The first stage of learning is called "unconscious incompetence". A trader in this stage does not yet understand all the hard work that goes along with trading. What's worse is they may have scored a few big hits in these early stages without doing the work, which reinforces the idea that if they could only just get a little smarter in order to "know" what the market is going to do next, bang, they've made it as a trader.

Thus when a guy asks "where do you set your stop," it is an opportunity for the teacher to throw down a rope so the guy can pull himself out of the "unconscious incompetence" phase and progress to the "conscious incompetence" phase. Answering him with "what are the results of your testing" and "it all depends on how much you are willing to risk" does him no good, because he does not yet know how to test and he does not understand the unknowable, probabilistic nature of a trade outcome the moment it is opened. In fact, he most likely has tested stops before in the entirely wrong manner, using some entry that is no better than a random entry. The results of his test are most likely that he loses money pretty consistently no matter where he places his stop.

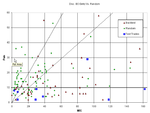

Stops are recurring question in this thread so I will answer it. There is a lot to it, but here are the basics. Once you decide on an entry method, mark down about 50 such entries in a spreadsheet : date, time, price, and side (long or short). Important: notice there is nothing about exits here at all. (That comes later.) Now you need some sort of metric to measure how good each entry is. For day trading, I like "Pain vs. MFE". Starting from your entry point, you find the best possible exit of the day. That is the "MFE". Then you mark down the maximum the trade moved against you in order to get to that point. That's the "Pain". Now you have two points associated with each entry, Pain and MFE. Plot these on a 2-D scatterplot, with MFE on the horizontal axis. You will see a bunch of really good entries that have a high MFE and low Pain. You can represent your initial stop with a horizontal line on this scatterplot. Wherever you draw that line (initial stop size), you gain access to all of the good trades below the line. It will be obvious to you that there is a certain point where you don't gain anything by moving this line up anymore. This place makes a mighty good initial stop. Now, here is a mindbender: you don't really ever want your trade to hit that initial stop. It is just for safety. But, that is another story for another day. Good luck!

Pete

Hi Sulong, here is once such scatterplot from a YM breakout methodology that is currently in the 1-lot test trade phase. There are a few more things on this plot than I first described. The main feature is a reference set of random entries over the same time period as the entries under study. You want to see a clear difference in the distributions, of course! Also, one purpose of the test trades is to make sure you are backtesting correctly (no cheating!!). They should fall in your backtested distribution. So far, so good!

p.s. I use Excel to do this

Thus when a guy asks "where do you set your stop," it is an opportunity for the teacher to throw down a rope so the guy can pull himself out of the "unconscious incompetence" phase and progress to the "conscious incompetence" phase. Answering him with "what are the results of your testing" and "it all depends on how much you are willing to risk" does him no good, because he does not yet know how to test and he does not understand the unknowable, probabilistic nature of a trade outcome the moment it is opened. In fact, he most likely has tested stops before in the entirely wrong manner, using some entry that is no better than a random entry. The results of his test are most likely that he loses money pretty consistently no matter where he places his stop.

Stops are recurring question in this thread so I will answer it. There is a lot to it, but here are the basics. Once you decide on an entry method, mark down about 50 such entries in a spreadsheet : date, time, price, and side (long or short). Important: notice there is nothing about exits here at all. (That comes later.) Now you need some sort of metric to measure how good each entry is. For day trading, I like "Pain vs. MFE". Starting from your entry point, you find the best possible exit of the day. That is the "MFE". Then you mark down the maximum the trade moved against you in order to get to that point. That's the "Pain". Now you have two points associated with each entry, Pain and MFE. Plot these on a 2-D scatterplot, with MFE on the horizontal axis. You will see a bunch of really good entries that have a high MFE and low Pain. You can represent your initial stop with a horizontal line on this scatterplot. Wherever you draw that line (initial stop size), you gain access to all of the good trades below the line. It will be obvious to you that there is a certain point where you don't gain anything by moving this line up anymore. This place makes a mighty good initial stop. Now, here is a mindbender: you don't really ever want your trade to hit that initial stop. It is just for safety. But, that is another story for another day. Good luck!

Pete

Hi Sulong, here is once such scatterplot from a YM breakout methodology that is currently in the 1-lot test trade phase. There are a few more things on this plot than I first described. The main feature is a reference set of random entries over the same time period as the entries under study. You want to see a clear difference in the distributions, of course! Also, one purpose of the test trades is to make sure you are backtesting correctly (no cheating!!). They should fall in your backtested distribution. So far, so good!

p.s. I use Excel to do this

Attachments

Last edited by a moderator: