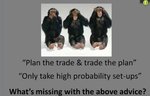

@smokealarm, the main point was that many people think they have a plan, when they in fact have a disaster waiting to happen.

I tell my students to ask themselves 'how can i' questions and go do some markups (show the ideas on charts), paying special attention to the places where their ideas fail. There are too many 'systems' that data mine to show 'good' trades and ignore bad ideas: often on the same 'example' charts posted.

@NVP,

thanks.

G.

All this does not work in reality , good luck with your vendor business and marketing sales.

Traders trade their beliefs ,cognitive biases and related distortions ,emotions ,stress responses (rective patterns ,freezing on trigger ,mistakes etc),subjective anylysis ,personality( Perfectionism ,Worry ,Overconfidence,

Negative Thinking.Self-blame etc),state of mind ,current body condition (tired ,fatigue,sleepless) and other influences .The trading phsychology is a complex subject ,the author has given a summary.

http://www.trade2win.com/boards/edu...92-your-brain-wasnt-built-handle-reality.html

Traders are like monkeys , they suffer from the MONKEY BIAS, THEY DO MONKEY BUSINESS ON LIVE ACCOUNTS

Like this?

Humans are very clever and we get clever , when it is not in our interests .When given a highly profitable system , we second guess systems , because we are smart and smarter than the creator of the system.We are like monkeys and do monkey business on live accounts .It is called self sabotage.

http://www.trade2win.com/boards/edu...-do-succesful-traders-hang-around-forums.html

We are curious and try new things , inventions and do the same in trading.

We get too clever for our own good in trading ,like these monkeys.