Hi Elefteros, although fractals seem to give a good entry when a retrace occurs it is proving difficult to wait for this to happen when the price just runs away! Although I do agree with you that patiently waiting for a retrace would be a very good entry.

I've been trying a few things over the past week with sniper to try to filter the signals as, like you, I have found some of the recent entry confirmations have continued to move against the signal. I thought that they might be worth mentioning here as we all seem to have picked up on one of the weaknesses of the system which is related to trending pairs vs non-trending pairs. It appears to give great signals for the former but as a lagging indicator gets caught out by the latter. What I've trying to do is to be as certain as possible that when sniper gives an affirmative signal that this is moving with a trend, rather than in an erratic chop.

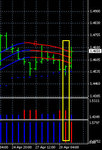

So, I am currently trading using sniper plus three other indicators: Awesome oscillator (as Wildpips has previously mentioned), Accelerator oscillator and EMA 60. Using the two oscillators to filter the sniper signals, I am currently only considering taking trades when Awesome Oscillator histogram is above/below the zero line depending on the sniper signal (eg. above zero if buy signal), is the same colour as sniper signal (blue if buy) and rising/falling respectively (rising for buy). And when the Accelerator Oscillator is the same colour as sniper and also moving in the same direction as the signal. This means that I am only taking trades when sniper lines all turn the same colour and produce the arrow, the two sniper trend lines are the same colour and the AO and AO are also the same colour and moving in the direction of the signal with the Awesome Oscillator positive or negative depending on buy/sell. Futhermore, I am only taking the sell signal if price is below 60EMA and vice versa for buys.

So far, this has managed to filter a fair few of the trades that I would have jumped into had I been taking only sniper signals. The signals have worked most effectively so far when entry arrow, both trend indicators and both oscillators are in agreement. It is only in its infancy and I will let you know if it looks viable in due course. I am also trying to take into account the distance between the three bars changing colour and the confirmation of the trend lines -too much of a delay and the signal becomes redundant? And is it helpful to only take 4H signals on pairs which have been trending nicely for the past few weeks rather than the recently erratic pairs?

I just though this might stimulate some debate on how sniper could be refined but is in no way to detract from this journal which is providing an excellent example to us all. It will be great to see the sums based on the system alone in a few weeks.

Tau.