SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

USDCAD market update by Solidecn

The US dollar is holding at local highs

During the Asian session, the USDCAD pair shows flat trading dynamics, consolidating near local highs of February 15. Investor activity remains subdued as US markets were closed on Monday for President's Day. At the same time, the news background was quite rich in various publications, and the focus of the market was the aggravation of the geopolitical situation in Eastern Europe. The optimistic sentiments of the traders were leveled after the official Kremlin stated that a meeting of the Russian and US presidents on the Ukrainian crisis was not yet planned. Earlier, the Russian leader announced the recognition of the self-proclaimed Donetsk and Lugansk People's Republics.

In turn, the pressure on the Canadian dollar remains after the publication of rather poor statistics last Friday. Thus, the volume of retail sales for December fell sharply by 1.8%. The focus of investors on Tuesday is a block of data from the US on business activity in February, while Canada will publish a report on ADP jobs for January.

Support and resistance

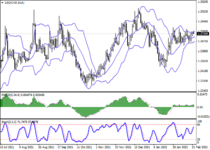

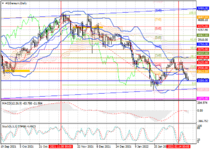

Bollinger bands on the daily chart are growing slightly: the price range expands from above, letting the "bulls" renew local highs. MACD shows an uncertain growth and keeps a very poor buy signal. Stochastic moves more confidently but reflects that USD may become overbought in the ultra-short term.

Resistance levels: 1.2786, 1.2812, 1.285, 1.29.

Support levels: 1.275, 1.27, 1.265, 1.26.