isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Canto your stop loss was hit for Dixons at 17.

Here's the closing trade details:

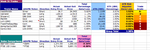

Closing Trade

Dixons Retail (LSE DXNS)

Direction: Short

Entry: 16

Exit: 17

Percentage loss: -5.88%

ATR Adjusted Percentage loss: -1.00%

Trade Grade: E

Unlucky Canto, this one had a big reversal today :-0

Here's the closing trade details:

Closing Trade

Dixons Retail (LSE DXNS)

Direction: Short

Entry: 16

Exit: 17

Percentage loss: -5.88%

ATR Adjusted Percentage loss: -1.00%

Trade Grade: E

Unlucky Canto, this one had a big reversal today :-0