You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Positions Update

Evening everyone. A choppy day in the markets. I would imagine it's due to fund managers etc repositioning today for the next quarter, but that's just me speculating.

Tomorrow is the final day of this weeks competition and wigtrade leads currently. It is also the end of the 1st quarters competition. So it's very close between TradeTheEasyWay and chilltrader at the top of the league for the first title at the moment. There is only 0.06% between them currently, so we'll see who gets it tomorrow.

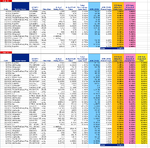

Here's the updated positions spreadsheet as of 6pm tonight.

Evening everyone. A choppy day in the markets. I would imagine it's due to fund managers etc repositioning today for the next quarter, but that's just me speculating.

Tomorrow is the final day of this weeks competition and wigtrade leads currently. It is also the end of the 1st quarters competition. So it's very close between TradeTheEasyWay and chilltrader at the top of the league for the first title at the moment. There is only 0.06% between them currently, so we'll see who gets it tomorrow.

Here's the updated positions spreadsheet as of 6pm tonight.

Attachments

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Here's a reminder of league table for tomorrows final day of the first quarters competition.

League Table

Name_________ATR Adjusted Percentage

chilltrader__________4.56%

TradeTheEasyWay____4.07%

isatrader___________1.86%

Black Swan_________1.83%

tar________________0.01%

Pat494____________-0.85%

wigtrade___________-1.88%

SlipperyC__________-1.97%

You'll need to add or minus the open positions to see what it is now.

League Table

Name_________ATR Adjusted Percentage

chilltrader__________4.56%

TradeTheEasyWay____4.07%

isatrader___________1.86%

Black Swan_________1.83%

tar________________0.01%

Pat494____________-0.85%

wigtrade___________-1.88%

SlipperyC__________-1.97%

You'll need to add or minus the open positions to see what it is now.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

My closing time was 8.07am GMT on the thread, so 9.07am BST and the closing price was 1564.5

Closing Trade

BG Group (LSE:BG.)

Direction: Long

Entry: 1540.5

Exit: 1564.5

Percentage Gain: 1.56%

ATR Adjusted Percentage Gain: 0.76%

I'm out for the rest of the day, so I will update anyone changes today when I get back tonight. Have a good day everyone 👍

Closing Trade

BG Group (LSE:BG.)

Direction: Long

Entry: 1540.5

Exit: 1564.5

Percentage Gain: 1.56%

ATR Adjusted Percentage Gain: 0.76%

I'm out for the rest of the day, so I will update anyone changes today when I get back tonight. Have a good day everyone 👍

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

SlipperyC you are out of your DAX trade. Your stop loss of 7130 was breached at 1330pm.

Closing Trade

DAX Index (DBI DAX)

Direction: Short

Entry: 6895.09

Exit: 7130

Percentage Loss: -3.29%

ATR Adjusted Percentage Loss: -2.41%

Unlucky SlipperyC. This one has just had too much strength this week.

Closing Trade

DAX Index (DBI DAX)

Direction: Short

Entry: 6895.09

Exit: 7130

Percentage Loss: -3.29%

ATR Adjusted Percentage Loss: -2.41%

Unlucky SlipperyC. This one has just had too much strength this week.

TradeTheEasyWay

Well-known member

- Messages

- 478

- Likes

- 4

AUDCAD - I hung on for a good finish to the week but it's over. A small loss.

Both these pairs turned out to be very strong players this week so I got trapped. The eurjpy I traded however just hit my target - major resistance.

Well done everyone and I will try be back for some more on Sunday.

Strange day with gpbusd diving below 1.60 and running up to 1.61+

Carzy

Mike

Both these pairs turned out to be very strong players this week so I got trapped. The eurjpy I traded however just hit my target - major resistance.

Well done everyone and I will try be back for some more on Sunday.

Strange day with gpbusd diving below 1.60 and running up to 1.61+

Carzy

Mike

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Well done to Pat494 who takes the final weekly win of the 1st quarter with his trade in SN.L. This is Pats third win in the 9 weeks since the start of the competition. :clap:

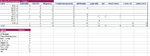

Week 9 Results

Name_________ATR Adjusted Percentage

Pat494___________0.81%

isatrader__________0.76%

TradeTheEasyWay__-0.16%

Canto1922_______-0.37%

wigtrade_________-0.79%

chilltrader________-0.98%

TraderJW_________-1.98%

SlipperyC_________-2.41%

I have the results of the whole quarter and will announce the first winner tomorrow. But you can work it out for yourself quite easily if you can't be bothered to wait for the table.

Week 9 Results

Name_________ATR Adjusted Percentage

Pat494___________0.81%

isatrader__________0.76%

TradeTheEasyWay__-0.16%

Canto1922_______-0.37%

wigtrade_________-0.79%

chilltrader________-0.98%

TraderJW_________-1.98%

SlipperyC_________-2.41%

I have the results of the whole quarter and will announce the first winner tomorrow. But you can work it out for yourself quite easily if you can't be bothered to wait for the table.

Attachments

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

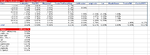

Q1 Results

I want to say to thank you to everyone that has taken part in this friendly competition thread so far. I've learnt a lot these last few months from my own trades and studying the trades of other people in the thread in real time. Performance has been good in general and I hope the people that have had a negative quarter will continue next quarter as everyone will be starting from 0% again.

Before I do the league tables here's some trades stats for the whole group.

Average Win____0.87%

Average Loss___1.15%

WinLoss Ratio___0.76

No. Wins_____32____55.17%

No. Loses____22____37.93%

Break even____4____6.90%

Here are the results of the first quarters competition. Congratulations to Mike (TradeTheEasyWay) for being the quarterly percentage winner. :clap: and we have joint winners on the points scale between Pat494 and chilltrader, so well done to both :clap:

Q1 Results

Name_________ATR Adjusted Percentage

TradeTheEasyWay____3.91%

chilltrader__________3.58%

isatrader___________2.62%

Black Swan_________1.83%

tar________________0.01%

Pat494____________-0.04%

Canto1922_________-0.37%

TraderJW__________-1.98%

wigtrade__________-2.67%

SlipperyC__________-4.38%

Name_________Points

Pat494_____________6

chilltrader__________6

TradeTheEasyWay____5

Black Swan_________4

isatrader___________4

SlipperyC__________0

Canto1922________-1

TraderJW_________-1

wigtrade_________-2

tar______________-2

The points system is getting an overhaul for the next quarter to only show performance points as it is flawed currently. This will simplify it as it only be a single point for each weeks winner and nothing else.

Don't forget to get your picks in as usual by the end of the weekend. 👍

Attached is the full trades sheet and the complete league tables.

I want to say to thank you to everyone that has taken part in this friendly competition thread so far. I've learnt a lot these last few months from my own trades and studying the trades of other people in the thread in real time. Performance has been good in general and I hope the people that have had a negative quarter will continue next quarter as everyone will be starting from 0% again.

Before I do the league tables here's some trades stats for the whole group.

Average Win____0.87%

Average Loss___1.15%

WinLoss Ratio___0.76

No. Wins_____32____55.17%

No. Loses____22____37.93%

Break even____4____6.90%

Here are the results of the first quarters competition. Congratulations to Mike (TradeTheEasyWay) for being the quarterly percentage winner. :clap: and we have joint winners on the points scale between Pat494 and chilltrader, so well done to both :clap:

Q1 Results

Name_________ATR Adjusted Percentage

TradeTheEasyWay____3.91%

chilltrader__________3.58%

isatrader___________2.62%

Black Swan_________1.83%

tar________________0.01%

Pat494____________-0.04%

Canto1922_________-0.37%

TraderJW__________-1.98%

wigtrade__________-2.67%

SlipperyC__________-4.38%

Name_________Points

Pat494_____________6

chilltrader__________6

TradeTheEasyWay____5

Black Swan_________4

isatrader___________4

SlipperyC__________0

Canto1922________-1

TraderJW_________-1

wigtrade_________-2

tar______________-2

The points system is getting an overhaul for the next quarter to only show performance points as it is flawed currently. This will simplify it as it only be a single point for each weeks winner and nothing else.

Don't forget to get your picks in as usual by the end of the weekend. 👍

Attached is the full trades sheet and the complete league tables.

Attachments

wigtrade

Junior member

- Messages

- 47

- Likes

- 3

isa many thanks for maintaining what is becoming a lively and interesting thread, I'm enjoying the competition and particularly the mix of styles evident - and for the record speaking as Q1 relegation fodder, my lowly league position this quarter will only strengthen my resolve for a run at the Q2 season afresh!! 👍

"It's been a season of consolidation, which was part of the three quarter plan all along, I would urge the fans to show some faith in the wigboard and the long term vision." :whistling

onwards and upwards!

Cheers,

Wig

"It's been a season of consolidation, which was part of the three quarter plan all along, I would urge the fans to show some faith in the wigboard and the long term vision." :whistling

onwards and upwards!

Cheers,

Wig

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

I am a bit pushed for time so I have grabbed this off the web by Nick Rainor. Let's see if he is any good at picking shares

Marston's at 96p MARS.L

Market

Long

TP 106

SL 86

Leisure sector

Yield: 6.0%

Pub companies are starting to show some signs of stability and resurgence in turnover.

Food sales have provided a vital boost to the company coffers and the management are set to focus on gearing the product to being family friendly and increasing the importance of food. The group is also promoting a new business model for tenanted pubs, which incentivise publicans.

Marston’s is a higher risk recovery stock, with an attractive yield, which has been swimming against the tide of economic and sector concerns. The management remain cautious on the outlook so investors will need to be patient.

Marston’s released a brief update in mid-March which noted that trading is in-line with its estimates for the first half. The total number of pubs being operated should be well over 2,000 by the time the interim figures are released.

Recent weakness has seen the share price fall which makes the yield very attractive but there is also potential growth on offer. It is high risk as consumer trends can fluctuate but the potential rewards are worth the risk.

Marston's at 96p MARS.L

Market

Long

TP 106

SL 86

Leisure sector

Yield: 6.0%

Pub companies are starting to show some signs of stability and resurgence in turnover.

Food sales have provided a vital boost to the company coffers and the management are set to focus on gearing the product to being family friendly and increasing the importance of food. The group is also promoting a new business model for tenanted pubs, which incentivise publicans.

Marston’s is a higher risk recovery stock, with an attractive yield, which has been swimming against the tide of economic and sector concerns. The management remain cautious on the outlook so investors will need to be patient.

Marston’s released a brief update in mid-March which noted that trading is in-line with its estimates for the first half. The total number of pubs being operated should be well over 2,000 by the time the interim figures are released.

Recent weakness has seen the share price fall which makes the yield very attractive but there is also potential growth on offer. It is high risk as consumer trends can fluctuate but the potential rewards are worth the risk.

Last edited:

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Marston's at 96p MARS.L

Market

Long

TP 106

SL 86

Leisure sector

Thanks Pat, here are your initial ATR targets based on Fridays close of 95.75 for MARS.L

ATR Targets

Daily ATR(200) = 2.37 (2.48%)

Weekly ATR(52) = 5.77 (6.03%)

-1x ATR: 93.38

1x ATR: 98.12

1.5x ATR: 99.31

2x ATR: 100.49

Good luck

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Week 10 Pick - FXPO.L

Ferrexpo (FXPO.L)

Sector: Industrial Metals (NMX1750)

Order Type: Warehoused

Direction: Long

Warehoused Entry: Will manually enter during the week, but I will reassess going long if it drops below 430 on Monday.

Initial Stop loss: 424

Initial Target: 465

ATR (200 Day): 14.48 (3.31%)

ATR (52 Week): 37.5 (8.58%)

ATR Targets: - Based on estimate entry point of 437

-1x ATR: 422.52

1x ATR: 451.48

1.5x ATR: 458.72

2x ATR: 465.96

Entry Reason

Five sectors moved to buy signals on Friday. Oil Equipment Services & Distribution, Industrial Metals, Industrial Engineering, Household Goods and Nonlife Insurance. So using those as my starting point I went through all of the individual stocks to see which had good relative strength vs their sector and the S&P 500 equal weighted index. Around 7 stood out, but after looking at the technical patterns I got it down to two - which were BKG.L and FXPO.L. Both looked good to me but FXPO.L tipped it as it still has 12% upside potential relative to the previous tops distance above the 200 day moving average. Also the weekly chart has made a Three White Soldiers candlestick pattern which is a high probability pattern. It also recently made a relative strength buy signal vs the market and continues to outperform its sector. I've attached my various charts so you can see what I'm looking at.

There is fairly strong resistance around the 430 level so I won't enter if it drops below that as the next level is down around 412. See the P&F charts as they show the support/resistance levels the best I think.

The daily ATR is 14.48 and the weekly is 37.5 so I'm going to aim to capture over 50% of the average weekly move this week.

Ferrexpo (FXPO.L)

Sector: Industrial Metals (NMX1750)

Order Type: Warehoused

Direction: Long

Warehoused Entry: Will manually enter during the week, but I will reassess going long if it drops below 430 on Monday.

Initial Stop loss: 424

Initial Target: 465

ATR (200 Day): 14.48 (3.31%)

ATR (52 Week): 37.5 (8.58%)

ATR Targets: - Based on estimate entry point of 437

-1x ATR: 422.52

1x ATR: 451.48

1.5x ATR: 458.72

2x ATR: 465.96

Entry Reason

Five sectors moved to buy signals on Friday. Oil Equipment Services & Distribution, Industrial Metals, Industrial Engineering, Household Goods and Nonlife Insurance. So using those as my starting point I went through all of the individual stocks to see which had good relative strength vs their sector and the S&P 500 equal weighted index. Around 7 stood out, but after looking at the technical patterns I got it down to two - which were BKG.L and FXPO.L. Both looked good to me but FXPO.L tipped it as it still has 12% upside potential relative to the previous tops distance above the 200 day moving average. Also the weekly chart has made a Three White Soldiers candlestick pattern which is a high probability pattern. It also recently made a relative strength buy signal vs the market and continues to outperform its sector. I've attached my various charts so you can see what I'm looking at.

There is fairly strong resistance around the 430 level so I won't enter if it drops below that as the next level is down around 412. See the P&F charts as they show the support/resistance levels the best I think.

The daily ATR is 14.48 and the weekly is 37.5 so I'm going to aim to capture over 50% of the average weekly move this week.

Attachments

wigtrade

Junior member

- Messages

- 47

- Likes

- 3

New season, clean slate.

TSCO (Tesco) - BUY

Warehoused long order

WEEKLY GRAPH

Price fell out of wedge, found support around 380 level with monster pin 😱 followed up by last weeks bullish hammer

DAILY GRAPH

Looks like inverse h&s formed perhaps - HH HL plus I really like the formation of last 7 candles. Nison refers to these patterns as the 'rising three methods' :-0 although not a perfect example it adds weight to the potential bull side for me

15M GRAPH

Falling trendline and 392 supres level is the action zone for me...

Will be watching for opportunity to enter during the week... hopefully tomorrow if price plays along 😴

Every little helps.

Cheers

Wig

TSCO (Tesco) - BUY

Warehoused long order

WEEKLY GRAPH

Price fell out of wedge, found support around 380 level with monster pin 😱 followed up by last weeks bullish hammer

DAILY GRAPH

Looks like inverse h&s formed perhaps - HH HL plus I really like the formation of last 7 candles. Nison refers to these patterns as the 'rising three methods' :-0 although not a perfect example it adds weight to the potential bull side for me

15M GRAPH

Falling trendline and 392 supres level is the action zone for me...

Will be watching for opportunity to enter during the week... hopefully tomorrow if price plays along 😴

Every little helps.

Cheers

Wig

Attachments

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

TSCO (Tesco) - BUY

Warehoused long order

Thanks wig, here's your initial ATR targets based on Fridays closing price of 388.95

ATR Targets

Daily ATR(200) = 6.82 (1.75%)

Weekly ATR(52) = 16.75 (4.31%)

-1x ATR: 382.13

1x ATR: 395.77

1.5x ATR: 399.18

2x ATR: 402.59

Good luck

I'll have a go at this.

GBP/JPY

Long.

Buy stop- 136.10

S/l- 134.60

T/p- 139.25

Reasoning?

Weekly-Close above BRN PPZ of 135. Break of downward trendline. Boj intervention. Large bullish bar in relation to the average.

Daily- another broken t/l

This reasoning probably has more holes in it than Swiss cheese, but im still learning and its not a trade im taking on my real account. Thats how much confidence I have in it 😀

GBP/JPY

Long.

Buy stop- 136.10

S/l- 134.60

T/p- 139.25

Reasoning?

Weekly-Close above BRN PPZ of 135. Break of downward trendline. Boj intervention. Large bullish bar in relation to the average.

Daily- another broken t/l

This reasoning probably has more holes in it than Swiss cheese, but im still learning and its not a trade im taking on my real account. Thats how much confidence I have in it 😀

Attachments

TradeTheEasyWay

Well-known member

- Messages

- 478

- Likes

- 4

Similar threads

- Replies

- 3

- Views

- 3K

- Replies

- 44

- Views

- 13K

- Replies

- 3

- Views

- 2K