supremegizmo

Active member

- Messages

- 219

- Likes

- 86

How technical can you get boys?

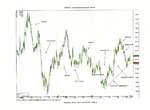

this is my analysis of pound on 4 hour since feb 09 .. have alook at it , its a head and shoulder play .. and if you wanna position trade that head and shoulder provided the left shoulder and head is in place hit the market at the middle of head ( of 50% fib of the head and neckline ) for a potential h&s play..

obviously this move is for big position traders who can afford wide stops ..

so if you did this for the month of feb .. with only a 100 pip stop .. you did not get stop out!!!1

tell me traders what you fink about it as i put it for education purposes..😴

this is my analysis of pound on 4 hour since feb 09 .. have alook at it , its a head and shoulder play .. and if you wanna position trade that head and shoulder provided the left shoulder and head is in place hit the market at the middle of head ( of 50% fib of the head and neckline ) for a potential h&s play..

obviously this move is for big position traders who can afford wide stops ..

so if you did this for the month of feb .. with only a 100 pip stop .. you did not get stop out!!!1

tell me traders what you fink about it as i put it for education purposes..😴