MajorDutch

Established member

- Messages

- 865

- Likes

- 87

Hi

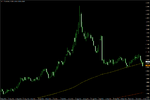

Following the success of my last no brainer trade. I am now on the look out for the next one. I will begin the search on Monday and post up when there is some action, could be days even weeks. The trades are likely to be in the vain of James16. daily pin bar entry fine tuned for a minimum of 3:1 RR. I might find something cheeky on the H4. This trading method requires large amounts of patience and waiting for the correct opportunity. Once the opportunity presents itself entries are normally taken off a retrace on the 5 minute chart. This is where a lot of waiting can occur, waiting for the break then retrace.

here is the link to my 1st no brainer tarde.

http://www.trade2win.com/boards/general-trading-chat/136714-no-brainer-trade.html

have a great weekend🙂

Following the success of my last no brainer trade. I am now on the look out for the next one. I will begin the search on Monday and post up when there is some action, could be days even weeks. The trades are likely to be in the vain of James16. daily pin bar entry fine tuned for a minimum of 3:1 RR. I might find something cheeky on the H4. This trading method requires large amounts of patience and waiting for the correct opportunity. Once the opportunity presents itself entries are normally taken off a retrace on the 5 minute chart. This is where a lot of waiting can occur, waiting for the break then retrace.

here is the link to my 1st no brainer tarde.

http://www.trade2win.com/boards/general-trading-chat/136714-no-brainer-trade.html

have a great weekend🙂