You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

S&P 500 cash weekly competition for 2016 with PRIZES!

- Thread starter postman

- Start date

- Watchers 24

P

postman

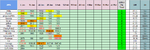

A 3 way tie for first place after 5 weeks.

Atilla, pat494 and pingpong1965 (leapfrogging to the top of the table).

Next week see's the halfway point.

https://docs.google.com/spreadsheet...i-Nn8trkqGik92wtcL28S1FI4/edit#gid=1460846430

Atilla, pat494 and pingpong1965 (leapfrogging to the top of the table).

Next week see's the halfway point.

https://docs.google.com/spreadsheet...i-Nn8trkqGik92wtcL28S1FI4/edit#gid=1460846430

Attachments

P

postman

Attachments

pingpong1965

Well-known member

- Messages

- 301

- Likes

- 23

Postie, Jeffre4 has pm'd me asking can he have a target of 1963 please (spelt correctly !!), as he's away on holiday, cheers

P

postman

Postie, Jeffre4 has pm'd me asking can he have a target of 1963 please (spelt correctly !!), as he's away on holiday, cheers

OK. He could have PM'd me I dont bite, much. 🙂

P

postman

I'm 1952 this week.

only 94 points away!

only 94 points away!

samspade79

Established member

- Messages

- 576

- Likes

- 25

1798

pingpong1965

Well-known member

- Messages

- 301

- Likes

- 23

OK. He could have PM'd me I dont bite, much. 🙂

I could have mentioned the PM was actually done by Whatsapp (saying PM sounded better and easier to type than whatsapp), im sure if he'd have had your number he would have contacted you directly. :innocent:👍

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

The S&P dropped off again yesterday, off the back of further risk off sentiment. We could potentially see a double bottom here with the 20th of January low, however more than likely we'll break the 1810 level sooner rather than later. With all this risk off sentiment and doom and gloom going on regarding a U.S Recession, and from looking at the chart, it looks like we just saw a nice healthy retracement before turning back down and moving lower. If we can break 1800 and close on a weekly chart below, expect 1720 before long.

P

postman

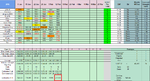

This has to be one for the record books!

Whilst there is an unremarkable 10 Bulls and 5 Bears, the range this week is a staggering 213 points between the high and the low guess. These arent just one off's I'm the 2nd biggest bull with jeffre4 just above me on 1952 and 1963 then we have f2calv and twintowin at the other end with 1778 and 1750. There is a fair spread of guesses all the way between those levels.

Just goes to show how unpredictable (wild, volatile, irrational, stupid) the markets are at the moment!

I was knackered by Thursday morning last week its only Tuesday and I feel a migraine coming on. Volatility, be careful what you wish for you might just get it.

https://docs.google.com/spreadsheet...i-Nn8trkqGik92wtcL28S1FI4/edit#gid=1460846430

Whilst there is an unremarkable 10 Bulls and 5 Bears, the range this week is a staggering 213 points between the high and the low guess. These arent just one off's I'm the 2nd biggest bull with jeffre4 just above me on 1952 and 1963 then we have f2calv and twintowin at the other end with 1778 and 1750. There is a fair spread of guesses all the way between those levels.

Just goes to show how unpredictable (wild, volatile, irrational, stupid) the markets are at the moment!

I was knackered by Thursday morning last week its only Tuesday and I feel a migraine coming on. Volatility, be careful what you wish for you might just get it.

https://docs.google.com/spreadsheet...i-Nn8trkqGik92wtcL28S1FI4/edit#gid=1460846430

Attachments

😱 😱 😱

OK so i meant monthly 50 EMA...

P

postman

The S&P managed to surprise people again!

We collectively had the largest range of all time (213) and the S&P moved in the smallest range all year (54.68).

That means the top guns this week are:

Pat494 with his second Gold of the year.

WackyPete2 with his second Silver of the year.

And Samspade79 with his second Bronze of the year.

:clap: :clap: :clap:

We collectively had the largest range of all time (213) and the S&P moved in the smallest range all year (54.68).

That means the top guns this week are:

Pat494 with his second Gold of the year.

WackyPete2 with his second Silver of the year.

And Samspade79 with his second Bronze of the year.

:clap: :clap: :clap:

Attachments

P

postman

P

postman

We now have Pat494 on top of the leaderboard on 10 points which puts him 5 points ahead of joint 2nd place pingpong1965, Atilla and f2calv.

https://docs.google.com/spreadsheet...i-Nn8trkqGik92wtcL28S1FI4/edit#gid=1460846430

https://docs.google.com/spreadsheet...i-Nn8trkqGik92wtcL28S1FI4/edit#gid=1460846430

Attachments

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

They bounce back after terrorist attacks, pick themselves up after earthquakes and cope with pandemics such as Zika. They can even handle years of economic uncertainty, stagnant wages and sky-high unemployment. But no developed nation today could possibly tolerate another wholesale banking crisis and proper, blood and guts recession.

We are too fragile, fiscally as well as psychologically. Our economies, cultures and polities are still paying a heavy price for the Great Recession; another collapse, especially were it to be accompanied by a fresh banking bailout by the taxpayer, would trigger a cataclysmic, uncontrollable backlash.

The public, whose faith in elites and the private sector was rattled after 2007-09, would simply not wear it. Its anger would be so explosive, so-all encompassing that it would threaten the very survival of free trade, of globalisation and of the market-based economy. There would be calls for wage and price controls, punitive, ultra-progressive taxes, a war on the City and arbitrary jail sentences.

For fear of allowing extremist or populist parties through the door, mainstream politicians would end up adopting much of this agenda, with devastating implications for our long-term prosperity. Central banks, in desperation, would embrace the purest form of money-printing: they would start giving consumers actual cash to spend, temporarily turbo-charging demand while destroying any remaining respect for the idea that money needs to be earned.

---------------------------------------------------------------------------------------------

Could be just journalist's ramping up the fear ?

We are too fragile, fiscally as well as psychologically. Our economies, cultures and polities are still paying a heavy price for the Great Recession; another collapse, especially were it to be accompanied by a fresh banking bailout by the taxpayer, would trigger a cataclysmic, uncontrollable backlash.

The public, whose faith in elites and the private sector was rattled after 2007-09, would simply not wear it. Its anger would be so explosive, so-all encompassing that it would threaten the very survival of free trade, of globalisation and of the market-based economy. There would be calls for wage and price controls, punitive, ultra-progressive taxes, a war on the City and arbitrary jail sentences.

For fear of allowing extremist or populist parties through the door, mainstream politicians would end up adopting much of this agenda, with devastating implications for our long-term prosperity. Central banks, in desperation, would embrace the purest form of money-printing: they would start giving consumers actual cash to spend, temporarily turbo-charging demand while destroying any remaining respect for the idea that money needs to be earned.

---------------------------------------------------------------------------------------------

Could be just journalist's ramping up the fear ?

Similar threads

- Replies

- 1K

- Views

- 185K

- Replies

- 989

- Views

- 134K

- Replies

- 2K

- Views

- 240K

- Replies

- 908

- Views

- 133K