stoploss please

Established member

- Messages

- 780

- Likes

- 10

Yucky yucky

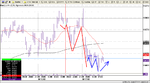

I have been trying to find this bottom all afternoon but every time I think I have got it, I get whipped out (academically). I need to keep counting those LHs and LLS.

Andy

Keep repeating to yourself, " A trend is in place until the weight of the evidence points otherwise". Or something like that.

Rossored,

Nice short but I thought you would hit it on the break of 3 and not 2. Tighter SL.

I have not had readybrek for ages. Do you still get that orange glow or is that Sunny Delight.

Lambchops

Thanks for the complement mate.

I have been trying to find this bottom all afternoon but every time I think I have got it, I get whipped out (academically). I need to keep counting those LHs and LLS.

Andy

Keep repeating to yourself, " A trend is in place until the weight of the evidence points otherwise". Or something like that.

Rossored,

Nice short but I thought you would hit it on the break of 3 and not 2. Tighter SL.

I have not had readybrek for ages. Do you still get that orange glow or is that Sunny Delight.

Lambchops

Thanks for the complement mate.