been a while since i posted anything.

my trading has been flat on the year so far. had one big winner gkp, but this has been offset by liz, ctb, and fosl which has gone against me.

thought i would share my gkp chart and trade as feel it is Weinstein example at it's best.

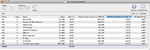

enclosed is a weekly, daily and oil sector shares/(in UK) chart.

the weekly chart shows that between Nov 2010, and December 2011 it was in a wide ranging congestion area of 120 points between 80-200. then at end of December it broke out on a very high trading week, but closed the week back at breakout level. then had a week of consolidation on much lighter volume, before resuming breakout. i bought at 205 as started going up again. obviously didn't expect it to rocket like it did.

as page 193 at the bottom suggests after an unexpected windfall takes place to take partial profits. i did this twice above the 270 level with small positions leaving just under half of original position left.

my stop has now been raised to breakeven, and will treat it now like the investment section of Weinstein does.