You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

exit

I decided to exit this as Palladium is at a short term support level and gold looks like it's going to bounce here. So want to get a win on the board after being down the last few weeks.

My exit time on the thread was 11.28am. So here's the closing trade:

Closing Trade

Palladium (June Contract)

Direction: Short

Entry: 733

Exit: 701.92

Percentage Gain: 4.43%

ATR Adjusted Percentage Gain: 1.91%

Trade Grade: A-

As I said previously, my longer term view is that this is going much lower yet so have moved my stop to break even in my real account and will let it run to see what I get.

Attachments

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Isa, I sold my real holding early today for a modest profit. Interesting to see where commodities etc go from here. Hanging on to CW. for the moment in the hope of some positive news..

Sods law it'll probably go up now. But who knows. One thing I think that is certain is more volatility in the commodities for a while.

TradeTheEasyWay

Well-known member

- Messages

- 478

- Likes

- 4

Inflation data tomorrow in the US. That could put a fire under the US$ if that is better than expected so trading light tomorrow till that is out.

Oil is really volatile at the moment - traded it down to the daily 200 at 95 and up to 100 so a great day. This is what oil was like back in the good old days of 06/08.

Mike

Oil is really volatile at the moment - traded it down to the daily 200 at 95 and up to 100 so a great day. This is what oil was like back in the good old days of 06/08.

Mike

tradeAweek

Member

- Messages

- 52

- Likes

- 0

Exit AUDUSD short.

1.0664 on my platform.

1.0664 on my platform.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Exit AUDUSD short.

1.0664 on my platform.

Thanks tradeAweek. I have 1.0665 on ADVFN for the 12.19am close, but it went well above you entry target so happy to use your price as it's so close. So here's you closing trade details:

Closing Trade

AUDUSD (FX:AUDUSD)

Direction: Short

Entry: 1.0820

Exit: 1.0664

Points Gain: 156

ATR Adjusted Percentage Gain: 1.65%

Trade Grade: A-

Well done tradeAweek a really good first trade in the group. Keep it up 👍

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Exit CW.

Thanks Canto. Your exit time was 4.22pm so the closing price for CW.L was 53. Here's the closing trade details:

Closing Trade

Cable and Wireless (LSE:CW.)

Direction: Long

Entry: 49.48

Exit: 53

Percentage Gain: 7.11%

ATR Adjusted Percentage Gain: 1.56%

Trade Grade: A-

Well done Canto, a really good trade 👍

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Hi Wig, the UK market is closed for the week so your Derwent London short has been exited at the close price of 1750. Here's your closing trade details:

Closing Trade

Derwent London (LSE DLN)

Direction: Long

Entry: 1722

Exit: 1750

Percentage Loss: -1.60%

ATR Adjusted Percentage Loss: -0.83%

Trade Grade: E

Unlucky on this one wig. It just didn't want to go down this week.

Closing Trade

Derwent London (LSE DLN)

Direction: Long

Entry: 1722

Exit: 1750

Percentage Loss: -1.60%

ATR Adjusted Percentage Loss: -0.83%

Trade Grade: E

Unlucky on this one wig. It just didn't want to go down this week.

Last edited:

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Hi CityTrader90, your USDCAD short has just stopped out at 0.9720, so here's the closing trade details:

Closing Trade

USDCAD (FX:USDCAD)

Direction: Short

Entry: 0.9664

Exit: 0.9720

Points Loss: 56

ATR Adjusted Percentage Loss: -0.81%

Trade Grade: E

This ones been on a tear today. Ok, so that's everyones positions closed now for the week so I'll do the results later 👍

Closing Trade

USDCAD (FX:USDCAD)

Direction: Short

Entry: 0.9664

Exit: 0.9720

Points Loss: 56

ATR Adjusted Percentage Loss: -0.81%

Trade Grade: E

This ones been on a tear today. Ok, so that's everyones positions closed now for the week so I'll do the results later 👍

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

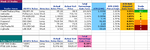

Week 15 Results

Wow, what a week it's been. Some great trades this week and the best overall group performance since we started. I personally had my best weeks trading for years shorting gold a few times and palladium as well. It could have been better as well as a few people had trades over 2% ATR adjusted at certain points of the week but let them ride a little too long.

Congratulations to Mike (TradeTheEasyWay) for a massive 3.55% ATR adjusted gain in Silver early in the week, which is the best trade anyone's done so far. :smart:

Below is this weeks results. I'll post the Q2 results in a separate post.

Name______ATR Adjusted Percentage

TradeTheEasyWay____3.55%

isatrader___________1.91%

tradeAweek_________1.65%

Canto1922_________1.56%

SlipperyC__________0.99%

Pat494____________0.77%

CityTrader90_______-0.81%

wigtrade__________-0.83%

Attached is the results spreadsheet

Wow, what a week it's been. Some great trades this week and the best overall group performance since we started. I personally had my best weeks trading for years shorting gold a few times and palladium as well. It could have been better as well as a few people had trades over 2% ATR adjusted at certain points of the week but let them ride a little too long.

Congratulations to Mike (TradeTheEasyWay) for a massive 3.55% ATR adjusted gain in Silver early in the week, which is the best trade anyone's done so far. :smart:

Below is this weeks results. I'll post the Q2 results in a separate post.

Name______ATR Adjusted Percentage

TradeTheEasyWay____3.55%

isatrader___________1.91%

tradeAweek_________1.65%

Canto1922_________1.56%

SlipperyC__________0.99%

Pat494____________0.77%

CityTrader90_______-0.81%

wigtrade__________-0.83%

Attached is the results spreadsheet

Attachments

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Q2 League Table

Name_____ATR Adjusted Percentage

dmt257___________3.00%

Pat494____________2.60%

tradeAweek________1.65%

SlipperyC__________1.52%

TradeTheEasyWay___0.68%

Canto1922_________0.51%

isatrader__________0.45%

CityTrader90_______0.03%

A_fr_____________-0.04%

wigtrade_________-3.20%

Name______Performance Points

Pat494_____________3

dmt257____________2

TradeTheEasyWay____1

Above is the current league table and performance points for Q2 so far, but the table doesn't tell the whole story as some members haven't traded every week. Pat is the most consistent performer so far this quarter trading every week and has put in 5 wins and only 1 losing week, and 3 of those weeks were the winning weekly performance. So well done Pat, it's great work. 👍

Well done to everyone else though as well. Keep it up

Name_____ATR Adjusted Percentage

dmt257___________3.00%

Pat494____________2.60%

tradeAweek________1.65%

SlipperyC__________1.52%

TradeTheEasyWay___0.68%

Canto1922_________0.51%

isatrader__________0.45%

CityTrader90_______0.03%

A_fr_____________-0.04%

wigtrade_________-3.20%

Name______Performance Points

Pat494_____________3

dmt257____________2

TradeTheEasyWay____1

Above is the current league table and performance points for Q2 so far, but the table doesn't tell the whole story as some members haven't traded every week. Pat is the most consistent performer so far this quarter trading every week and has put in 5 wins and only 1 losing week, and 3 of those weeks were the winning weekly performance. So well done Pat, it's great work. 👍

Well done to everyone else though as well. Keep it up

Attachments

tradeAweek

Member

- Messages

- 52

- Likes

- 0

Thanks again for all the work in creating the charts and stats isa.

Tricky one this week for the DAX.

S&P, DAX etc seem to be testing support severely. Part of me says that with overall negative sentiment the support is gonna give way.

But, for better or worse I'm going with the support of the Fed/Uncle Bernanke and my trade will be;

LIMIT DAX LONG

Entry; 7350

Stop; 7245

Target; 7600

Tricky one this week for the DAX.

S&P, DAX etc seem to be testing support severely. Part of me says that with overall negative sentiment the support is gonna give way.

But, for better or worse I'm going with the support of the Fed/Uncle Bernanke and my trade will be;

LIMIT DAX LONG

Entry; 7350

Stop; 7245

Target; 7600

CityTrader90

Junior member

- Messages

- 15

- Likes

- 1

Damn my last trade was looking pretty solid for a while and then it just disappeared! 😀

I'll have my pick up soon for next week. Happy trading e1.

Edit - I should have managed my trade better though and moved my S/L but oh well!

I'll have my pick up soon for next week. Happy trading e1.

Edit - I should have managed my trade better though and moved my S/L but oh well!

Last edited:

CityTrader90

Junior member

- Messages

- 15

- Likes

- 1

EUR/CHF Short

Entry Market

SL - 1.27010

Target - 1.24444

Entry Market

SL - 1.27010

Target - 1.24444

Similar threads

- Replies

- 3

- Views

- 3K

- Replies

- 44

- Views

- 13K

- Replies

- 3

- Views

- 2K