mrchuffster

Junior member

- Messages

- 40

- Likes

- 0

I used the formula from this, without good results, but when I use sierra chart i get much better

results, don't know why. Cheers

results, don't know why. Cheers

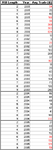

JonnyT said:I'm trying to find a mathematical definition of RSI so I can write the backtest code!

Anyone got one with worked examples?

I've collected the data.

Thanks

JonnyT