Hi all,

100% automated

trading 18 futures markets

on 24hrs all week

multi time frame

multi-strategy

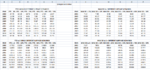

please view attached screendump of performance based on $100k minimum account size (for 18 market portfolio)

YEAR RISK REWARD RATIO

2002 3.47

2003 0.31

2004 2.47

2005 3.87

2006 2.48

2007 7.76

2008 12.82

2009 11.71

2010 12.50

2011 2.46

please note we only have actual trading track record from around Feb 2011. All previous ytd performance are back-tested hypothetical results, however, our actual trading results are in line with the back-tested past results showing robustness of the system.

looking forward to hearing your thoughts/queries etc.

cheers

100% automated

trading 18 futures markets

on 24hrs all week

multi time frame

multi-strategy

please view attached screendump of performance based on $100k minimum account size (for 18 market portfolio)

YEAR RISK REWARD RATIO

2002 3.47

2003 0.31

2004 2.47

2005 3.87

2006 2.48

2007 7.76

2008 12.82

2009 11.71

2010 12.50

2011 2.46

please note we only have actual trading track record from around Feb 2011. All previous ytd performance are back-tested hypothetical results, however, our actual trading results are in line with the back-tested past results showing robustness of the system.

looking forward to hearing your thoughts/queries etc.

cheers

Attachments

Last edited: