You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DashRiprock

Experienced member

- Messages

- 1,650

- Likes

- 482

sweeeet

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

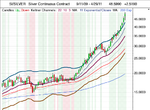

Attached is the three two years logarithmic charts from the last 10 years. The 2002 to 2004 move, the 2004 to 2006 move and the current chart.

The current move may be the biggest percentage wise but it looks very similar in style. Something to consider for the newbies to silver.

The current move may be the biggest percentage wise but it looks very similar in style. Something to consider for the newbies to silver.

Attachments

DashRiprock

Experienced member

- Messages

- 1,650

- Likes

- 482

close here

DashRiprock

Experienced member

- Messages

- 1,650

- Likes

- 482

id leave it now mate, the tradeable opportunity has gone. anything else is punting from graphs.

there were a couple of good shorter term trades to be had along the way as well 🙂

there were a couple of good shorter term trades to be had along the way as well 🙂

DashRiprock

Experienced member

- Messages

- 1,650

- Likes

- 482

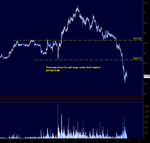

looks like stops then program selling to me, but im not listening to any news

amit1986

Experienced member

- Messages

- 1,100

- Likes

- 66

I agree - purely stops. I am watching SSRI right now (silver stock) and I can tell it's all stops being hit...a major area of support was broken on the daily chart. If you were watching the order flow, you should have seen the flurry of selling that came as it broke support.

DashRiprock

Experienced member

- Messages

- 1,650

- Likes

- 482

im just watching the futures charts with no tape or dom, but you can see where stops would have been and volume spikes from market orders coming in

amit1986

Experienced member

- Messages

- 1,100

- Likes

- 66

What stops? You mean they forced price up to trigger longs, only to sell into them and their stops are hit on the shoot down giving an extra kick to the move?

Makes me wonder if I should be trading real money if I don't know this.

It's obvious silver was going to be weak today - no doubt. Since it's been on an uptrend lately, there are going to a tonne of sellers looking to close their positions (either because they are in a long or because they need to sell in order to meet new margin rules). Thus, more sellers than buyers.

As it gapped down this morning, it started with a spike in selling pressure. Who was buying from all these sellers? The market maker was. Then at one point the market maker stopped buying and let all the short covering and speculative buying drive the price higher. Price actually started ticking up (contrary to what most traders believed would happen), forcing those who went short to cover (hence, buy) thereby adding more buying pressure. As the price was ticking higher, market maker was slowly liquidating his long position to all those buyers by appearing on the ask. By the time the market maker had sold all his contracts, there were no more buyers left. In come the sellers.

All those people who bought early in the day were now covering as silver fell to new lows. Check out the daily chart as well...especially for SSRI - it penetrated the 50-period EMA and SMA...inviting stops to be hit. A lot of people use those MAs as trailing stops.

DashRiprock

Experienced member

- Messages

- 1,650

- Likes

- 482

DashRiprock

Experienced member

- Messages

- 1,650

- Likes

- 482

Similar threads

- Replies

- 7

- Views

- 2K