You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Sniper Forex System

- Thread starter stevespray

- Start date

- Watchers 195

GumRai,

Could you attach your spreadsheet with your above post, please? I would like to take a look...

I did attach the spreadsheet, but it has disappeared. It showed in my attached files. Will have to upload it again 🙁. The upload speed on my internet connection is dire.

I'm not an expert with excel, but I quite enjoy playing with it. 🙂

Attachments

Thanks

Thanks GumRai for your work👍

I will study this now, special the trades and compare with my trades.

also the tactic , I will play with.

Tanks a lot

I did attach the spreadsheet, but it has disappeared. It showed in my attached files. Will have to upload it again 🙁. The upload speed on my internet connection is dire.

I'm not an expert with excel, but I quite enjoy playing with it. 🙂

Thanks GumRai for your work👍

I will study this now, special the trades and compare with my trades.

also the tactic , I will play with.

Tanks a lot

GR

The spreadsheet is great, but I do have a question.

You give figures for taking profit, but have you worked out profit levels with scaling out of trades e.g. close 50% at 50 pips, leaving the remainder to run etc. (sorry if your figures do take this into account)?

The spreadsheet is great, but I do have a question.

You give figures for taking profit, but have you worked out profit levels with scaling out of trades e.g. close 50% at 50 pips, leaving the remainder to run etc. (sorry if your figures do take this into account)?

greenfield

Member

- Messages

- 91

- Likes

- 1

Hello forexkunta, GumRai, RuMouR et al.

I've noticed the same as you – that taking profits using the lower figures mentioned works against maximising profits. Just to recap (for anyone who has recently started following this thread) – we've been looking at variations of the Sniper suggestion to divide each trade into 5. I've been taking out 2 trades – 1 to exit when the system dictates, and the other a TP75. I've mentioned in some recent posts that the 2nd trade has a psychological element – making a gain on those trades where large gains evaporate to break even or sometimes even end up at a loss. But by using TP75 means making a small loss, albeit it small loss – compared with letting the trade run its course.

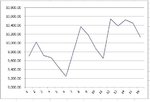

During the period since April 14, according to my figures, the average gain on all trades, letting them run their course, is 22 pts per day/18 pts per trade. The attached copy of a spreadsheet shows that TP75 results in an 18 pts per day gain. TP135 shows a gain of 28 pts per day – the most beneficial being TP165, TP170 and TP175. Though I'm not sure if I would be happy to enter a TP at 165. The principle behind this being a TP at a certain level could hold onto a gain that may evaporate – but at the same time this may mean closing a trade that could go on to make a gain of several hundred points. Bear in mind that during this period there have been 34 trades that have reached 175 pts, (9 closing above 175 pts).

Therefore, I've felt that a set TP trade is too mechanical/dogmatic, and at 75 results in a (comparative) loss, albeit a small one. So over the last week I have changed tactics. Now I take out 2 trades – 1 that runs its course as per Sniper rules, and 1 which I treat in a similar way to the way I do with equities, that is skim off profits as and when it seems appropriate (using S&R levels possibly).This should be in keeping with the realities of each individual trade.

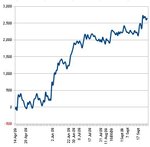

As mentioned above, the figures I have trading Sniper for 5½ months/149 trades, work out at an average of 22 pts a day/18 pts a trade. I've put together an updated chart (attached) showing the points gained/lost since April.

Bye,

I've noticed the same as you – that taking profits using the lower figures mentioned works against maximising profits. Just to recap (for anyone who has recently started following this thread) – we've been looking at variations of the Sniper suggestion to divide each trade into 5. I've been taking out 2 trades – 1 to exit when the system dictates, and the other a TP75. I've mentioned in some recent posts that the 2nd trade has a psychological element – making a gain on those trades where large gains evaporate to break even or sometimes even end up at a loss. But by using TP75 means making a small loss, albeit it small loss – compared with letting the trade run its course.

During the period since April 14, according to my figures, the average gain on all trades, letting them run their course, is 22 pts per day/18 pts per trade. The attached copy of a spreadsheet shows that TP75 results in an 18 pts per day gain. TP135 shows a gain of 28 pts per day – the most beneficial being TP165, TP170 and TP175. Though I'm not sure if I would be happy to enter a TP at 165. The principle behind this being a TP at a certain level could hold onto a gain that may evaporate – but at the same time this may mean closing a trade that could go on to make a gain of several hundred points. Bear in mind that during this period there have been 34 trades that have reached 175 pts, (9 closing above 175 pts).

Therefore, I've felt that a set TP trade is too mechanical/dogmatic, and at 75 results in a (comparative) loss, albeit a small one. So over the last week I have changed tactics. Now I take out 2 trades – 1 that runs its course as per Sniper rules, and 1 which I treat in a similar way to the way I do with equities, that is skim off profits as and when it seems appropriate (using S&R levels possibly).This should be in keeping with the realities of each individual trade.

As mentioned above, the figures I have trading Sniper for 5½ months/149 trades, work out at an average of 22 pts a day/18 pts a trade. I've put together an updated chart (attached) showing the points gained/lost since April.

Bye,

Attachments

Last edited:

Thanks GumRai for your work👍

I will study this now, special the trades and compare with my trades.

also the tactic , I will play with.

Tanks a lot

Your welcome Eagle. Remember if you want to play around with the or add new "what -ifs", the password to unlock the worksheets is sniper

GR

The spreadsheet is great, but I do have a question.

You give figures for taking profit, but have you worked out profit levels with scaling out of trades e.g. close 50% at 50 pips, leaving the remainder to run etc. (sorry if your figures do take this into account)?

Hello Wil,

There is nothing in the spreadsheet to work this out at the moment.

However, as in your example close 50% at 50 pips, it's just a case of splitting the trade into 2.

Enter 50 in the Take profit (yellow H1) box

and the result will be "Total Profit if Take Profit at 50 Would be 136 Pips"

You know from the result in A5 -"Profit to date totals 310 Pips" which is the total if all trades are allowed to run their course.

So half your deal with TP at 50 will give you 136 divided by 2 = 68

And half your deal with no Take profit level will be 310 divided by 2 = 155

This totals 155 + 68 = 223

Compared to 310 by allowing each trade to run.

I have other spreadsheets where I've downloaded price data, calculated the RSI for example and done a "what if" open a long trade when the RSI exceeds 50 and short if goes under 50. Almost invariably using too small a TP and SL is detrimental to your profits.

Greenfield,

I think that you are absolutely right. Taking profits at certain levels will most certainly have a psychological benefit for many traders.

If I remember correctly, you use the office suite from SUN ?

Can you open and edit excel spreadsheets ok? Any comparisons to Excel.

I've never managed to make a really nice chart using excel (that may be down to my limitations), your one looks great! 🙂

I think that you are absolutely right. Taking profits at certain levels will most certainly have a psychological benefit for many traders.

If I remember correctly, you use the office suite from SUN ?

Can you open and edit excel spreadsheets ok? Any comparisons to Excel.

I've never managed to make a really nice chart using excel (that may be down to my limitations), your one looks great! 🙂

greenfield

Member

- Messages

- 91

- Likes

- 1

Hello GumRai,

I'm no expert – it's a lot to do with trial and error. Yes, I use the SUN office suite. The 2 systems are very similar. I've put a chart on Sheet3. You'll need to amend it as data is added. Double click on chart, right click – Data Range – i.e. $A$42 will change to $A$43, and $R$42 to $R$43 (no need to change every time (it will get a little tedious) – whenever you feel like it). There may well be some way that it automatically updates, but I don't know how that may be done.

2.8747% in 1 month. I know there are people out there who claim to make a fortune every day, but I reckon that is quite impressive. If compounded every month for, say, 1 year, that would make quite a useful profit.

Bye,

Oh! - I added the chart using SUN; I've just opened up the chart in Excel and it looks a little odd. Back to the drawing board! Perhaps you can play around with it to improve it.

I'm no expert – it's a lot to do with trial and error. Yes, I use the SUN office suite. The 2 systems are very similar. I've put a chart on Sheet3. You'll need to amend it as data is added. Double click on chart, right click – Data Range – i.e. $A$42 will change to $A$43, and $R$42 to $R$43 (no need to change every time (it will get a little tedious) – whenever you feel like it). There may well be some way that it automatically updates, but I don't know how that may be done.

2.8747% in 1 month. I know there are people out there who claim to make a fortune every day, but I reckon that is quite impressive. If compounded every month for, say, 1 year, that would make quite a useful profit.

Bye,

Oh! - I added the chart using SUN; I've just opened up the chart in Excel and it looks a little odd. Back to the drawing board! Perhaps you can play around with it to improve it.

Last edited:

salvadorveiga

Active member

- Messages

- 228

- Likes

- 5

how about instead of having a TP fixed, which is not logical having a TP that is dynamic?

For this you would check the Average Daily Range... so if the average for the past 5 days were to be 180 pips maybe you'd want to get out at 25-50-75% of that number and then let the rest go its course??

But one week later, if ADR is at 90 pips, your TP instead of being 0.75*180 would be 0.75*90 pips.

Do you see my reasoning?

Just a suggestion that may be better... GBPJPY just keeps going great... this one for September alone so far +800 pips

For this you would check the Average Daily Range... so if the average for the past 5 days were to be 180 pips maybe you'd want to get out at 25-50-75% of that number and then let the rest go its course??

But one week later, if ADR is at 90 pips, your TP instead of being 0.75*180 would be 0.75*90 pips.

Do you see my reasoning?

Just a suggestion that may be better... GBPJPY just keeps going great... this one for September alone so far +800 pips

salvadorveiga

Active member

- Messages

- 228

- Likes

- 5

Hello forexkunta, GumRai, RuMouR et al.

I've noticed the same as you – that taking profits using the lower figures mentioned works against maximising profits. Just to recap (for anyone who has recently started following this thread) – we've been looking at variations of the Sniper suggestion to divide each trade into 5. I've been taking out 2 trades – 1 to exit when the system dictates, and the other a TP75. I've mentioned in some recent posts that the 2nd trade has a psychological element – making a gain on those trades where large gains evaporate to break even or sometimes even end up at a loss. But by using TP75 means making a small loss, albeit it small loss – compared with letting the trade run its course.

During the period since April 14, according to my figures, the average gain on all trades, letting them run their course, is 22 pts per day/18 pts per trade. The attached copy of a spreadsheet shows that TP75 results in an 18 pts per day gain. TP135 shows a gain of 28 pts per day – the most beneficial being TP165, TP170 and TP175. Though I'm not sure if I would be happy to enter a TP at 165. The principle behind this being a TP at a certain level could hold onto a gain that may evaporate – but at the same time this may mean closing a trade that could go on to make a gain of several hundred points. Bear in mind that during this period there have been 34 trades that have reached 175 pts, (9 closing above 175 pts).

Therefore, I've felt that a set TP trade is too mechanical/dogmatic, and at 75 results in a (comparative) loss, albeit a small one. So over the last week I have changed tactics. Now I take out 2 trades – 1 that runs its course as per Sniper rules, and 1 which I treat in a similar way to the way I do with equities, that is skim off profits as and when it seems appropriate (using S&R levels possibly).This should be in keeping with the realities of each individual trade.

As mentioned above, the figures I have trading Sniper for 5½ months/149 trades, work out at an average of 22 pts a day/18 pts a trade. I've put together an updated chart (attached) showing the points gained/lost since April.

Bye,

by the way, that chart is nice... what is it based on? Fixed lots? 2500 profits out of what?

Please indicate both the size of orders if they are fixed and the size account or if you don't want to disclose the size, put the y-axis in % gains 😉

Just a suggestion that may be better... GBPJPY just keeps going great... this one for September alone so far +800 pips

Did you take all trades? As I understand, most of profit was taken in the period 24-28 sept.? You didn't use any tp levels and let the trade run?

If not secret, what was the profit with gbp/usd?

greenfield

Member

- Messages

- 91

- Likes

- 1

how about instead of having a TP fixed, which is not logical having a TP that is dynamic?

For this you would check the Average Daily Range... so if the average for the past 5 days were to be 180 pips maybe you'd want to get out at 25-50-75% of that number and then let the rest go its course??

But one week later, if ADR is at 90 pips, your TP instead of being 0.75*180 would be 0.75*90 pips.

Do you see my reasoning?

Just a suggestion that may be better... GBPJPY just keeps going great... this one for September alone so far +800 pips

Hello salvadorveiga,

Sounds useful – will have a look. I agree with you about GBPJPY trades, although as I've only been trading this pair for 6 weeks, it's too early (for me) to say.

The chart shows the accumulated points gained/lost during the 5½ month period (GBPUSD 1HR). A chart of my main a/c wouldn't be of any use as there are numerous trades other than Sniper trades.

Hello GumRai,

2nd attempt! I've found a copy of Excel on an old PC. I think this chart on Sheet 3 looks better, though I can't find how to smooth lines on Excel. I really prefer the SUN open source system.

Bye,

Attachments

salvadorveiga

Active member

- Messages

- 228

- Likes

- 5

Hello salvadorveiga,

Sounds useful – will have a look. I agree with you about GBPJPY trades, although as I've only been trading this pair for 6 weeks, it's too early (for me) to say.

The chart shows the accumulated points gained/lost during the 5½ month period (GBPUSD 1HR). A chart of my main a/c wouldn't be of any use as there are numerous trades other than Sniper trades.

Hello GumRai,

2nd attempt! I've found a copy of Excel on an old PC. I think this chart on Sheet 3 looks better, though I can't find how to smooth lines on Excel. I really prefer the SUN open source system.

Bye,

oh ok so since you've started you've gained 2500 pips? That's a good amount... that's based on what you actually traded and your results or is it all trades issued from SF even the ones you didn't take?

I think the dynamic Target Profit may help those that use it be more profitable... because if stop is dynamic i wouldn't TP be as well? a 100 pip TP when the pair moves with an ADR of 200 pips makes no sense...

Amigo1, actually if i had taken ALL trades i would be up around 1800 pips but Ididn't take every single trade... bummer and no I don't use Target Profits... to me it doesn't make sense getting stopped out at 100% of your positions and scaling out of profits... that way are taking losses the full amount, and not getting profits the full amount which for me makes no sense

Hello GumRai,

2nd attempt! I've found a copy of Excel on an old PC. I think this chart on Sheet 3 looks better, though I can't find how to smooth lines on Excel. I really prefer the SUN open source system.

Hello Greenfield,

Doing charts certainly isn't easy 🙁

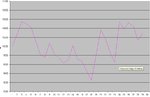

It's better if you have the balance at the end of each day, obviously some days there are more than 1 deal and that messes it up somewhat. I see that you changed the days to number of deals and I did the same in excel. This is what I ended up with. I'll only post the image as uploading the whole spreadsheet will be a big file.I don't know why our charts look different. Maybe because I have more tick points in mine?

EDIT, Actually now I see them posted side by side, I think that your chart only captures the last half of the month

Attachments

salvadorveiga

Active member

- Messages

- 228

- Likes

- 5

Hello Greenfield,

Doing charts certainly isn't easy 🙁

It's better if you have the balance at the end of each day, obviously some days there are more than 1 deal and that messes it up somewhat. I see that you changed the days to number of deals and I did the same in excel. This is what I ended up with. I'll only post the image as uploading the whole spreadsheet will be a big file.I don't know why our charts look different. Maybe because I have more tick points in mine?

EDIT, Actually now I see them posted side by side, I think that your chart only captures the last half of the month

is it open office the suite from SUN ? I really need to learn doing some graphs on those... definitly sweet for tracking equity curve

greenfield

Member

- Messages

- 91

- Likes

- 1

Hello GumRai,

I'm getting to dislike Windows Office in a big way! No problems with the SUN open source system though.

Hello salvadorveiga,

My aim has always been to try to replicate the results on the Sniper website. So I take every trade and stick to the Sniper rules (although, as we've discussed here, there are a few rules that we need to 'play by ear.'). At the beginning of this period I missed a handful of trades – I have tried to calculate these missed trades as accurately as possible and added to the data. I don't think I've missed a trade since about July. The idea is to see if this system actually works. I reckon it does.

Bye,

I'm getting to dislike Windows Office in a big way! No problems with the SUN open source system though.

Hello salvadorveiga,

My aim has always been to try to replicate the results on the Sniper website. So I take every trade and stick to the Sniper rules (although, as we've discussed here, there are a few rules that we need to 'play by ear.'). At the beginning of this period I missed a handful of trades – I have tried to calculate these missed trades as accurately as possible and added to the data. I don't think I've missed a trade since about July. The idea is to see if this system actually works. I reckon it does.

Bye,

salvadorveiga

Active member

- Messages

- 228

- Likes

- 5

thanks... from the data you have, do you have numbers regarding to biggest loser in pips, biggest winner in pips, average loser and average winner also in pips?

and how about winners %? in 149 trades how many were winners?

and how about winners %? in 149 trades how many were winners?

Hello GumRai,

I'm getting to dislike Windows Office in a big way! No problems with the SUN open source system though.

I've only ever used MS office, maybe I should download the SUN system and give it a go. I'm fairly comfortable with MS Office and sometimes it difficult to change from what you know. But bearing in mind that I use Office 20003, I'm obviously a bit reluctant to pay for the newer versions, especially if I can get something reasonably close for free ):

One thing that I do have a big problem with , and maybe you can help me.

When I'm using a function, I don't really like the result to be returned as zero. The reason being that I prefer blank cells to zeros. But often if I use "" as the result to indicate a zero result, other functions don't recognise it as a blank cell. When this happens, I have no choice but to alter the function so that it results in zero instead of "" and then use the conditional format on the range of cells so that zero appears in white ink on a white background. This is not ideal, but at least I don't get a lot of unnecessary zeros in my spreadsheet.

Any suggestions?

Maybe this is not a problem with OpenOffice?

Thanks for any advice that you can give. 🙂

greenfield

Member

- Messages

- 91

- Likes

- 1

Hello salvadorveiga,thanks... from the data you have, do you have numbers regarding to biggest loser in pips, biggest winner in pips, average loser and average winner also in pips?

and how about winners %? in 149 trades how many were winners?

So, from 121 days/149 trades, my data shows 22 pts per day/17.9 pts per trade.

Biggest single winner – 490 pts; biggest single loser – 112 pts.

Average winner – 96.9 pts; average loser – 56 pts.

Winners/losers – 72/77 or 48.3%/51.7%.

Biggest number of consecutive winners – 6 (= +682 pts); biggest number of consecutive losers – 6 (= -430 pts); though it's rare to have that number of winners/losers together.

I should point out that the figures I have are not as high as those on the Sniper website. I would be very interested to see data from anyone else using Sniper to see if the results I get are the norm.

Bye,

greenfield

Member

- Messages

- 91

- Likes

- 1

....................When I'm using a function, I don't really like the result to be returned as zero. The reason being that I prefer blank cells to zeros......................

Hello GumRai,

Yes, I've got lots of zeros too! I would love to be able to help out but I can't think of anyway better than your way of dealing with it. Perhaps there's someone out there who has been able to sort it.

Bye,

Similar threads

- Replies

- 25

- Views

- 9K

- Replies

- 0

- Views

- 2K

- Replies

- 52

- Views

- 13K