You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

S&P 500 cash weekly competition for 2016 with PRIZES!

- Thread starter postman

- Start date

- Watchers 24

Atilla

Legendary member

- Messages

- 21,038

- Likes

- 4,209

This should help keep him warm...

👍

Spiced Irish Coffee

Print

Prep time

10 mins

Total time

10 mins

Recipe

Serves: 2

Ingredients:

For the pumpkin spice whipped cream:

½ cup heavy cream

1½ teaspoons sugar

1 teaspoon pumpkin spice

For the Irish coffee:

1½ cups freshly brewed hot coffee

1 tablespoon sugar

4 tablespoons whiskey

Instructions:

For the pumpkin spice whipped cream:

Whip all ingredients to stiff peaks.

For the Irish coffee:

Divide all ingredients between two glasses.

Pipe the whipped cream onto each drink.

Sprinkle with pumpkin spice.

👍

Spiced Irish Coffee

Prep time

10 mins

Total time

10 mins

Recipe

Serves: 2

Ingredients:

For the pumpkin spice whipped cream:

½ cup heavy cream

1½ teaspoons sugar

1 teaspoon pumpkin spice

For the Irish coffee:

1½ cups freshly brewed hot coffee

1 tablespoon sugar

4 tablespoons whiskey

Instructions:

For the pumpkin spice whipped cream:

Whip all ingredients to stiff peaks.

For the Irish coffee:

Divide all ingredients between two glasses.

Pipe the whipped cream onto each drink.

Sprinkle with pumpkin spice.

samspade79

Established member

- Messages

- 576

- Likes

- 25

1862

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

Let's hope Pete is keeping warm in the snowstorm.

OK here. The brunt of the storm was inland.🙂

Peter

pingpong1965

Well-known member

- Messages

- 301

- Likes

- 23

1950 please

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

1850 🙂

Peter

Peter

P

postman

I'm going with 1858 this week.

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

Well, what a week. Finally towards the end of last week the markets found some support. Now we're in that tricky phase of deciding whether to stick with this year's bearish trend or get back on the side of the bulls, hoping we have a bottom in place and that January's sell off was just another retracement in this long term bull market.

Personally I am on the fence at the moment and would like to see more confirmation of further monetary stimulus from the ECB, PBoC and BoJ before making a call. In saying that it does look as though there is greater value on the downside, especially when taking into consideration the global market sentiment at the moment.

Lets take a look now at some of the key data releases last week. The big event was of course the ECB meeting, which only happens every six weeks. Although Draghi and the ECB decided not to take any action at this meeting, his dovish comments regarding further stimulus in March supplied the support needed to finally turn the market around. In reality he didn't mention anything new, however the markets took it as reinforcing the "bad news is good news" theme and so went bid.

Personally I am on the fence at the moment and would like to see more confirmation of further monetary stimulus from the ECB, PBoC and BoJ before making a call. In saying that it does look as though there is greater value on the downside, especially when taking into consideration the global market sentiment at the moment.

Lets take a look now at some of the key data releases last week. The big event was of course the ECB meeting, which only happens every six weeks. Although Draghi and the ECB decided not to take any action at this meeting, his dovish comments regarding further stimulus in March supplied the support needed to finally turn the market around. In reality he didn't mention anything new, however the markets took it as reinforcing the "bad news is good news" theme and so went bid.

P

postman

P

postman

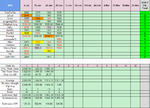

Heres week 4's entries, another week with a huge range, 126 points.

TwinToWin with the highest forecast at 1976 and WackyPete at the opposite end with 1850.

9 Bulls and 4 Bears, with both averages bullish this week.

Samspade79 rejoins us this week and is already above me in the league table. 😱

Asian markets in turmoil again and oil on everyone's lips (errr 🤢). Today could be a turning point, looks like the bulls are throwing everything at it including the kitchen sink right at this moment.

Interesting times. :clover:

TwinToWin with the highest forecast at 1976 and WackyPete at the opposite end with 1850.

9 Bulls and 4 Bears, with both averages bullish this week.

Samspade79 rejoins us this week and is already above me in the league table. 😱

Asian markets in turmoil again and oil on everyone's lips (errr 🤢). Today could be a turning point, looks like the bulls are throwing everything at it including the kitchen sink right at this moment.

Interesting times. :clover:

Attachments

P

postman

This weeks result seemed to be no surprise to some people.

Considering the volatility we've had the top three couldn't have been closer.

Here's a three finger salute to the winners.

Atilla gets the middle finger ... and Gold.

NickBk seems happy with his Silver index.

Weighted average has a bronze ring.

2,3 and 4 points off the close respectively, has it ever been closer?

Even 4th place (Lexcorp) was 5 points off the close.

Amazing result guys. 😎

https://docs.google.com/spreadsheet...i-Nn8trkqGik92wtcL28S1FI4/edit#gid=1460846430

Considering the volatility we've had the top three couldn't have been closer.

Here's a three finger salute to the winners.

Atilla gets the middle finger ... and Gold.

NickBk seems happy with his Silver index.

Weighted average has a bronze ring.

2,3 and 4 points off the close respectively, has it ever been closer?

Even 4th place (Lexcorp) was 5 points off the close.

Amazing result guys. 😎

https://docs.google.com/spreadsheet...i-Nn8trkqGik92wtcL28S1FI4/edit#gid=1460846430

Attachments

Similar threads

- Replies

- 1K

- Views

- 185K

- Replies

- 989

- Views

- 134K

- Replies

- 2K

- Views

- 240K

- Replies

- 908

- Views

- 133K