splashy

Well-known member

- Messages

- 368

- Likes

- 67

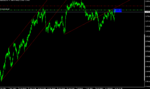

When looking at the angled line,yes it probably isnt as reliable as S and R but it really depends on how you look at it. look at this aud/chf line. Its not a strong one but I have traded from this and am at b/e for the trades in a rising trend. I can take a trade from near the line and take 1/2 off at 1:1 and leave the rest for a runner. I have not had one decent runner in the last two weeks and yet I am ahead on pips. The risks are minimal and the reward big when I get the runners. There are a possible 3 trades from this line,one a clear loser of say 25 pips x 2, and two where I got 1/2 off before being stopped at b/e. All methods have to involve strong MM and discipline to work. The angled lines work better if the trade is taken below the recent high,not like where the chart is at the moment, and yes as someone and I mentioned,confluence adds to their performance. Once or twice a month I will come across an angled line that has pulled back to a SR area and it is also a big fib area.That is a perfect storm. I will find better examples and will post more and better chance when I get the chance,but am in the middle of a busy week

Cheers flash, informative as always.

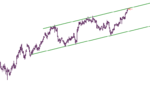

Its amazing how different people look at things. The first thing i did was move the line so that it was more palateable to me. Now i feel comfortable about trading it but it would be in the opposite direction to you.🙁

I split trades from time to time but i don't make a habit of it but I think in going short off a rising line and vice versa, i can see it would be a prudent thing to do. I do see what you mean about the potential rewards as long as one has the discipline to hold on to the trade.👍

Do you trust your lines enough to wait for a touch in order to minimise risk or do you view them as being a little subjective and just happy with getting within 5 pips eg.?