szt0495

Junior member

- Messages

- 14

- Likes

- 0

Kudos for your efforts, but how did you decide on your entry levels for this backtesting? Did you use the opening or close of the candle in your calculations?

You have to be aware that sniper gives many entry and exit signals that subsequently disappear. Because with backtesting, you don't know what signals have disappeared, you cannot have taken all the false signals.

Recently, we have had many stop signals, that have subsequently disappeared and so you cannot do accurate backtesting.

OK right now at the beginning of the candle on GBPUSD there is an entry to a long position at 1.5795 on 13th October 2 PM Alapri time, 1 PM UK time. If this position goes up, you will be able to see it when you look back in many months time. If it goes down, it will disappear forever. It makes backtesting with any accuracy impossible.

Hi!

I know that "testing" like this cant be accourate, but gives some guidelines about how to use the system.

For entry points, I did not wait for candle close, I used avarage 10-15 pips from the cross of the previous sniper stop levels. The manual also says that

"Do NOT wait until the end of the bar/candle to enter the trade,

enter precisley when all conditions have been met."

enter precisley when all conditions have been met."

And I also aware of that some signals used to go away when conditions change sharply, so yes, this "testing" can not be as accurate as I would like it to be. I'm trading it since a few weeks, and I did not see that much disappearing signals yet. The ones I saw were not gamechanger signals, just some false alarms, and false arrows, but these disappearing signals did not mach all the conditions anyway so I didn't take them. Of course this couldn't mean that there are no false "disappearing entry signals" in every month. (But if it would disappear after I entered, I think I would bailt out of those trades)

I think if someone is well experienced, and educated enough in forex anyways, should recognise a probable false signal.

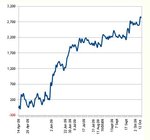

I traded demo account first, and took every possible signal on gbpjpy even when I knew that it would be pretty much a looser trade (and it was), and overall still made very good gains of profit. I'm not affraid to trade live now. And I take much more care about technicals and fundamentals this time, so I hope I'll do better than on demo.

Cheers