American Express: A strong stock from an outperforming Sector

As of October 8, the best performing sectors in the US Stock Market are the Energy and the Financial Sectors.

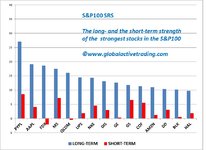

See the long- and the short-term momentum of all 11 US Sectors, plus the SPY for comparison.

Although both the long- and the short-term momentum of the Energy Sector are bigger, let’s try to find stocks from the Financial Sector, as there is more potential for profit to them.

As we can see in the chart below, the Financial Sector ETF has just broken above the resistance line at 39. Price itself started moving above its 10- 20- and 50-day moving averages, another sign of a bullish trend.

Apart from that, XLF’s PPO moved to positive territory, as it moved above its Signal Line.

In addition to the above, XLF’s Relative Strength is moving up and above its 20-day moving average. The same is true of XLF’s Money Flow Index.

I chose the AXP - American Express Co. as an example of a Large Cap promising stock belonging to the Financial Sector.

Below is the daily chart of AXP.

Although the stock is still trying to break above the resistance line at 176, it’s currently moving above its rising 10- 20- and 50-day moving averages, and along the upper Bollinger Band.

This build-up of momentum is evident in PPO, which is moving in positive territory.

In addition, the stock’s MFI is moving up and above its rising 20-day moving average, a sign that money is flowing into the stock.

Finally, the stock’s Relative Strength is moving up and above its rising 20-day moving average, which of course means that the stock outperforms our benchmark, which is the SPY.

Let’s have a look at the stock’s weekly chart to get a longer-term view of its behavior.

In the weekly chart, we see that the stock found support on the 10- and 20-week moving averages, before moving up.

This bullish momentum has started showing up in the PPO Histogram, which has started moving up toward zero.

Furthermore, the stock’s Relative Strength on the weekly chart has moved up and above its 20-week moving average.

Finally, let’s calculate our Stop Loss and the Size of our position.

We suppose that our capital is USD 100000 and we don’t want to lose more than 1% or our capital in any trade.

That is, our risk tolerance is USD 1000 (100000*1%) per trade.

We decide to buy AXP at 176 and sell the stock when it falls below 171. So, our risk per stock is USD 5 (176-171).

If we divide the total risk, USD 1000, by the risk per stock, USD 5, we find that we should buy 200 shares (1000:5=200).

Let’s sum up:

Buy at USD 176

Sell at USD 171 (this is our first Stop Loss, in case the stock moves lower)

We buy 200 shares to limit our total loss to USD 1000.

Our approach tries to combine:

- Technical Analysis

- Relative Strength

- Multiple Time Frame Analysis

- Sound Money Management

Any comments are welcome!