss ratio of the trades that determines overall success.

twalker BEGIN:: does limit mean where you take profit or move stop? That is question.

I would also question the rationale that you need a larger profit target than stop on every trade, despite what the people who write books say. I have a successful es sysem that takes 6 pts profit and runs a 17 point stop but the ratio is in my favour.

END.

I questioned the logic, as would any newbie, of risking more than the potentail reward. Above was the reply.

twalker appears to regularly risk 17 to win 6. But because the hit ratio is so high, it is worth it.

( Soc reagrds 1:1 as stupid )

The whole premise of 10:10 pips won/risked being bad rests on the assumption that the trade success ratio is also possibly 1:1.

If you can use patterns / indicstors / volume analysis to have a better chance of identifying the direction, then the 10:10 is relatively meaningless.

If you can identify the direction, say 70% of the time, and carry out your "coin-flip", then you will win 7 lots of 10 pips agiant losing 3 lots of 10 pips.

surely is not only risk:reward, but also the win:loss ratio of the trades that determines overall success.

badtrader said:Let see what answers we get. Lets say you got a target of 10 points and with a stop of 10 points. Over time what will work best. based on 2 lots

10 point target...10 points stop,,, enter 2 lots

or

10 point target...10 points stop,,, enter 2 lots sell 1 lots after 5 points then move stop to even.

or

10 point target...10 points stop ,,, enter 1 lot then at 5 points profit buy 1 more lot. stop stays at you entry price

An extremely interesting problem. You put it in a very general way, and the general answer can be very long. Also I'm not sure I understood exactly the conditions you're giving, so I'll try to be clear about what I assumed. I also assume that what you're asking is: I have 2 lots to buy: which strategy should I choose?

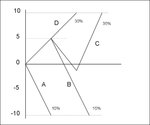

In the attached graph you'll find the different relevant possibilites for a trade. I also attach a table with the outcomes for the different scenarios.

After looking at the table, I'm quite sure that most people in this board, being traders and having read trading books will choose the strategy 3, which has the minimum drawdown. It is the one where you're losing the less. However, there is no one answer. The answer is: what suits you best.

Consider what happens when you take into account your probability of choosing a good trade (this is related to the 3:1 ratio trade you were talking about before), and how the probability of touching the stop loss/ reaching your target changes. To clarify, I'll give an example with numbers. Say that I'm very hard working (assuming that here we're working) and I taught myself to be a very good card counter. I win 70% of the time. Then, after 100 trades I can expect to get a total profit of 800 (70% of 100 x 20 = 1400 from the winning trades and 30x(-20)=-600 from the losing trades). To calculate what to expect from strategies 2 and 3 we need to distribute the probabilities of winning and losing among the different scenarios. So, if I distribute those probabilities evenly I get the probabilities as indicated in the graph. Using these values I get for strategy 2 total expected winnings of 525 and total losses of 300, which gives a total profit of 225. Strategy 3 yields a profit of 125 points. We can go even further and calculate how profitable I need to be for the different strategies to work? Strategy 1 is the simplest to work out. You don't need to do any calculation to realise that you need to be right more than 50% of the time to expect a profit. For strategies 2 and 3 the calculation is quite straightforward:

strategy 2: After a reasonable number of trades I can expect to end up with a loss if -20xA/2 + 0xA/2 + 0xB/2 + 15xB/2 < 0. Here A is the probability of losing (30% in the previous example) and B is the probability of winning (70% previously). These probabilities are divided by 2 because they are the number of different ways I can achieve a loss/winning. (In the previous example 30%/2=15% for the two possible price patterns that give a loss, and 70%/2=35% for each of the two winners). Note that A=1-B. The result is that if B<57.14% , on average you'll lose.

Strategy 3: Doing the same kind of calculation, if B<60% in average you'll lose.

So it seems that if you're not very good, strategy 1 should be the winner. You only need to be right more than 50% of the time.

This sounds in contradiction with what we read in all these trading books that want us to succeed. But actually it isn't. It all depends on what you want. A particular trade strategy needs to be put in the 'context' of your general capital management. How much is it worth for you betting 10 points in 2 lots? Is it 100% of your capital? Or is it just a small portion of it, say 3%? In one case I will want to minimize my maximum drawdown, because I don't want to go broke. In the other case I'll want to maximize my expected return, because I do want to make money. To illustrate how trying to maximize your expected return using the wrong amount of your capital can make you broke, you have to forget about your average return and think in terms of the rare event when you have one losing trade after another. Being right 70% of the time doesn't mean that after 3 losing trades you can be absolutely sure the next one is a winner. You can have a strike of 10 losing trades, for example. Or if you're very lucky, may be 20 losing trades...Average return means that after a big number of trades you'll be 70% right. If 10 times 2 lots represents 50% of your capital, then probably you'll go broke, even if you're right 90% of the time.

One last remark. When we calculate expected returns we're assuming we're betting the same amount everytime, so we're not reinvesting our winnings and we're not resizing our bets after losses. There is a very interesting work by J. L. Kelly, where he finds the optimun betting size in order to increase your capital and not go broke, as a function of your capital and your probability of being right. The article in itself could be a little bit complicated with the maths, but just do a search in the internet and you can get to the formula faster and with a simple explanation.

I think the stock market is a game of probabilities. You need to play it many times for it to make sense. Why is it better than a casino or a poker group? Because they're not going to shut down your business when you're winning and nobody is going to beat you up.

Good trading!

Silvia.

Attachments

commanderco

Well-known member

- Messages

- 363

- Likes

- 7

Hello BT

10 pt target, 10 point stop, I imagine that put you into the 1M,3M or maybe 5M frame.

I do not know if you are trading fades or breakouts, or what instrument(s).

Maybe I missed this as I have only just jumped on board this thread in which case, my apologies; but your problem at the coalface is slippage/spreads/commissions in addition to target/stops. You simply do not have the luxury of time like other frames of trading.

I know a little about trading CME IMMs at this level and the best in my opinion is EC as it fills in, and has a spread under solid volume of 1 point, unless of course something exciting is about to take place.(but that is another story)You can remove this by buying the ask etc and your commissions should be less than one third of a point.

I have debated, with my self, ( dont you just love that expression) whether to use 2 or 3 points as a stop with a target of around 7 - 10 points ...... it all depends on bid/ask, as it does as to where you exit, but never never, ever ever let a profit drift back into a loss.

I would regard a 10/10 target/stop at the best as a lack of understanding of the quick timeframes and at the worst as sheer insanity.

There are just too many other contributing factors at this level as I have stated.

There is also the very important question of trading platform. I am in the middle of making a switch to a better platform that will allow me brackets ,one touch entry / exit and several other features .... always looking to improve my edge and if you want to know what the edge is .... it is knowledge.We simply need to know more about trading our time frames and instruments than the other bugger, which brings me back to your 10/10 strategy!

10 pt target, 10 point stop, I imagine that put you into the 1M,3M or maybe 5M frame.

I do not know if you are trading fades or breakouts, or what instrument(s).

Maybe I missed this as I have only just jumped on board this thread in which case, my apologies; but your problem at the coalface is slippage/spreads/commissions in addition to target/stops. You simply do not have the luxury of time like other frames of trading.

I know a little about trading CME IMMs at this level and the best in my opinion is EC as it fills in, and has a spread under solid volume of 1 point, unless of course something exciting is about to take place.(but that is another story)You can remove this by buying the ask etc and your commissions should be less than one third of a point.

I have debated, with my self, ( dont you just love that expression) whether to use 2 or 3 points as a stop with a target of around 7 - 10 points ...... it all depends on bid/ask, as it does as to where you exit, but never never, ever ever let a profit drift back into a loss.

I would regard a 10/10 target/stop at the best as a lack of understanding of the quick timeframes and at the worst as sheer insanity.

There are just too many other contributing factors at this level as I have stated.

There is also the very important question of trading platform. I am in the middle of making a switch to a better platform that will allow me brackets ,one touch entry / exit and several other features .... always looking to improve my edge and if you want to know what the edge is .... it is knowledge.We simply need to know more about trading our time frames and instruments than the other bugger, which brings me back to your 10/10 strategy!

Profitaker

Established member

- Messages

- 773

- Likes

- 70

Is it really ?SOCRATES said:

Ok, I will embarrass you if you like.

Using a 10 point stop to try to capture !0 points is not advantageous, it is stupid, absolutely STUPID.

It is akin to flicking a coin in the air and hoping you will win.

But using a very tight stop on a very high ratio is a very different matter.

Let give you a scenario to think about. Trader A and trader B both trade the same underlying and with the same directional succes rate. Both exit when a profit of 10 points has been achieved. But trader A uses a 5 point stop, trader B uses a 10 point stop. Who makes the most profit ?

And try not to embarrass yourself here.

SOCRATES

Veteren member

- Messages

- 4,966

- Likes

- 136

No I am not embarrasing myself, I am embarrassed for you,that what you can post can be so STUPID as well, just for the sake of arguing with me.Profitaker said:Is it really ?

Let give you a scenario to think about. Trader A and trader B both trade the same underlying and with the same directional succes rate. Both exit when a profit of 10 points has been achieved. But trader A uses a 5 point stop, trader B uses a 10 point stop. Who makes the most profit ?

And try not to embarrass yourself here.

Just read carefully what it is you have written and when you fully understand the extent of the STUPIDITY you have written is you who ought to be embarrassed ~ though I doubt in your case your level of awareness is sufficiently developed for you to experience ANYTHING CONSTRUCTIVE.

Know your place and from now on, if you are going to post anything relevant to this discussion, think carefully before you do so, so as not to make a greater STUPIDITY of what you say than it already STUPIDLY IS.

c6ackp

Well-known member

- Messages

- 441

- Likes

- 28

Who makes the most profit ?

dunno - depends on the ratio of (trader A stopped out) / (trader B stopped out), which depends on the market noise and the quality of the original entry

badtrader has kindly highlighted a very important technique which can be used to improve the profitability (and comfort) of one's trading

from my perspective the only thing wrong with the original question is the fixed 10 point target - why limit the upside? exit the first lot in profit to pay for your second, which will provide plenty of free (or almost free) bets at the casino...

Just my 2c

Happy Trading

Steve

sandpiper

Well-known member

- Messages

- 458

- Likes

- 54

trendie,

What Socrates stated was that a 1:1 R/R with regards to short term trading was stupid. The way in which bad phrased the question made it clear that it was short term trading he was discussing. AFAIK, Twalker was referring to positional (or at least longer term) system based trades that he explores as an aside to his main income stream.

BB is obviously right in as much as it's pointless arguing the merits of 10pts without knowing the pair and the situation in question. Good point about time as well. I can also see where BB is coming from with regard to tight stops. However, if you stand back from it and look objectively at your stop placement and think about it in a more precise way it can often reveal inadequacies in your entry method with regards to timing, etc (at least it did for me), i.e. with a better entry I get a much tighter stop. A wide stop and it means I've screwed the entry up.

Mr. Charts has on many occasions mentioned the precision with which his entries can be judged based on the ebb and flow of Level II and T&S. I haven't seen it, but I don't doubt it for a minute. The pits are/were full of locals who were/are able to effectively use the tightest stop loss possible. Nearly impossible to do off-floor. However, exactly the same principals apply as those used by Mr. Charts. Personally, I have long since come to terms with the fact that my own inability to replicate this level of precision is due to my own limitations and lack of understanding and not down to the fact that it isn't achievable.

bad.. I don't doubt that you have taken money from the market. Nor do I doubt that you've helped people out.... I like threads where people throw ideas around, where people are open and honest about their stage of development and about their intentions. There are many of those threads around but this isn't one of them.

What Socrates stated was that a 1:1 R/R with regards to short term trading was stupid. The way in which bad phrased the question made it clear that it was short term trading he was discussing. AFAIK, Twalker was referring to positional (or at least longer term) system based trades that he explores as an aside to his main income stream.

BB is obviously right in as much as it's pointless arguing the merits of 10pts without knowing the pair and the situation in question. Good point about time as well. I can also see where BB is coming from with regard to tight stops. However, if you stand back from it and look objectively at your stop placement and think about it in a more precise way it can often reveal inadequacies in your entry method with regards to timing, etc (at least it did for me), i.e. with a better entry I get a much tighter stop. A wide stop and it means I've screwed the entry up.

Mr. Charts has on many occasions mentioned the precision with which his entries can be judged based on the ebb and flow of Level II and T&S. I haven't seen it, but I don't doubt it for a minute. The pits are/were full of locals who were/are able to effectively use the tightest stop loss possible. Nearly impossible to do off-floor. However, exactly the same principals apply as those used by Mr. Charts. Personally, I have long since come to terms with the fact that my own inability to replicate this level of precision is due to my own limitations and lack of understanding and not down to the fact that it isn't achievable.

bad.. I don't doubt that you have taken money from the market. Nor do I doubt that you've helped people out.... I like threads where people throw ideas around, where people are open and honest about their stage of development and about their intentions. There are many of those threads around but this isn't one of them.

Similar threads

- Replies

- 34

- Views

- 13K